- United States

- /

- Banks

- /

- NYSE:C

Citigroup (C): Reassessing Valuation After a 60% Year-to-Date Share Price Surge

Reviewed by Simply Wall St

Citigroup (C) has quietly delivered a strong run for shareholders, with the stock up about 60% year to date and roughly 62% over the past year, outpacing many big bank peers.

See our latest analysis for Citigroup.

That surge in confidence is showing up in the numbers, with a roughly 11% 1 month share price return building on a near 60% year to date share price gain and a powerful multi year total shareholder return trend.

If Citigroup’s momentum has you thinking more broadly about the market, this could be a good moment to explore fast growing stocks with high insider ownership for other potential standouts.

Yet despite that surge, Citi still trades at a noticeable discount to many peers and some estimates of intrinsic value. This raises a key question: is this a late cycle momentum play or a genuine mispricing of future growth?

Most Popular Narrative: 52% Undervalued

According to ChadWisperer, the latest fair value estimate of around $233 sits far above Citigroup’s recent $111.80 close, framing a sharp upside gap that hinges on bold long term assumptions.

The Citi Token Services platform, expanding into more markets and applications like tokenized deposits and crypto custodial solutions, is expected to unlock entirely new, high-margin revenue streams by redefining cross-border payments and liquidity management for its vast institutional client base. Simultaneously, sustained share gains in Investment Banking, propelled by strategic talent investments and a focus on high-growth sectors like tech and healthcare, will add significant fee income.

Want to see what powers that punchy valuation gap? The narrative leans on compounding revenue, rising margins, and a future earnings multiple more often reserved for market darlings. Curious which specific growth engines and profitability targets have to click into place to justify that price? Dive in to unpack the full playbook behind this fair value call.

Result: Fair Value of $233.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several risks could derail this bullish path, including slower adoption of Citi Token Services and a tougher macro backdrop that pressures credit quality and capital returns.

Find out about the key risks to this Citigroup narrative.

Another Lens on Value

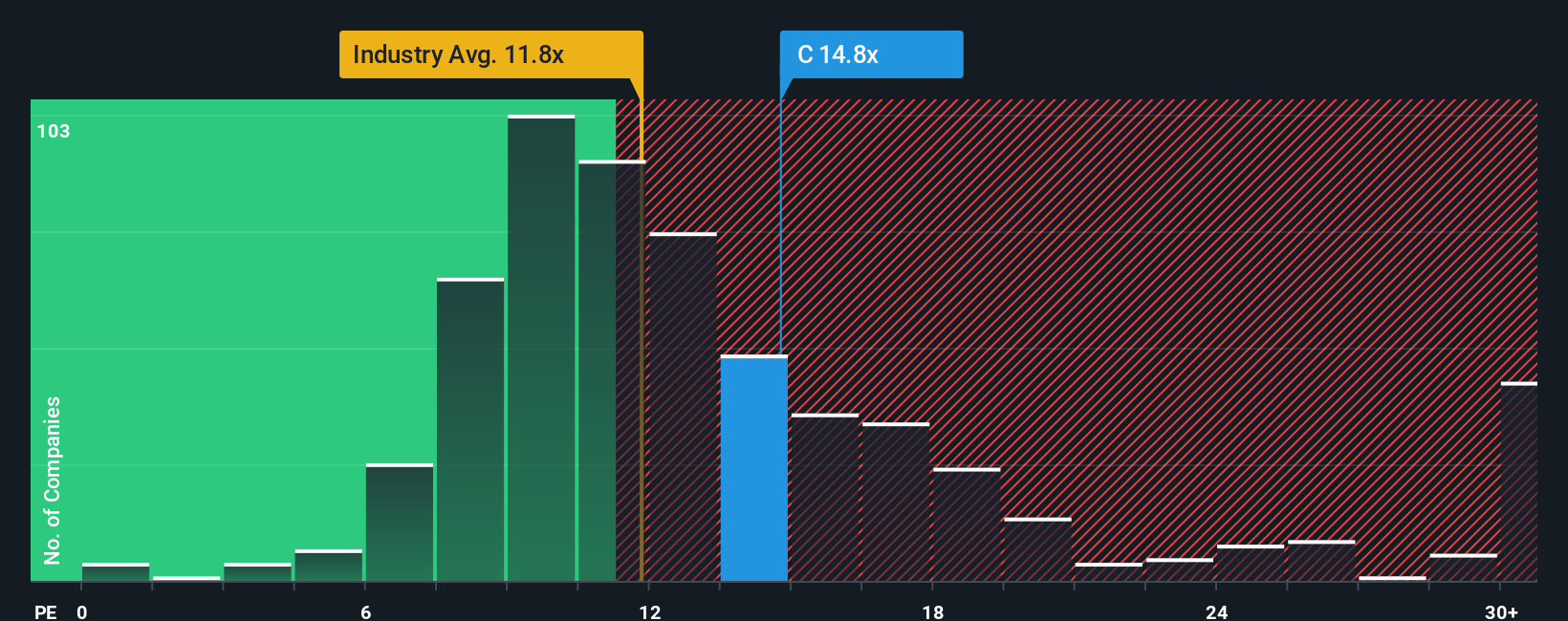

Step away from narrative driven upside and Citi suddenly looks less of a steal. On earnings, the stock trades at about 14.9 times, richer than the US banks sector at 11.9 times and even above peer averages around 13.6 times. That hints at less margin for error if growth underwhelms.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Citigroup Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Citigroup.

Ready for your next investing move?

Do not stop at Citigroup. Use the Simply Wall St Screener to lock onto fresh, data backed opportunities before other investors crowd into the same trades.

- Capitalize on mispriced potential by targeting quality businesses trading below intrinsic value through these 908 undervalued stocks based on cash flows, where upside and fundamentals align.

- Ride structural shifts in medicine by focusing on companies using smart algorithms to transform patient outcomes with these 30 healthcare AI stocks.

- Strengthen your income stream by filtering for reliable payers offering attractive yields and robust financials via these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:C

Citigroup

A diversified financial service holding company, provides various financial product and services to consumers, corporations, governments, and institutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion