- United States

- /

- Banks

- /

- NYSE:C

Citigroup (C) Profit Margin Surge Reinforces Bullish Narratives Despite Slower Revenue Growth

Reviewed by Simply Wall St

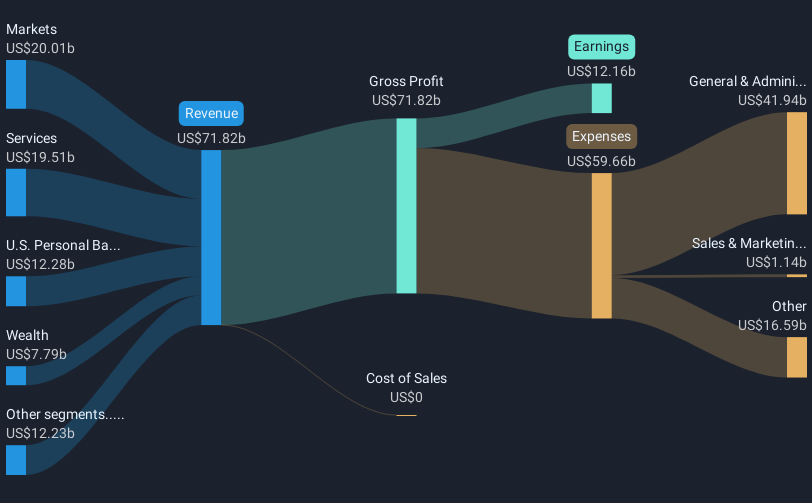

Citigroup (C) delivered a sharp turnaround, posting net profit margins of 17.8% compared to 9.7% last year and an EPS surge of 100.6% over the past year. This contrasts with a 5-year average earnings decline of 10.4% per year. With anticipated earnings growth at 16.04% annually and revenue expected to rise 5.5% per year, the results give investors reasons for optimism, even as growth and valuation multiples trail the broader market. Solid margins and the absence of flagged risks indicate an improved earnings quality that could support positive sentiment going forward.

See our full analysis for Citigroup.Now let’s see how these headline numbers compare when set side by side with the market’s prevailing narratives. Some expectations may get confirmed, while others might face a challenge.

See what the community is saying about Citigroup

Share Price Lags Behind DCF Fair Value

- Citigroup's share price stands at $99.78, which is below its DCF fair value of $124.90, representing a discount of about 20%. This gap highlights a valuation tension that isn't fully explained by near-term growth rates alone.

- Analysts' consensus view notes Citigroup’s valuation multiples price it above both the US banks industry average (13.3x versus 11.7x) and peer average (13.3x versus 12.5x). However, the significant discount to DCF fair value sustains debate over whether current market skepticism undervalues the impact of long-term improvements.

- Interestingly, the consensus 2028 price target is 13% above today’s share price but remains less than the DCF fair value. This suggests that analysts are cautiously optimistic, but not as bullish as the DCF model might imply.

- The consensus narrative highlights that further margin expansion, earnings growth, or successful cost-cutting could help narrow this gap, though sector-wide challenges and transformation costs account for much of the current discount.

Bulls Eye Rising Margins by 2028

- Bullish analysts forecast profit margins to climb from 16.9% now to 21.9% in three years, driving projected earnings growth to $20.0 billion and EPS to $12.14 by 2028, which is well above today's levels.

- Several factors support these targets for the bullish case:

- Bulls contend that strategic investments in AI, infrastructure modernization, and wealth management will enable Citigroup to outperform broader macro risk factors and grow revenue by 8.3% per year, significantly ahead of the 5.5% consensus forecast.

- While improved cost management and a $20 billion buyback plan are viewed as catalysts for higher PE multiples, current trading multiples remain above industry peers. The narrative thus depends on sustained operational execution and margin leverage.

Industry Average Revenue Growth Outpaces Citi

- Citigroup’s revenue is expected to grow at 5.5% per year, falling short of the broader US market’s anticipated 10% annual revenue growth. This gap shapes both competitive and investor expectations.

- According to the analysts' consensus view, digital transformation is beginning to pay off with more efficient operations and higher margins, but limited revenue momentum remains a central concern:

- Consensus notes that cross-border transaction and trade activity are clear growth drivers, yet regulatory pressure, transformation costs, and a still-slowing segment mix explain why Citigroup’s overall top-line expansion is unlikely to match sector leaders.

- This tension lies at the center for investors balancing the bank’s operating improvements with the realities of a tougher competitive and regulatory landscape.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Citigroup on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Thinking about the figures in a new light? Use just a few minutes to build your own interpretation and narrative. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Citigroup.

See What Else Is Out There

While Citigroup’s long-term margin and earnings outlook is improving, its revenue growth still trails sector peers and broader market leaders.

If steady, above-average growth appeals to you, use our stable growth stocks screener (2096 results) to single out companies consistently delivering robust results, regardless of the market backdrop.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:C

Citigroup

A diversified financial service holding company, provides various financial product and services to consumers, corporations, governments, and institutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives