- United States

- /

- Banks

- /

- NYSE:CUBI

Customers Bancorp (CUBI): Margin Compression Challenges Bullish Valuation Narrative Despite Profit Growth Forecasts

Reviewed by Simply Wall St

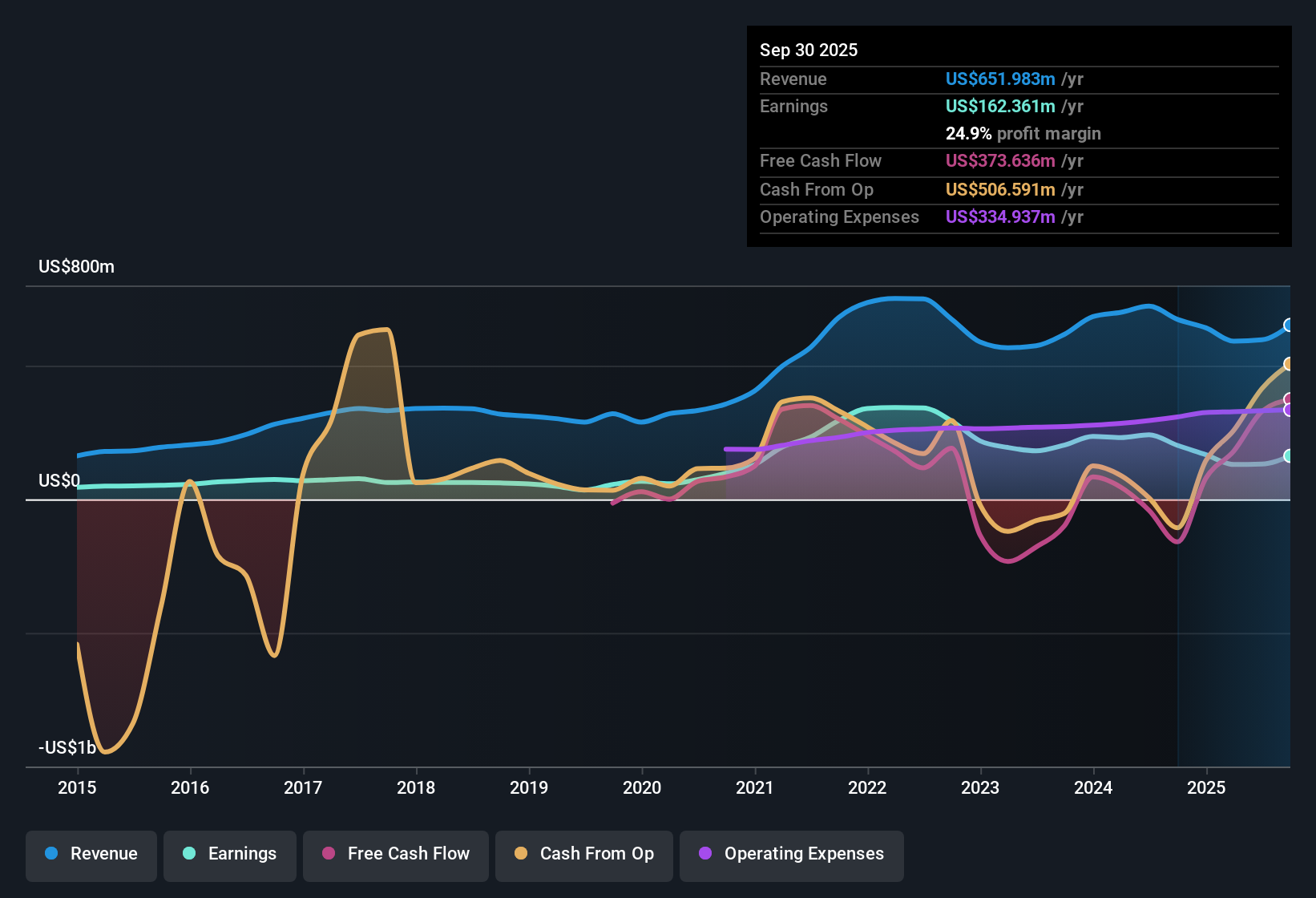

Customers Bancorp (CUBI) posted net profit margins of 25.2%, down from 29.9% the previous year, while earnings have declined by an average of 5.6% annually over the past five years. The stock is trading at $70.11, below its discounted cash flow estimated fair value of $134.4, and the company’s Price-to-Earnings Ratio stands at 14.4x, higher than the US Banks industry average of 11.2x but just under the peer average of 15x. Looking ahead, forecasts call for 27.8% yearly earnings growth and 10% revenue growth. High-quality earnings and robust profit gains are expected to drive sentiment, despite recent margin compression.

See our full analysis for Customers Bancorp.Next, we compare these numbers directly with the widely followed narratives to see where market expectations and the latest results are aligned and where they differ.

See what the community is saying about Customers Bancorp

Margin Expansion Forecasts: Analyst Estimates Point to 43.5%

- Current profit margins stand at 25.2%. Analysts are modeling an increase to 43.5% within three years, which represents more than a 70% improvement over today’s level.

- According to the analysts' consensus view, this optimistic outlook is supported by Customers Bancorp’s efforts to reduce costs through automation and technology investment. Two factors stand out:

- Efficiency ratios are already reported in the top quartile and have improved sequentially, which reinforces the claim that operational leverage is a meaningful contributor to future margins.

- The consensus highlights expansion into high-growth verticals such as fintechs and healthcare finance. This diversification of revenue streams could help make higher margins sustainable as the business scales.

- These results help explain why analysts remain positive on margin recovery as a potential driver of upside.

Deposit Base Quality: 16–17% Exposed to Digital Assets

- Deposits related to digital assets now account for 16 to 17% of Customers Bancorp’s total. The cubiX balances have surpassed previous internal caps, indicating a real shift in funding mix.

- Analysts' consensus notes that while the proprietary digital banking platform is supporting granular deposit and loan growth, concentration risk is increasing:

- Significantly, heavy exposure to digital assets creates the risk of rapid deposit outflows if crypto markets destabilize, a challenge not found in more diversified banks.

- Consensus also points out that this focus increases regulatory risk and potential earnings volatility. While it supports near-term fee income growth, it may also make margins less resilient than those of peers during stressed periods.

Valuation Gap: DCF Fair Value at $134.40, Stock at $70.11

- Shares trade at $70.11, which is a 48% discount to the DCF fair value of $134.40 and below the analyst consensus price target of $79.00.

- According to analysts' consensus, this gap is notable because forecasts for 27.8% annual profit growth and a premium price-to-earnings ratio (14.4x, higher than the US Banks average) could justify leading sector multiples:

- Even with margin compression and concentration risks, the combination of high-quality earnings, projected profit acceleration, and efficient operations creates a positive risk-reward setup for the stock.

- Analysts indicate that if the projected profit margin expansion and revenue growth occur, valuation rerating could happen quickly, supporting the case for potential upside from current levels.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Customers Bancorp on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See something others might miss? Take a couple of minutes to shape your own view and add your unique perspective to the narrative. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Customers Bancorp.

See What Else Is Out There

While Customers Bancorp’s digital asset concentration and volatile margins may expose investors to significant risk during industry downturns, others may offer more stability.

If greater consistency is what you want, use our stable growth stocks screener (2095 results) to find companies that have delivered reliable earnings and revenue growth across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CUBI

Customers Bancorp

Operates as the bank holding company for Customers Bank that provides banking products and services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)