- United States

- /

- Banks

- /

- NYSE:CFR

Cullen/Frost Bankers (CFR): Assessing Valuation as Shares Ease After Recent Gains

Reviewed by Kshitija Bhandaru

Cullen/Frost Bankers (CFR) has caught the attention of investors recently, with the stock showing movement that invites a closer look at its performance and valuation over the past month and beyond.

See our latest analysis for Cullen/Frost Bankers.

While shares in Cullen/Frost Bankers have seen a mild pull-back in recent months, the bigger picture shows momentum has remained positive, with a solid 1-year total shareholder return of 15.63% reflecting longer-term growth even as near-term price returns have been quieter.

If you’re watching the banking sector but also open to new ideas, now is a great moment to broaden your scope and discover fast growing stocks with high insider ownership

With shares currently trading below analyst targets and some intrinsic value estimates, the key question for investors is whether Cullen/Frost Bankers represents a genuine bargain or if the market is already reflecting its growth prospects.

Most Popular Narrative: 6.8% Undervalued

Cullen/Frost Bankers’s narrative fair value estimate of $136.73 stands nearly $10 above the recent close at $127.43, marking the stock as modestly undervalued. The current figure is driven by optimism around margin potential and rapid growth in key regional markets.

The full payoff from the branch expansion strategy is approaching, with maturing branches in high-growth markets shifting from breakeven to accretive by 2026. This will unlock operating leverage and drive faster bottom-line growth relative to the past three years.

Curious what’s fueling this number? This narrative leans hard on future growth powered by branch expansion and assumes both earnings and margins will surpass recent results. Want to see the exact projections and understand the logic behind this punchy fair value? Unlock the details and challenge your own assumptions.

Result: Fair Value of $136.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, even with these strengths, concentrated exposure to Texas markets or a slower than expected payoff from expansion could threaten the optimistic outlook.

Find out about the key risks to this Cullen/Frost Bankers narrative.

Another View: Is the Market Multiple Sending a Different Signal?

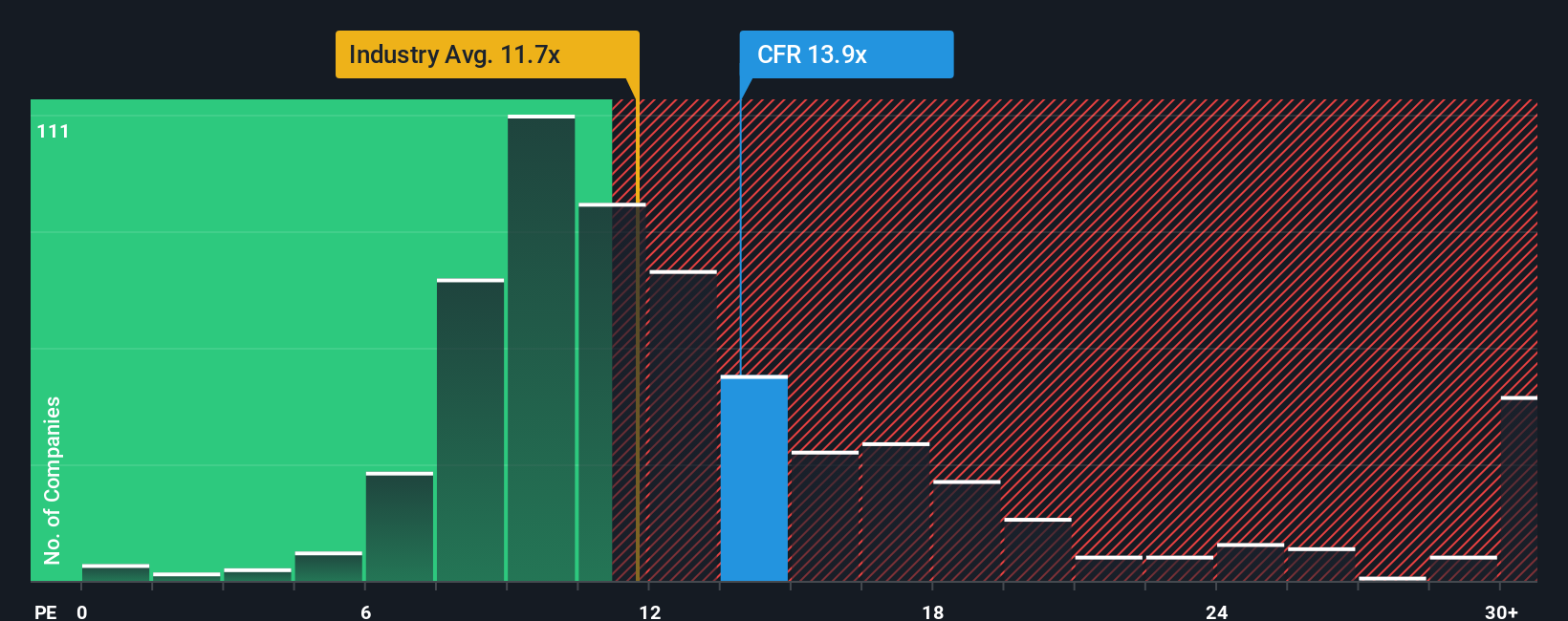

Looking at valuation through earnings multiples, Cullen/Frost Bankers trades at a price-to-earnings ratio of 13.7x. This is higher than the US Banks industry average of 11.8x and above its own estimated fair ratio of 11.9x. While it appears pricier than peers, it is less expensive compared to the group average (14.9x). Does this gap suggest greater downside risk, or could it reflect confidence in long-term growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cullen/Frost Bankers Narrative

If you see things differently or want to dig into the numbers your way, you can shape your own view in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Cullen/Frost Bankers.

Looking for more investment ideas?

Don’t wait to expand your investing horizons. The market’s best opportunities are available to those who act, not to those who hesitate. Use the Simply Wall Street Screener to target new themes and unlock your next winning idea:

- Tap into fresh opportunities with these 898 undervalued stocks based on cash flows, which could be the hidden gems missing from your portfolio.

- Explore game-changing tech with these 25 AI penny stocks, a group leading advancements in artificial intelligence innovation and transformation.

- Boost your passive income with these 19 dividend stocks with yields > 3%, featuring stocks that deliver reliable yields above 3% for steady growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CFR

Cullen/Frost Bankers

Operates as the bank holding company for Frost Bank that provides commercial and consumer banking services in Texas.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives