- United States

- /

- Banks

- /

- NYSE:CFG

The Bull Case For Citizens Financial Group (CFG) Could Change Following TD Cowen’s AI-Focused Reassessment

Reviewed by Sasha Jovanovic

- TD Cowen recently reaffirmed its positive view on Citizens Financial Group, highlighting the bank’s “founder-type culture,” expected earnings momentum, and improving profitability metrics such as net interest margin and return on tangible common equity.

- The firm also pointed to Citizens’ expanding private banking franchise and early move into artificial intelligence as potential long-term competitive advantages.

- We’ll now examine how TD Cowen’s emphasis on Citizens’ AI adoption could influence the bank’s existing investment narrative and risk-reward profile.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Citizens Financial Group Investment Narrative Recap

To own Citizens Financial Group, you need to believe it can convert its technology and private banking investments into durable earnings growth while managing credit and regulatory risks. TD Cowen’s upbeat view on earnings momentum and profitability does not materially change the near term focus on credit quality in commercial real estate as the key swing factor, or the risk that digital efforts could still lag bigger peers even with early AI adoption.

The recent increase in the common dividend to US$0.46 per share ties into this narrative, signaling confidence in earnings stability and capital strength while Citizens invests in “Reimagining the Bank,” its AI and automation push. For investors watching short term catalysts, that combination of a higher payout and ongoing tech spend puts even more weight on whether profitability improvements can keep pace with any future credit normalization.

Yet behind the optimism around AI and earnings momentum, investors should still be aware of the bank’s concentrated exposure to...

Read the full narrative on Citizens Financial Group (it's free!)

Citizens Financial Group's narrative projects $10.3 billion revenue and $2.8 billion earnings by 2028. This requires 12.6% yearly revenue growth and an earnings increase of about $1.3 billion from $1.5 billion today.

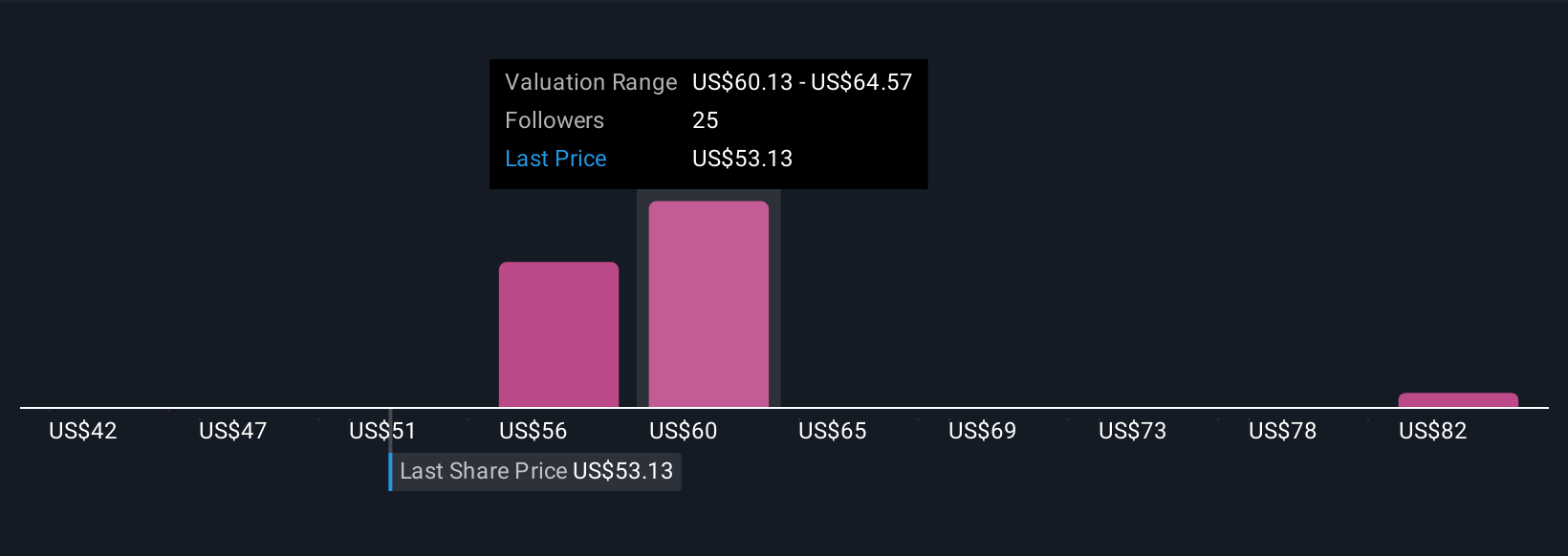

Uncover how Citizens Financial Group's forecasts yield a $61.82 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members currently place Citizens’ fair value between US$42.41 and US$80.69 across 3 independent views, highlighting how far opinions can diverge. Against that backdrop, TD Cowen’s focus on AI driven efficiency and earnings momentum gives you one more angle to weigh alongside ongoing concerns about commercial real estate exposure and digital competitiveness.

Explore 3 other fair value estimates on Citizens Financial Group - why the stock might be worth as much as 45% more than the current price!

Build Your Own Citizens Financial Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Citizens Financial Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Citizens Financial Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Citizens Financial Group's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CFG

Citizens Financial Group

Operates as the bank holding company that provides retail and commercial banking products and services to individuals, small businesses, middle-market companies, large corporations, and institutions in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026