- United States

- /

- Banks

- /

- NYSE:C

What Citigroup (C)'s Preferred Stock Reset and Funding Moves Mean for Shareholders

Reviewed by Sasha Jovanovic

- In early December 2025, Citigroup Inc. redeemed all US$1.50 billions of its 4.000% Series W preferred stock and simultaneously created a new 6.625% Fixed Rate Reset Noncumulative Preferred Stock, Series HH, while continuing to issue and refinance a range of senior unsecured notes across currencies and maturities.

- These capital and funding moves, alongside new leadership appointments in Japan and South Korea and ongoing investor outreach, suggest Citi is actively reshaping its balance sheet and regional franchises to support its longer-term business priorities.

- We’ll now examine how Citi’s replacement of Series W preferred stock with new Series HH shares may influence its investment narrative and outlook.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Citigroup Investment Narrative Recap

To own Citi today, you need to believe its global network and ongoing simplification can translate recent earnings momentum into better returns, even as regulation and restructuring remain heavy overhangs. The Series W redemption and creation of higher-coupon Series HH preferreds look incremental for now, with limited direct impact on near term catalysts like cost discipline and capital return, or on key risks such as regulatory scrutiny and execution on the overhaul.

The most relevant recent announcement here is Citi’s full US$1.50 billion redemption of 4.000% Series W preferred stock just before Series HH was created. Together with ongoing senior note issuance, this shows Citi actively refreshing its funding stack while it invests in technology, exits lower priority businesses and reallocates capital, which all sit at the heart of the current catalyst story around efficiency and potential improvements in returns.

Yet investors should also weigh how quickly rising funding costs could pressure Citi’s margins and earnings trajectory if credit or regulation surprises...

Read the full narrative on Citigroup (it's free!)

Citigroup's narrative projects $88.8 billion revenue and $17.2 billion earnings by 2028.

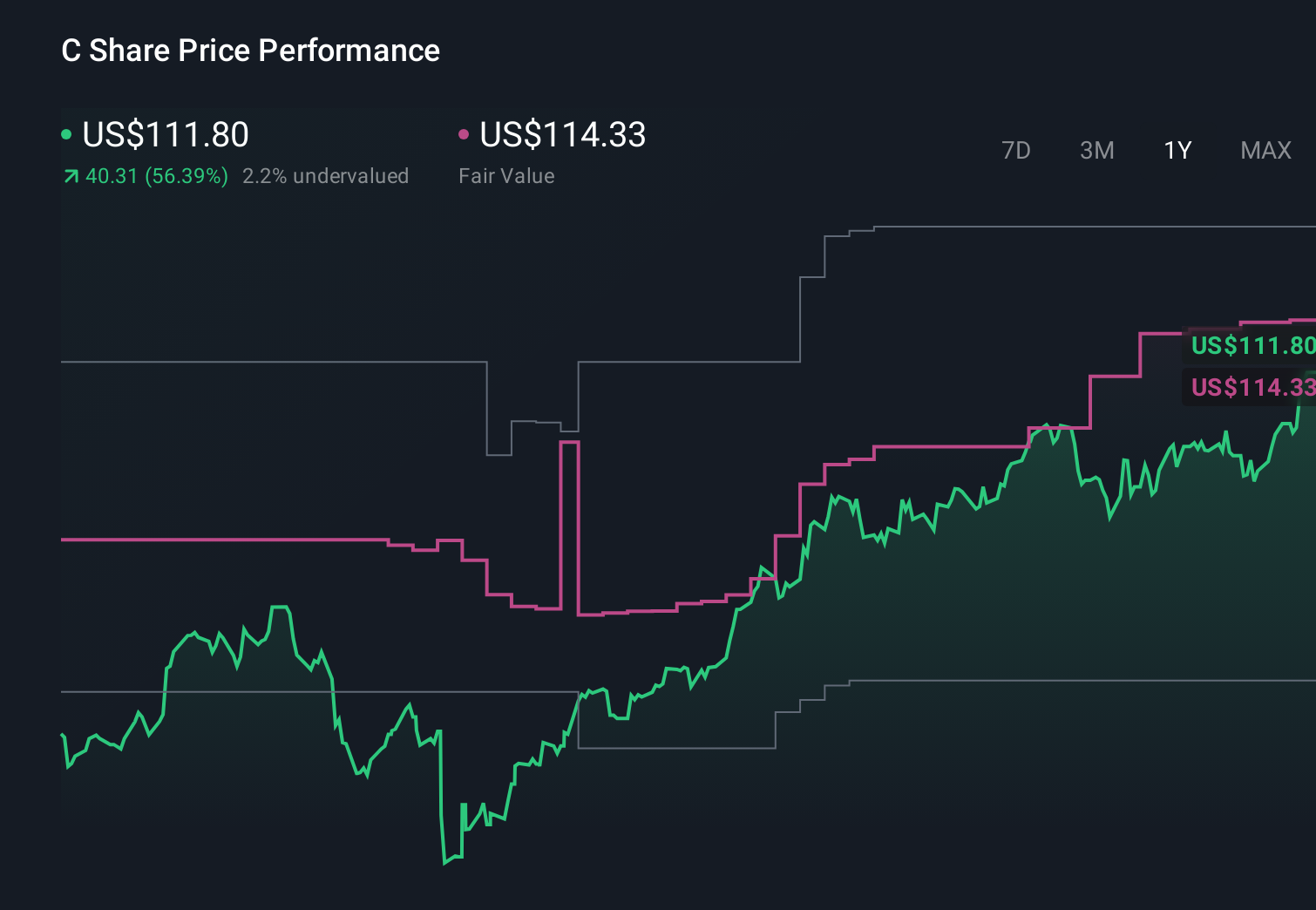

Uncover how Citigroup's forecasts yield a $114.33 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts were assuming Citi could lift annual earnings to about US$20.0 billion, but if geopolitical and macro risks hit trade flows and credit losses, that bullish path could look very different, underscoring how your view on these uncertainties can lead to very different conclusions about the same stock.

Explore 12 other fair value estimates on Citigroup - why the stock might be worth over 2x more than the current price!

Build Your Own Citigroup Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Citigroup research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Citigroup research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Citigroup's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:C

Citigroup

A diversified financial service holding company, provides various financial product and services to consumers, corporations, governments, and institutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026