- United States

- /

- Banks

- /

- NYSE:CBU

Can Community Financial System's (CBU) Dividend Growth Weather Sector-Wide Credit Concerns?

Reviewed by Sasha Jovanovic

- Community Financial System, Inc. recently declared a quarterly cash dividend of US$0.47 per share, payable on January 12, 2026, to shareholders of record as of December 12, 2025, representing an annualized yield of 3.21% based on the October 14, 2025 closing share price.

- While the company continues its long streak of dividend growth, broader concerns about loan quality among regional banks have drawn investor attention to the sector.

- Given renewed industry-wide focus on credit risk, we'll examine how these loan quality concerns may impact Community Financial System's outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Community Financial System Investment Narrative Recap

To be a shareholder in Community Financial System, it helps to have confidence in the company's ability to manage disciplined lending and maintain strong asset quality while navigating sector headwinds. The recently announced dividend affirms management's ongoing commitment to shareholder returns, but broader warnings on deteriorating loan quality across regional banks may not materially impact the company's short-term catalyst of deposit and footprint growth, even as loan losses remain a key risk to watch.

The latest dividend declaration of US$0.47 per share, representing a 3.21% annualized yield, stands out among recent announcements as it continues a decades-long streak of payout increases and signals ongoing financial health despite sector pressures. This move is particularly relevant given current focus on credit risk, as it provides a measure of reassurance while underlying questions about future commercial loan performance linger.

However, investors should note that, even with sustained dividend growth, the risk of rising net charge-offs and credit provision...

Read the full narrative on Community Financial System (it's free!)

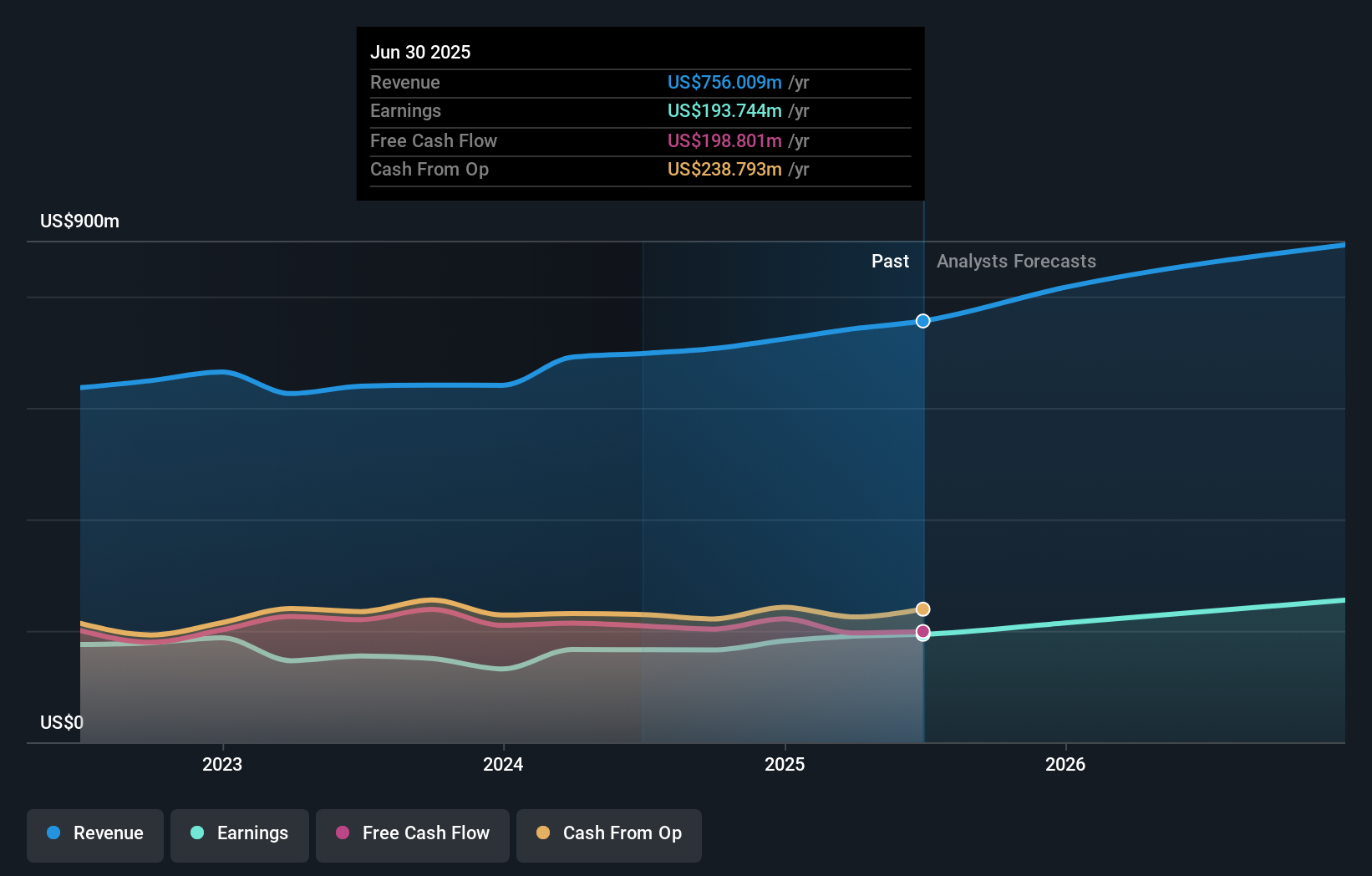

Community Financial System's narrative projects $1.0 billion revenue and $328.8 million earnings by 2028. This requires 11.5% yearly revenue growth and a $135.1 million earnings increase from $193.7 million currently.

Uncover how Community Financial System's forecasts yield a $67.40 fair value, a 21% upside to its current price.

Exploring Other Perspectives

You can find three Simply Wall St Community fair value estimates for US$50.66 to US$72.18, suggesting a wide range of individual views. Yet with credit quality now in the spotlight, the company's share price could be influenced by growing concerns around loan losses and sector risks, so it pays to consider several perspectives before making decisions.

Explore 3 other fair value estimates on Community Financial System - why the stock might be worth 9% less than the current price!

Build Your Own Community Financial System Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Community Financial System research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Community Financial System research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Community Financial System's overall financial health at a glance.

No Opportunity In Community Financial System?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBU

Community Financial System

Operates as the bank holding company for Community Bank, N.A.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives