- United States

- /

- Banks

- /

- NYSE:CUBI

Should Strong Bank Earnings and Fed Policy Shifts Influence Customers Bancorp (CUBI) Digital Growth Strategy?

Reviewed by Sasha Jovanovic

- In the past week, several major banks reported third-quarter results that exceeded Wall Street expectations, driven by a recovery in investment banking and strong trading activity, while Federal Reserve Chair Jerome Powell indicated that quantitative tightening could soon end, easing financial system pressures.

- This wave of positive sentiment and strong earnings across the sector contributed to improved outlooks for regional banks like Customers Bancorp, reflecting broader investor confidence in the banking industry.

- We’ll explore how renewed optimism around Federal Reserve policy may influence Customers Bancorp’s digital banking growth outlook and risk profile.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Customers Bancorp Investment Narrative Recap

To own Customers Bancorp, investors must believe in the continued growth of digital-first banking and fee-based platforms, particularly through the cubiX ecosystem. The recent wave of positive earnings by major banks and signals of a potential pause in Fed quantitative tightening have boosted short-term sentiment and eased sector liquidity fears; however, the immediate impact on Customers Bancorp’s critical exposure to digital asset deposit risk remains limited, so monitoring regulatory and market shifts is still essential.

One of the more relevant updates tied to this optimism is the recent follow-on equity offering that raised nearly US$150 million, enhancing the company's capital position. While healthier sector funding and capital strengthen near-term growth prospects, these funds may also be vital in supporting additional compliance and technology investments should regulatory scrutiny intensify regarding digital assets and BSA/AML practices.

But unlike some peers, Customers Bancorp’s heavy reliance on digital-asset linked deposits creates a unique vulnerability that investors should keep in mind...

Read the full narrative on Customers Bancorp (it's free!)

Customers Bancorp's outlook projects $977.5 million in revenue and $424.9 million in earnings by 2028. This requires 17.9% annual revenue growth and a $293.3 million increase in earnings from $131.6 million today.

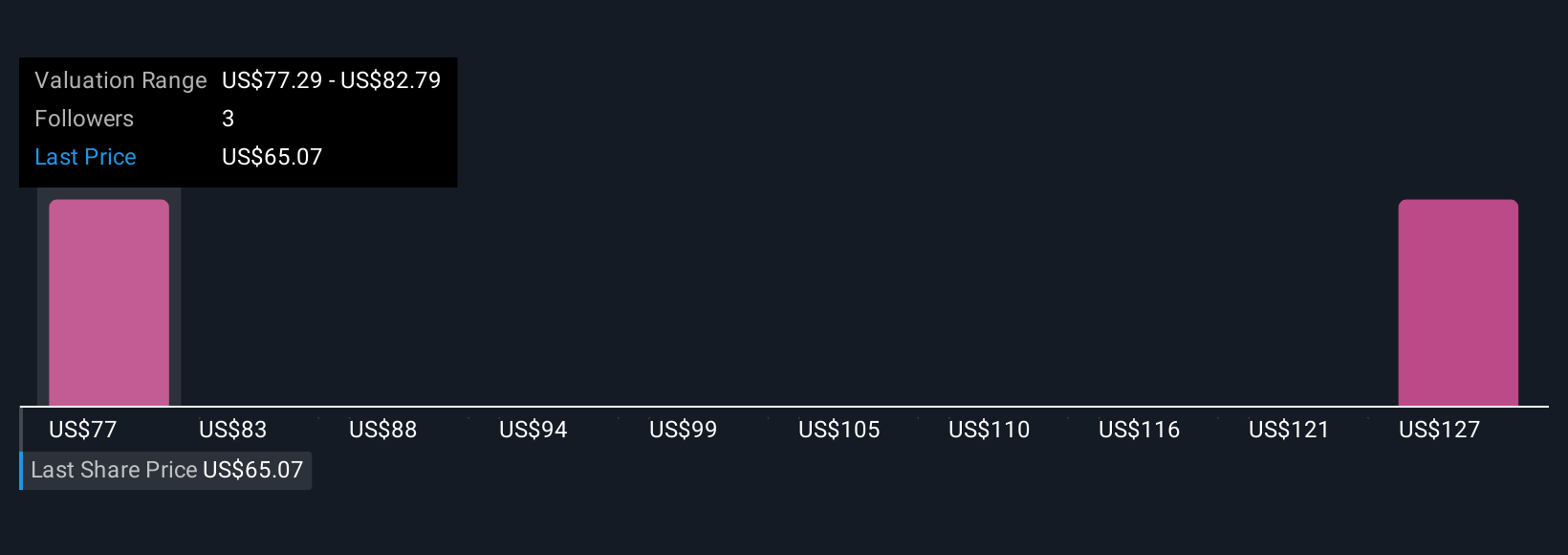

Uncover how Customers Bancorp's forecasts yield a $77.29 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Two Community members value Customers Bancorp between US$77.29 and US$134.09 per share. Opinions vary widely, especially with the ongoing regulatory focus on digital asset exposure shaping future prospects.

Explore 2 other fair value estimates on Customers Bancorp - why the stock might be worth over 2x more than the current price!

Build Your Own Customers Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Customers Bancorp research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Customers Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Customers Bancorp's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CUBI

Customers Bancorp

Operates as the bank holding company for Customers Bank that provides banking products and services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives