- United States

- /

- Banks

- /

- NYSE:FBK

A Look at FB Financial’s Valuation After FirstBank Joins the Federal Reserve System

Reviewed by Simply Wall St

FB Financial (FBK) recently saw its subsidiary FirstBank join the Federal Reserve System, shifting primary federal oversight from the FDIC to the Fed. This regulatory upgrade could subtly reshape how investors view its risk profile.

See our latest analysis for FB Financial.

That backdrop helps explain why investors have been steadily warming to FB Financial, with the share price at $56.89 and a solid year to date share price return pointing to building momentum, while its multi year total shareholder returns underline the appeal of the story over time.

If this shift in FB Financial’s regulatory profile has you rethinking your bank exposure, it could be a good moment to discover fast growing stocks with high insider ownership.

Yet with revenue and earnings growing briskly, and the shares still trading at a notable discount to both intrinsic value estimates and analyst targets, is FB Financial a genuine value opportunity, or are investors already pricing in its next leg of growth?

Most Popular Narrative Narrative: 12.7% Undervalued

With the narrative fair value pinned at $65.17 against FB Financial’s $56.89 close, the story assumes investors have not fully priced in its next phase.

The planned combination with Southern States Bank is expected to enhance scale and market opportunities, potentially benefiting revenue growth through expanded market presence and improved margin stabilization. FB Financial's ability to adjust cost structures, such as repricing certificates of deposit at lower rates, indicates management's focus on improving net margins by reducing the cost of funds.

Want to see how ambitious revenue growth, sharply higher margins, and a very different future earnings base are stitched together into that valuation story? The specific targets, time frames, and profit assumptions may surprise you. Dive in to see the exact financial blueprint behind this fair value call.

Result: Fair Value of $65.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, integration missteps with Southern States Bank or weaker credit quality in commercial portfolios could quickly undermine those upbeat revenue and margin assumptions.

Find out about the key risks to this FB Financial narrative.

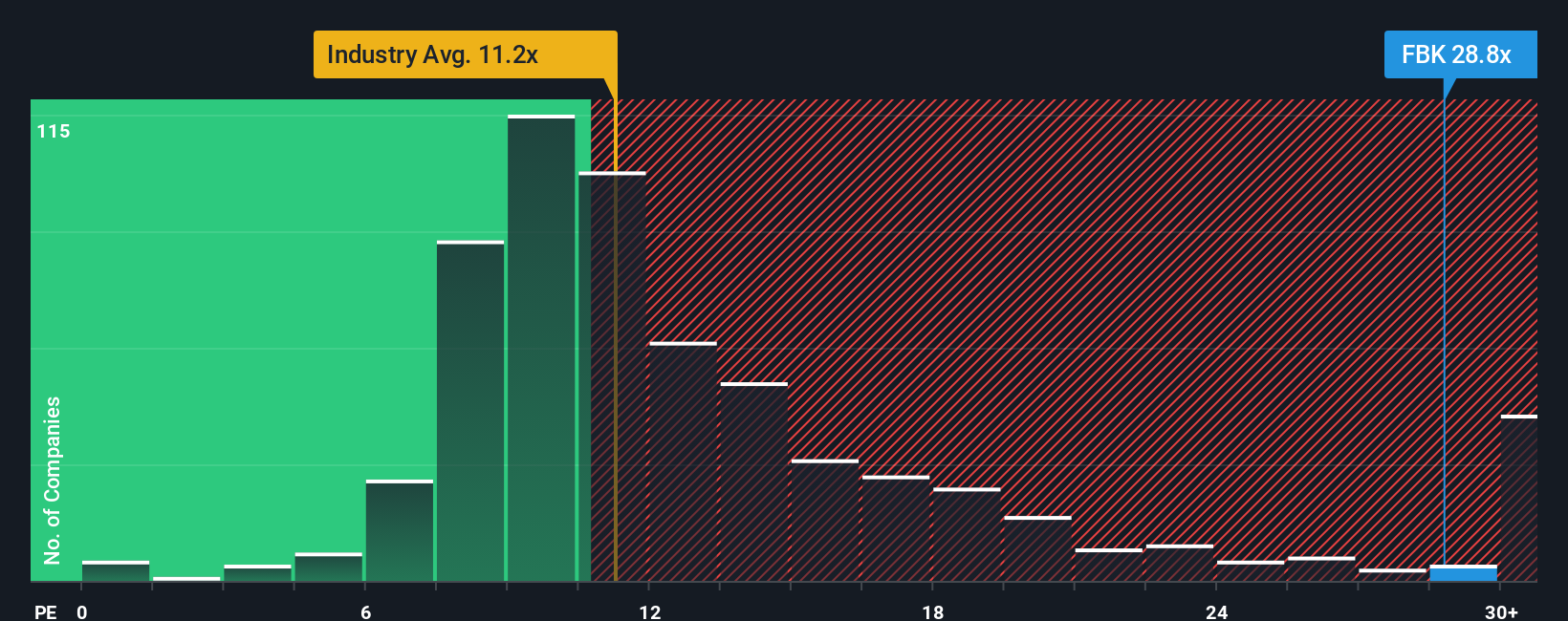

Another View: Valuation Looks Stretched on Earnings

There is a different angle when you look at FB Financial through its price to earnings lens. At 29.4 times earnings, the stock trades nearly three times the US Banks industry average of 11.7 times and well above its 20.9 times fair ratio. This raises questions about how much good news is already in the price.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FB Financial Narrative

If you see the story differently, or want to dig into the numbers yourself, you can shape a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding FB Financial.

Looking for more investment ideas?

Do not stop with a single bank story; use the Simply Wall Street Screener to uncover fresh opportunities that match your strategy before the market moves on.

- Capture potential bargain entries by targeting companies trading below intrinsic value through these 906 undervalued stocks based on cash flows, grounded in future cash flows.

- Ride the momentum of innovation by focusing on cutting edge businesses powering automation, machine learning, and data platforms via these 26 AI penny stocks.

- Lock in reliable income streams by zeroing in on companies offering attractive yields and consistent payouts using these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FBK

FB Financial

Operates as a bank holding company for FirstBank that provides a suite of commercial and consumer banking services.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026