- United States

- /

- Banks

- /

- NYSE:FLG

Do Shifting Fed Policies and Sector Optimism Reshape Flagstar Financial's (FLG) Competitive Edge?

Reviewed by Sasha Jovanovic

- Earlier this week, strong third-quarter earnings from major banks and comments from Federal Reserve Chair Jerome Powell about a possible end to quantitative tightening drove market optimism for the broader financial sector.

- This created a favorable backdrop for thrift and mortgage finance companies like Flagstar Financial even in the absence of company-specific news.

- With robust sector sentiment and shifting Fed policy expectations, we'll explore how these factors inform Flagstar Financial's investment story.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Flagstar Financial's Investment Narrative?

Flagstar Financial attracts shareholders who are willing to look past short-term losses and management turnover in favor of the bank’s potential for strong revenue growth and eventual profitability. The optimism sparked by positive third-quarter earnings from larger banks and softer comments from the Federal Reserve regarding future tightening might lift near-term sentiment around Flagstar and its sector peers. These conditions could ease some immediate headwinds, such as high funding costs and weaker loan demand, as improved liquidity generally supports lending and banking margins. Still, investors must track unresolved issues ranging from high levels of non-performing loans and delayed SEC filings to pending lawsuits and proposed structural changes following the special shareholders meeting. While the recent news may buoy short-term sentiment, the core risks around asset quality, governance experience, and sustained unprofitability remain crucial for the investment case.

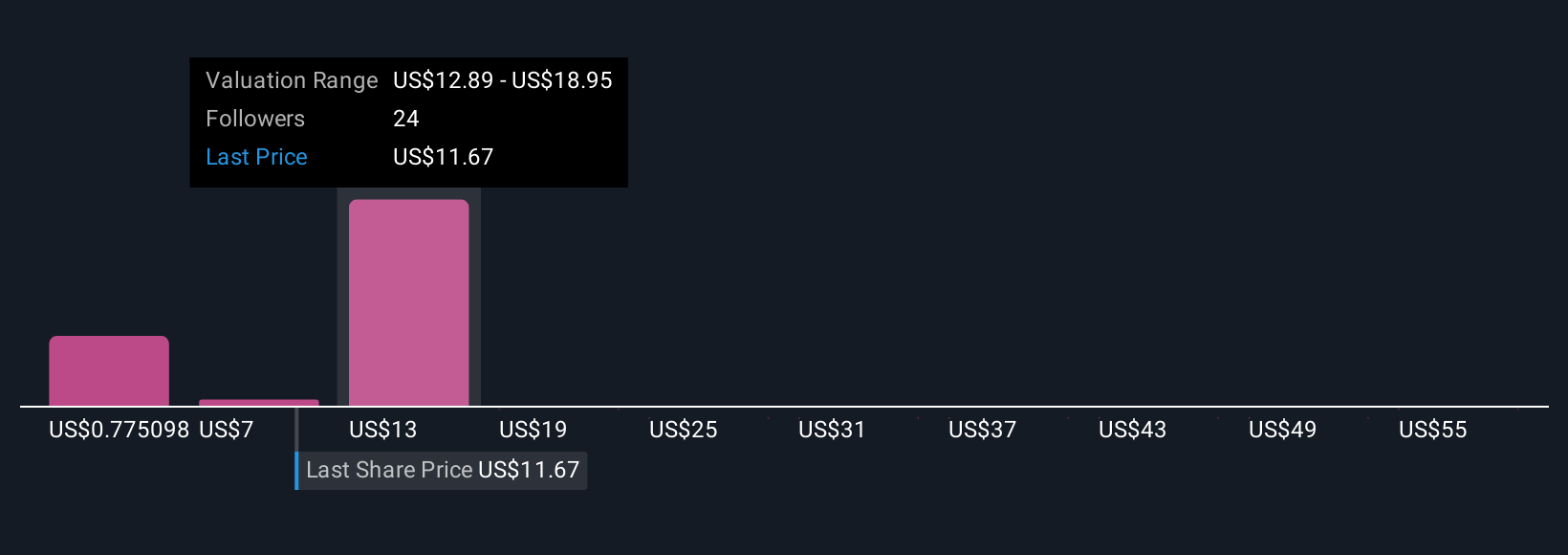

But, despite sector optimism, the allowance for bad loans remains strikingly low and deserves closer scrutiny. Our valuation report unveils the possibility Flagstar Financial's shares may be trading at a premium.Exploring Other Perspectives

Explore 10 other fair value estimates on Flagstar Financial - why the stock might be worth over 5x more than the current price!

Build Your Own Flagstar Financial Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Flagstar Financial research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Flagstar Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Flagstar Financial's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 39 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLG

Flagstar Financial

Operates as the bank holding company for Flagstar Bank, N.A.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives