- United States

- /

- Banks

- /

- NasdaqGS:PEBO

Dividend Stocks To Consider For September 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences a rebound with the Nasdaq and S&P 500 rising after a challenging week, concerns about a potential government shutdown loom large, prompting investors to seek stability in dividend stocks. In such uncertain times, dividend stocks can offer a reliable income stream and potential for growth, making them an attractive option for those looking to navigate current market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Rayonier (RYN) | 10.93% | ★★★★★☆ |

| OceanFirst Financial (OCFC) | 4.46% | ★★★★★★ |

| Huntington Bancshares (HBAN) | 3.56% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 5.78% | ★★★★★★ |

| Ennis (EBF) | 5.45% | ★★★★★★ |

| Employers Holdings (EIG) | 3.03% | ★★★★★☆ |

| DHT Holdings (DHT) | 7.72% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.53% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.63% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.35% | ★★★★★☆ |

Click here to see the full list of 125 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Peoples Bancorp (PEBO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Peoples Bancorp Inc. is the financial holding company for Peoples Bank, offering commercial and consumer banking products and services, with a market cap of $1.06 billion.

Operations: Peoples Bancorp Inc. generates revenue primarily through its Community Banking segment, which accounted for $554.42 million.

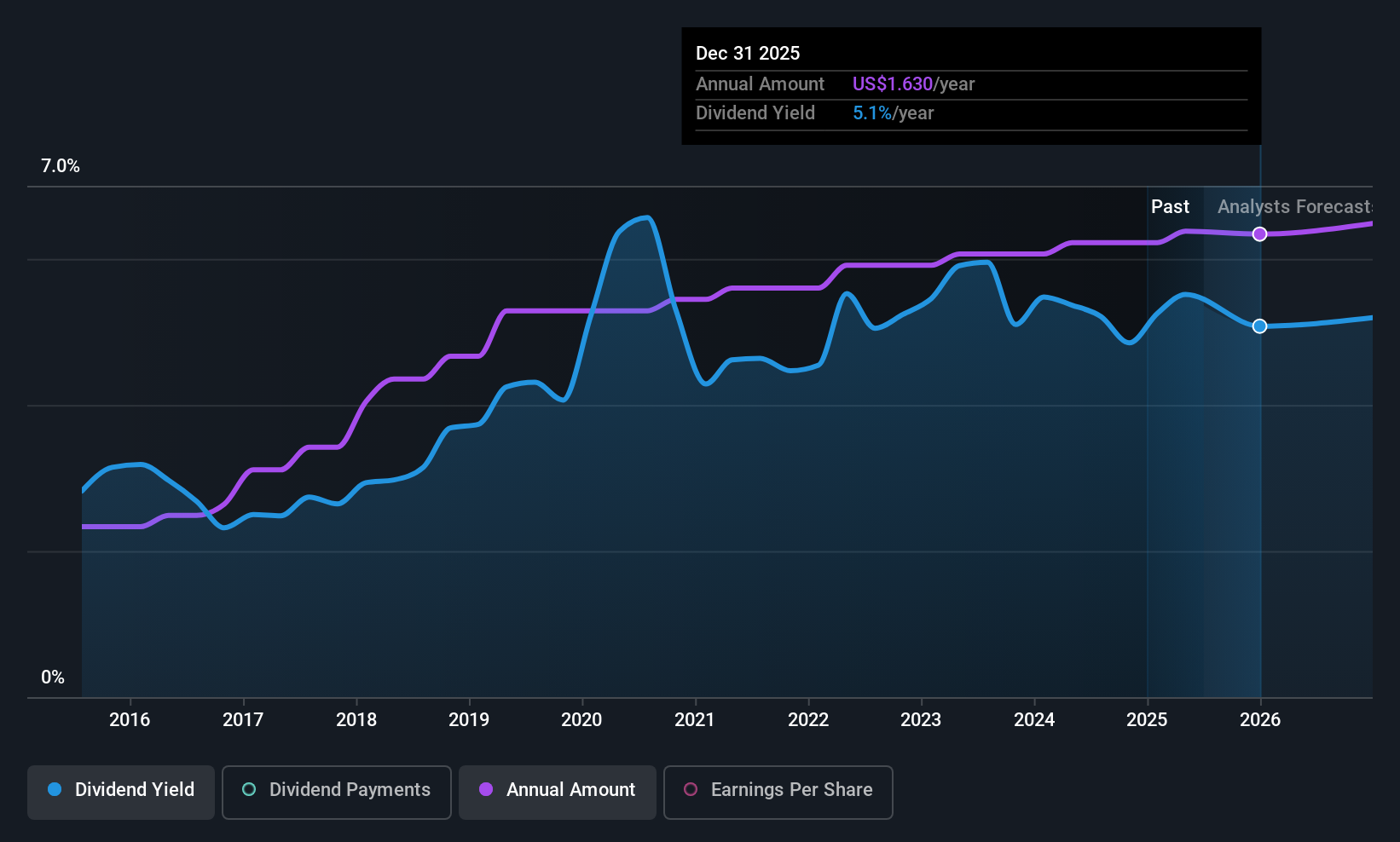

Dividend Yield: 5.4%

Peoples Bancorp offers a high and reliable dividend yield of 5.39%, placing it in the top 25% of US dividend payers. Despite recent earnings declines, with net income at $21.21 million for Q2 2025 compared to $29.01 million a year ago, its dividends remain stable over the past decade with a reasonable payout ratio of 54.8%. The company completed a share buyback program worth $13.85 million, enhancing shareholder value further.

- Unlock comprehensive insights into our analysis of Peoples Bancorp stock in this dividend report.

- Our valuation report here indicates Peoples Bancorp may be undervalued.

First Commonwealth Financial (FCF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Commonwealth Financial Corporation is a financial holding company offering a range of consumer and commercial banking products and services in the United States, with a market cap of approximately $1.81 billion.

Operations: First Commonwealth Financial Corporation generates revenue primarily through its banking segment, which accounted for $454.63 million.

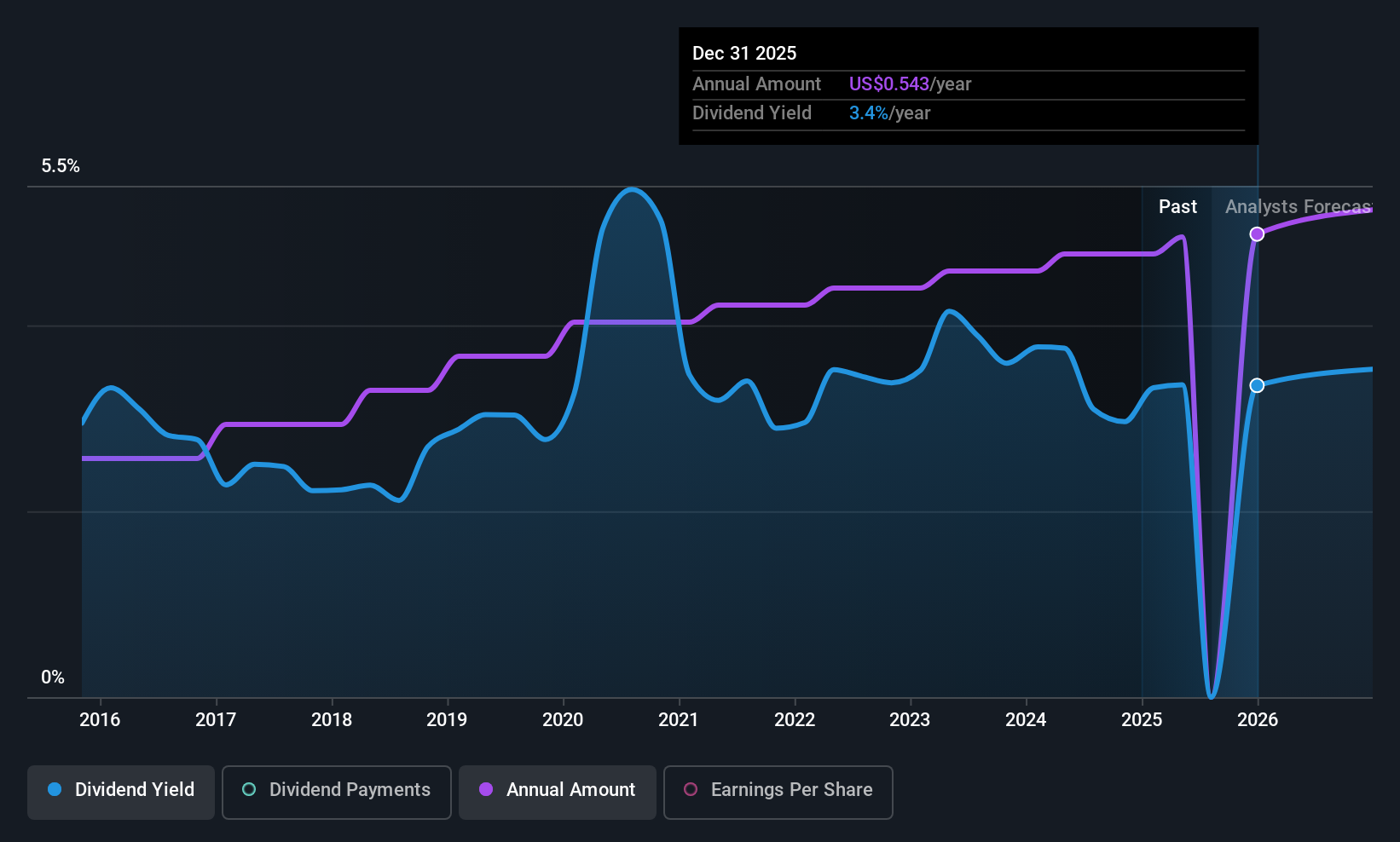

Dividend Yield: 3.1%

First Commonwealth Financial's dividend, yielding 3.1%, is reliable and has grown steadily over the past decade, supported by a low payout ratio of 40.4%. Recent earnings show net interest income growth to US$106.24 million in Q2 2025, though net income decreased to US$33.4 million compared to last year. The company declared a US$0.135 per share dividend, marking a 3.9% increase from the previous year, and announced a new $25 million share repurchase program enhancing shareholder value further.

- Click to explore a detailed breakdown of our findings in First Commonwealth Financial's dividend report.

- Our comprehensive valuation report raises the possibility that First Commonwealth Financial is priced lower than what may be justified by its financials.

National Bank Holdings (NBHC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Bank Holdings Corporation is a bank holding company for NBH Bank, offering a range of banking products and financial services to commercial, business, and consumer clients in the United States, with a market cap of approximately $1.49 billion.

Operations: National Bank Holdings Corporation generates its revenue primarily through its banking segment, which accounts for $399.53 million.

Dividend Yield: 3%

National Bank Holdings maintains a reliable dividend yield of 3.04%, supported by a low payout ratio of 37.9%, indicating sustainability. Over the past decade, dividends have grown steadily with little volatility. Recent earnings highlight growth, with Q2 net income rising to US$34.02 million from US$26.14 million last year, and a quarterly dividend of US$0.30 per share confirmed for September 2025, reinforcing its commitment to shareholder returns amidst strategic expansions like the $5 million investment in Nav.

- Dive into the specifics of National Bank Holdings here with our thorough dividend report.

- Upon reviewing our latest valuation report, National Bank Holdings' share price might be too pessimistic.

Key Takeaways

- Explore the 125 names from our Top US Dividend Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEBO

Peoples Bancorp

Operates as the financial holding company for Peoples Bank that provides commercial and consumer banking products and services.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives