- United States

- /

- Banks

- /

- NYSE:CUBI

Why Customers Bancorp (CUBI) Is Down 5.3% After $150 Million Equity Offering and Shelf Registration

Reviewed by Simply Wall St

- In early September 2025, Customers Bancorp completed a follow-on equity offering of nearly US$150 million and filed a broad shelf registration, covering common and preferred stock, debt, depositary shares, warrants, and units. This dual move expands the company's capital-raising options and signals preparation for additional financing or growth initiatives.

- The concurrent equity raise and shelf registration are meaningful events, as they signal both immediate and future capital plans that may affect shareholder dilution as well as the company’s flexibility to pursue new opportunities or strengthen its balance sheet.

- We’ll examine how this expansion of capital-raising flexibility could influence Customers Bancorp’s long-term growth strategy and investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Customers Bancorp Investment Narrative Recap

For investors considering Customers Bancorp, the underlying belief centers on the bank's ability to leverage innovation in commercial fintech and digital asset banking to drive above-average deposit and revenue growth. The recent US$150 million equity raise and shelf registration expand the company’s flexibility, but do not materially shift the immediate catalyst: sustained fee and deposit growth from its proprietary cubiX platform. The main near-term risk remains the bank’s concentrated exposure to digital asset-related deposits, which could amplify earnings swings if market or regulatory turbulence arises.

One especially relevant recent announcement was Customers Bancorp’s inclusion in key Russell indices at the end of June 2025. Index additions highlight growing institutional recognition and help support liquidity, which may complement the expanded capital-raising options from this month’s equity offering if the bank chooses to pursue new growth opportunities or shore up its balance sheet.

However, investors should also weigh the potential downside: if digital asset market volatility triggers rapid deposit outflows, then...

Read the full narrative on Customers Bancorp (it's free!)

Customers Bancorp's outlook forecasts $974.7 million in revenue and $417.4 million in earnings by 2028. This is based on an expected annual revenue growth rate of 17.8% and a $285.8 million increase in earnings from the current $131.6 million level.

Uncover how Customers Bancorp's forecasts yield a $76.57 fair value, a 13% upside to its current price.

Exploring Other Perspectives

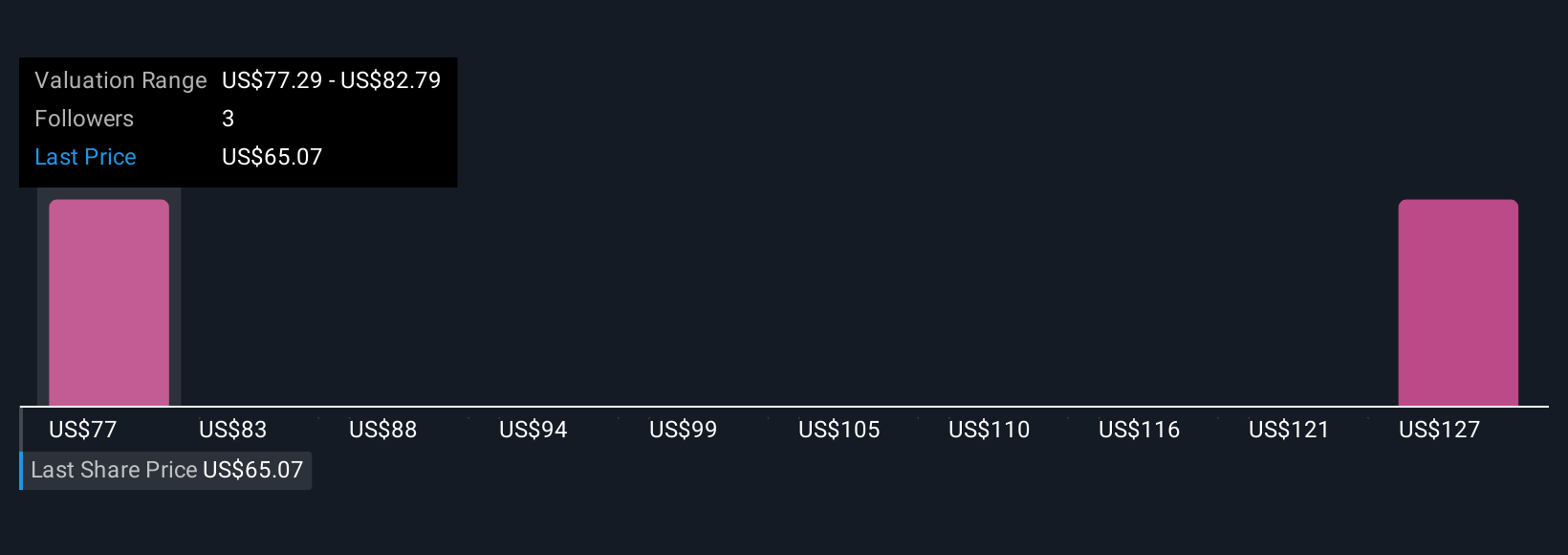

Two fair value estimates from the Simply Wall St Community range from US$76.57 to US$125.61 per share. While investor opinions span a wide spectrum, the ongoing reliance on digital asset and stablecoin-related deposits raises questions about how resilient earnings and liquidity could be if market conditions change, explore a variety of viewpoints before making up your mind.

Explore 2 other fair value estimates on Customers Bancorp - why the stock might be worth as much as 85% more than the current price!

Build Your Own Customers Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Customers Bancorp research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Customers Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Customers Bancorp's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CUBI

Customers Bancorp

Operates as the bank holding company for Customers Bank that provides banking products and services.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives