- United States

- /

- Banks

- /

- NYSE:FBK

FB Financial (FBK): Assessing Valuation as Investors Revisit Regional Bank Growth Story

Reviewed by Simply Wall St

FB Financial (FBK) has been quietly moving this month, showing a slight uptick despite a generally muted market for banks. Investors are beginning to re-examine the company’s fundamentals and the story reflected in its latest growth trends.

See our latest analysis for FB Financial.

After a relatively swift climb over the past three months, with the 90-day share price return up 11.78%, FB Financial is catching renewed attention as investors weigh recent momentum against its longer-term value. Its one-year total shareholder return of 13.93% and a five-year total return above 100% suggest that growth potential and risk appetite are both in play as the market reassesses U.S. regional banks.

If this kind of quietly building strength has you thinking about what else is out there, now is a great moment to discover fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst targets and robust earnings growth behind it, the real question now is whether FB Financial is genuinely undervalued, or if investors are already pricing in future gains.

Most Popular Narrative: 11.3% Undervalued

With FB Financial’s fair value set at $61.17 according to the most closely watched narrative, and shares last closing at $54.26, consensus sees upside in the stock if aggressive growth goals are met in coming years.

The planned merger with Southern States Bank could boost revenue and margins through market expansion and stabilization. Strategic growth in commercial loans and hiring aims to enhance revenue, leverage, and potential EPS through efficient capital use.

Want to learn what drives this valuation? The most influential variable behind the narrative is a set of bold growth assumptions that could transform the company’s scale. Curious about which financial leap analysts are baking in? Unlock the narrative for the details behind these projections.

Result: Fair Value of $61.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, integration challenges from the Southern States Bank merger or a sudden economic downturn could undermine these optimistic growth assumptions and valuation targets.

Find out about the key risks to this FB Financial narrative.

Another View: Valuation by Earnings Multiple

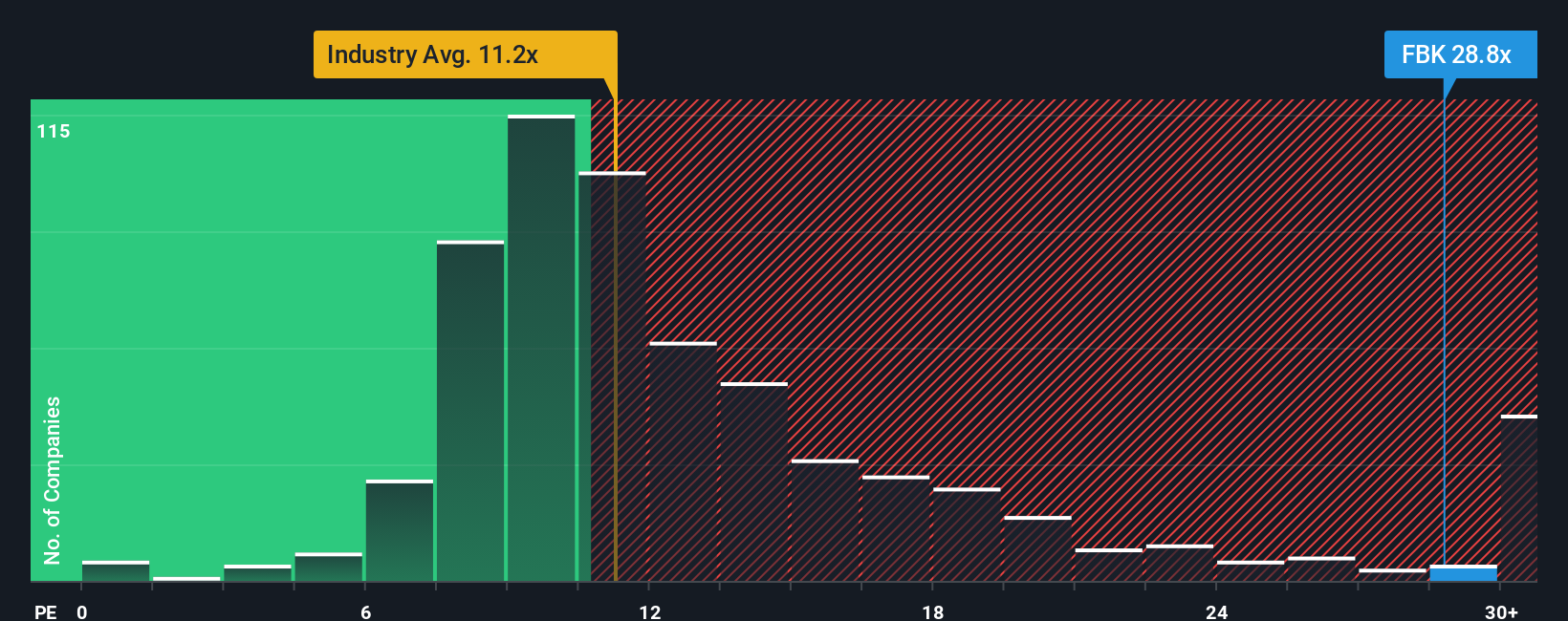

Looking from an earnings multiple perspective, FB Financial trades at a price-to-earnings ratio of 28x, which is much higher than both the US Banks industry average of 11.3x and the peer average of 10.9x. The fair ratio for FB Financial is estimated at 20x. This makes the current price look expensive compared to where the market could drift. Does this suggest investors are overpaying for its growth story, or is the market right to look past the headline numbers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FB Financial Narrative

If the consensus narrative or established valuations do not quite fit your own outlook, dive into the data and craft your personal take in under three minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding FB Financial.

Looking for more investment ideas?

If you want to stay ahead and avoid missing the next big trend, check out these handpicked stock avenues that could reshape your portfolio:

- Boost your returns by stepping into the world of strong passive income with these 17 dividend stocks with yields > 3%, offering yields above 3% and resilient fundamentals.

- Tap into digital disruption by checking out these 79 cryptocurrency and blockchain stocks, powering advancements in payment, blockchain, and Web3 technologies.

- Capture tomorrow’s leading innovators early when you scan these 25 AI penny stocks, with explosive growth and real-world applications in every sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FBK

FB Financial

Operates as a bank holding company for FirstBank that provides a suite of commercial and consumer banking services.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives