- United States

- /

- Banks

- /

- NYSE:FHN

Fresh Look at First Horizon (FHN) Valuation After a 20% One-Year Share Price Gain

Reviewed by Simply Wall St

Market context for First Horizon

First Horizon (FHN) has quietly outperformed many regional peers this year, with the stock up about 20% over the past year and nearly 8% in the past month. This performance invites a closer look.

See our latest analysis for First Horizon.

With the share price now at $23.59 and a 1 month share price return of just over 8 percent, that recent momentum builds on a solid 1 year total shareholder return above 20 percent. This hints that investors are gradually reassessing both earnings power and risk.

If First Horizon’s move has you thinking about what else might be quietly re rating, it could be a good moment to explore fast growing stocks with high insider ownership.

With earnings and revenue still growing and shares trading at a meaningful discount to some valuation estimates, the next question is clear: Is First Horizon a fresh buying opportunity, or is the market already pricing in that future growth?

Most Popular Narrative: 3.7% Undervalued

With First Horizon last closing at $23.59 against a narrative fair value of about $24.49, the story leans toward modest upside grounded in disciplined execution.

The diversified business model, offering countercyclical revenue support, may shield earnings from macroeconomic volatility and ensure a steady revenue stream across various interest rate environments.

Curious how modest growth expectations, stable margins and a shifting share count can still point to upside from here? The narrative’s math might surprise you.

Result: Fair Value of $24.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising credit costs and weaker fee income could quickly undercut margin resilience and challenge the case for steady, compounding earnings from here.

Find out about the key risks to this First Horizon narrative.

Another Way to Look at Value

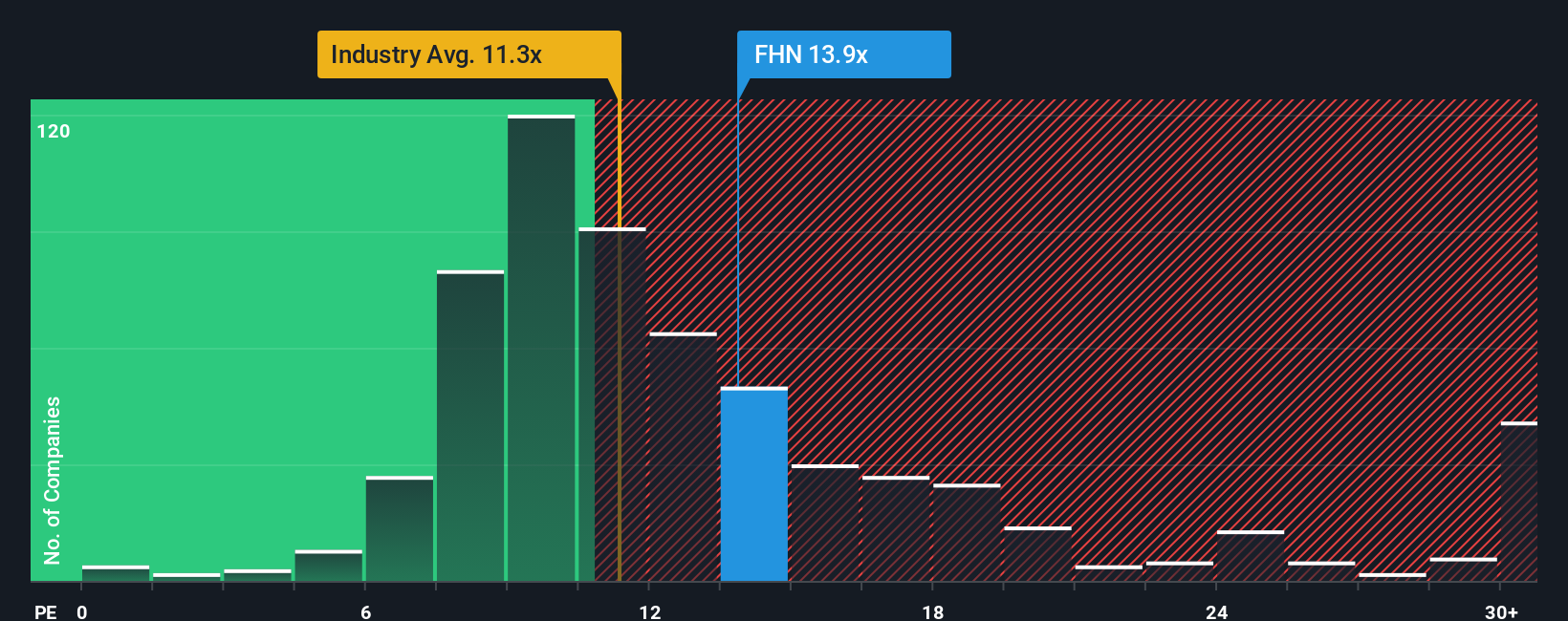

On earnings, First Horizon trades at 13.6 times profits, richer than both peers at 11.2 times and the US Banks average at 12 times, and above its 12.7 times fair ratio. If sentiment cools, could that valuation premium unwind faster than fundamentals improve?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Horizon Narrative

If you see the story differently, or would rather dig into the numbers yourself, you can build a fresh view in minutes with Do it your way.

A great starting point for your First Horizon research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before the market’s next move leaves you watching from the sidelines, put your research edge to work with targeted stock ideas tailored to different strategies and themes.

- Capitalize on potential mispricing by scanning these 907 undervalued stocks based on cash flows that may offer strong cash flow at attractive entry points.

- Position for tomorrow’s breakthroughs by focusing on these 26 AI penny stocks pushing the boundaries of automation, data intelligence, and digital transformation.

- Lock in income potential by reviewing these 13 dividend stocks with yields > 3% that can help anchor your portfolio with reliable cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FHN

First Horizon

Operates as the bank holding company for First Horizon Bank that provides various financial services.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)