- United States

- /

- Banks

- /

- NYSE:LOB

A Fresh Look at Live Oak Bancshares’s Valuation After Strategic Gains and Fed’s Positive Signals

Reviewed by Simply Wall St

Live Oak Bancshares (NYSE:LOB) made headlines after unveiling a series of updates that caught investor attention. The company is set to realize a sizeable pre-tax gain from the Apiture acquisition, announced a fresh stake in an AI-powered lending platform, and saw a key director buying shares. These moves came just as the Federal Reserve signaled a friendlier rate environment, which gave a lift to the entire sector. Investors weighing their next steps might wonder if these company actions, paired with a broader market rally, signal a reset for Live Oak’s growth story or simply a positive bump in sentiment.

Looking at the year so far, Live Oak’s share price has made a modest recovery, gaining 11% over the past month and 35% in the past 3 months. However, it is still down around 11% over the last 12 months. Alongside the new initiatives, other headlines such as the board appointment of a fintech veteran and steady dividend affirmations have helped build a sense that the company is sharpening its focus on digital banking and operational scale. The recent wave of news appears to have added momentum, bringing renewed attention to what was previously a stagnant narrative around the stock.

With the shares still below last year’s levels, the question now is whether Live Oak Bancshares is trading at a discount or if these upgrades are already reflected in the price. Investors may be considering whether this is the right moment to invest or if the market is pricing in future growth that may not materialize.

Most Popular Narrative: Fairly Valued

According to community narrative, Live Oak Bancshares is considered fairly valued by analysts, with the current price closely matching consensus fair value estimates. The stock is seen as keeping pace with its projected growth, rather than offering a deep discount or presenting substantial risk of being overvalued.

The rapid scaling of new digital products, such as Live Oak Express and checking account offerings (both essentially at zero in 2023 and now meaningfully contributing to loan and deposit growth), positions the company to capture increased demand from the ongoing shift toward tech-enabled banking and digital-native small business owners. This supports sustained revenue and margin growth.

Curious what’s fueling this balanced fair value? The secret ingredients include bold digital banking bets and some powerful but not extreme assumptions about future profits. Ever wondered how top analysts blend fast-growing business lines and digital disruption to arrive at a precise price target? There’s more to the story than meets the eye. Dive in to uncover the hidden mechanics behind this valuation call.

Result: Fair Value of $38.00 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy reliance on government-backed lending and the fast pace of digital innovation may still present challenges for Live Oak’s growth trajectory.

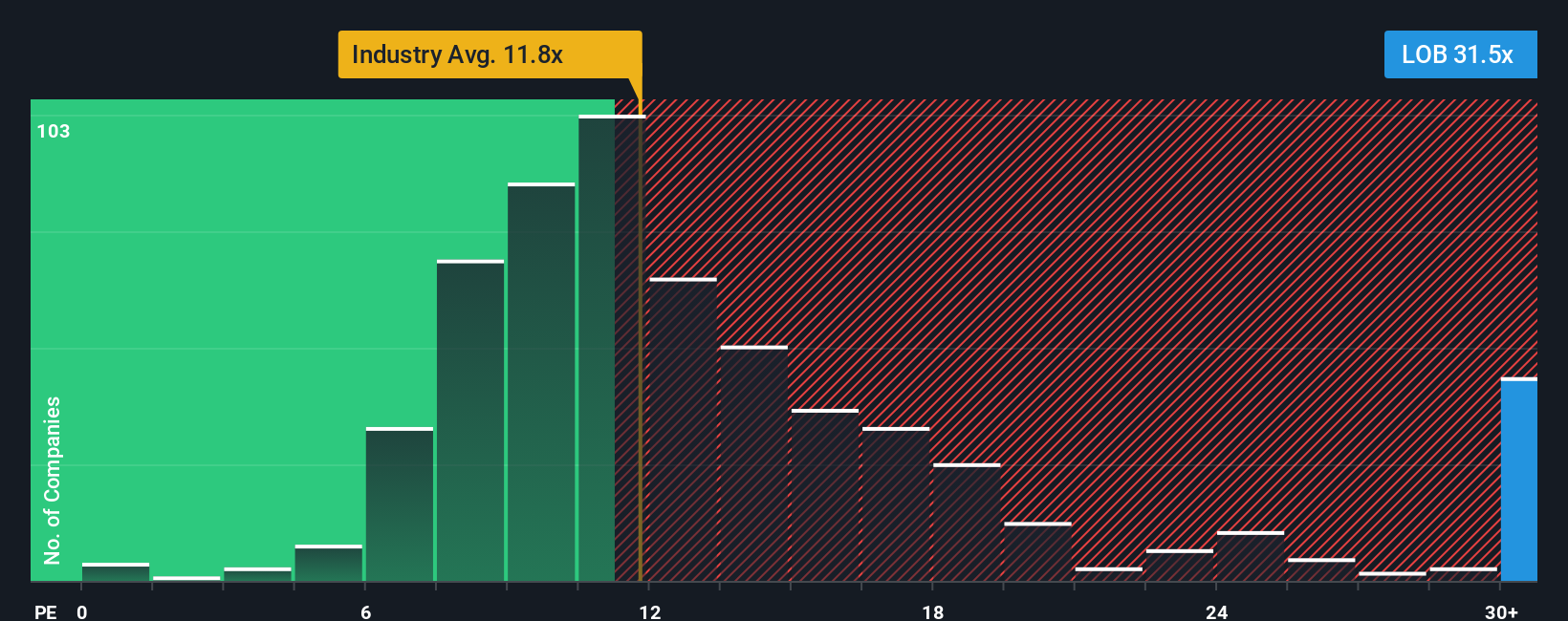

Find out about the key risks to this Live Oak Bancshares narrative.Another View: Market Ratios Send a Caution Signal

While analysts' growth projections suggest fair value, a look at the company’s price compared to the broader industry’s market ratios presents a more expensive picture. Could market optimism be running a little ahead of reality? Time will tell.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Live Oak Bancshares Narrative

If you see the story differently or want to dig into the numbers on your own, you have the tools to craft your own take in just a few minutes. Feel free to do it your way.

A great starting point for your Live Oak Bancshares research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more high-potential opportunities?

Why stop at one idea when the market is full of standout companies? Give your portfolio a boost by exploring other investment angles and hand-picked stocks. If you miss these picks, you could overlook the next big performer. Use the tools at your fingertips to make your moves confidently.

- Capitalize on waves of innovation by targeting AI penny stocks. Discover AI-driven businesses positioned to disrupt industries and set new standards for growth.

- Strengthen your income stream and seek stability with dividend stocks with yields > 3%, a selection of top-yielding dividend payers that reward long-term shareholders.

- Follow the momentum in healthcare breakthroughs with healthcare AI stocks and identify companies combining medical expertise with advanced AI technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOB

Live Oak Bancshares

Operates as the bank holding company for Live Oak Banking Company that provides various banking products and services in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives