- United States

- /

- Banks

- /

- NYSE:CUBI

Customers Bancorp (CUBI): Assessing Valuation After Fed Signals Possible Rate Cuts at Jackson Hole

Reviewed by Simply Wall St

Customers Bancorp (CUBI) just became the center of attention after Fed Chair Jerome Powell’s dovish tone at Jackson Hole. His remarks hinting at possible interest rate cuts caught investor ears, especially for regional banks like Customers Bancorp that often move in tandem with monetary policy shifts. With inflation risks easing and low unemployment giving the Fed some breathing room, the broader market’s optimism quickly translated to a spike in CUBI’s stock price.

This surge is not happening in isolation. Over the past month, Customers Bancorp shares jumped nearly 10 percent, and momentum has built rapidly, up 35 percent in the past 3 months and delivering a 45 percent gain so far this year. These moves follow a year of steady growth as banks navigated a high-rate environment, along with solid annual improvements in both revenue and net income. The combination of policy signals and strong fundamentals is drawing fresh interest from both short-term traders and long-term holders alike.

After this latest run, is the stock trading below its real value or are investors already factoring in future growth? The next step is to dig into valuation and see what is really on offer for buyers today.

Most Popular Narrative: 10.3% Undervalued

According to community narrative, Customers Bancorp is seen as undervalued relative to its projected future performance, with a fair value nearly 11 percent above the current share price.

The rapid digitization of commercial banking and payments is driving institutional clients to seek tech-focused, 24/7 banking solutions. Customers Bancorp capitalizes on this shift through its proprietary cubiX platform. With payments volume of $1.5 trillion in 2024 and accelerating growth, ongoing regulatory clarity around digital assets and stablecoins positions Customers as the leading provider. This supports significant potential for deposit and fee income growth.

Curious how these future-focused bets translate into such a bullish valuation? The key to this narrative is a projected leap in profitability, powered by scalable digital business and margin expansion. Want a peek at the bold financial forecasts and assumptions propelling that price target? The numbers inside might just surprise you.

Result: Fair Value of $76.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heightened regulatory scrutiny of digital assets or sudden deposit volatility could quickly disrupt Customers Bancorp's momentum and impact future earnings growth.

Find out about the key risks to this Customers Bancorp narrative.Another View: Market Comparison

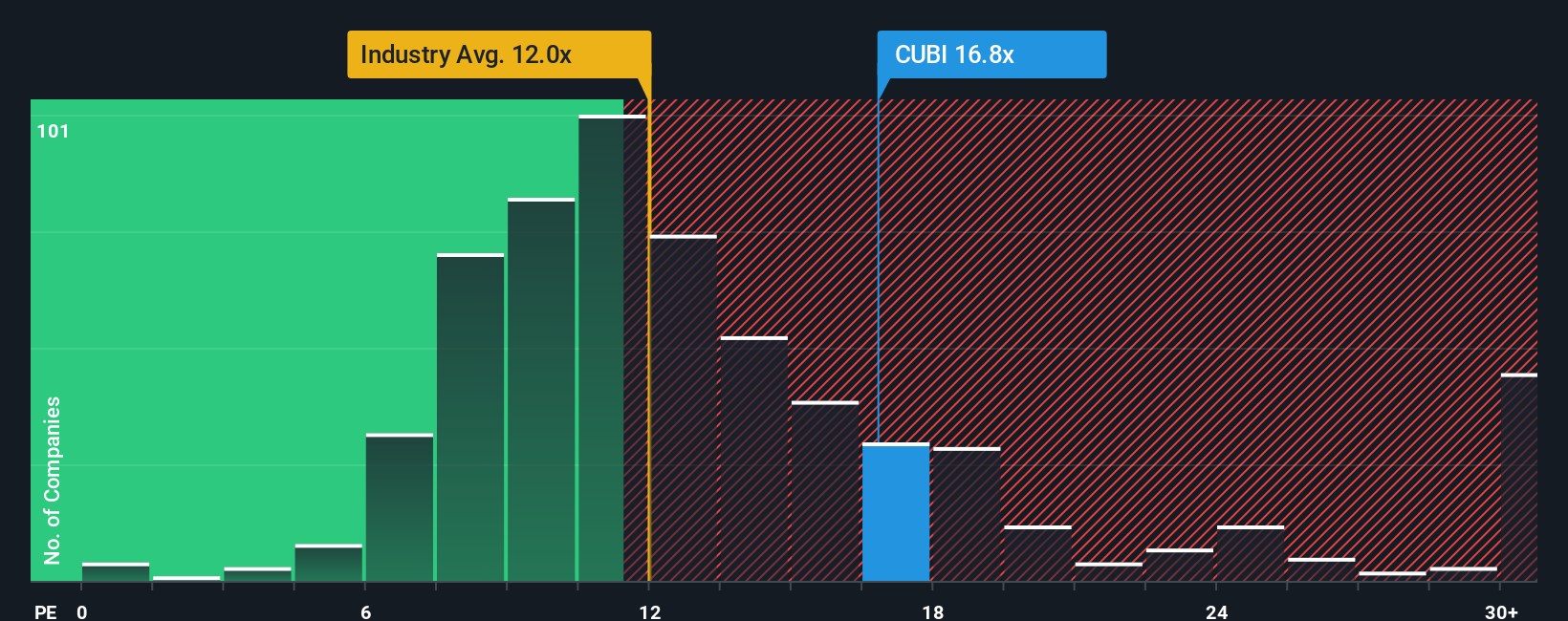

Looking from a different angle, a check against industry pricing suggests Customers Bancorp shares are trading at a premium compared to the typical bank. While fundamentals tell one story, the market may be hinting at caution.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Customers Bancorp Narrative

If these viewpoints don’t quite match your outlook, you can dig into the numbers yourself and shape your own perspective in just a few minutes. do it your way.

A great starting point for your Customers Bancorp research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your research to just one stock. There are many opportunities available, and now is a great time to look for the next potential addition to your portfolio. Use these handpicked strategies to help put your money to work and stay ahead of the curve:

- Capitalize on next-generation healthcare breakthroughs by exploring emerging companies leading advances in artificial intelligence for medicine with healthcare AI stocks.

- Explore ways to grow your income stream by tracking companies offering strong yield potential with dividend stocks with yields > 3%.

- Discover opportunities in the rapidly evolving world of technology by identifying rising stars in quantum computing through quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CUBI

Customers Bancorp

Operates as the bank holding company for Customers Bank that provides banking products and services.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives