- United States

- /

- Food

- /

- NYSE:BG

Top 3 US Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As U.S. stocks rise and Treasury yields decline following a slight slowdown in wholesale inflation, investors are closely monitoring the market's response to potential interest rate changes. In this environment, dividend stocks can offer stability and income, making them an attractive option for those looking to balance growth with steady returns amidst fluctuating economic conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.29% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.93% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.92% | ★★★★★★ |

| FMC (NYSE:FMC) | 6.33% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 5.94% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.20% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.87% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.88% | ★★★★★★ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.51% | ★★★★★★ |

Click here to see the full list of 135 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Atlantic Union Bankshares (NYSE:AUB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Atlantic Union Bankshares Corporation is a bank holding company for Atlantic Union Bank, offering banking and financial products and services to consumers and businesses across the United States, with a market cap of $3.48 billion.

Operations: Atlantic Union Bankshares Corporation generates revenue through its banking operations, providing a range of financial products and services to both individual and business clients in the United States.

Dividend Yield: 3.6%

Atlantic Union Bankshares offers a stable dividend profile with consistent payouts over the past decade and a current yield of 3.6%, though below the top quartile of U.S. dividend payers. Recent earnings growth supports its payout ratio of 56.8%, indicating dividends are well-covered by earnings, with future forecasts suggesting improved coverage at 34.3%. Despite shareholder dilution in the past year, net income rose to US$209.13 million in 2024, enhancing its financial footing for continued dividend reliability.

- Delve into the full analysis dividend report here for a deeper understanding of Atlantic Union Bankshares.

- Our valuation report here indicates Atlantic Union Bankshares may be undervalued.

Bunge Global (NYSE:BG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bunge Global SA is an agribusiness and food company with operations worldwide and a market cap of approximately $9.76 billion.

Operations: Bunge Global SA generates revenue through its diverse segments, including Agribusiness at $38.60 billion, Refined and Specialty Oils at $12.77 billion, Milling at $1.56 billion, and Sugar & Bioenergy at $130 million.

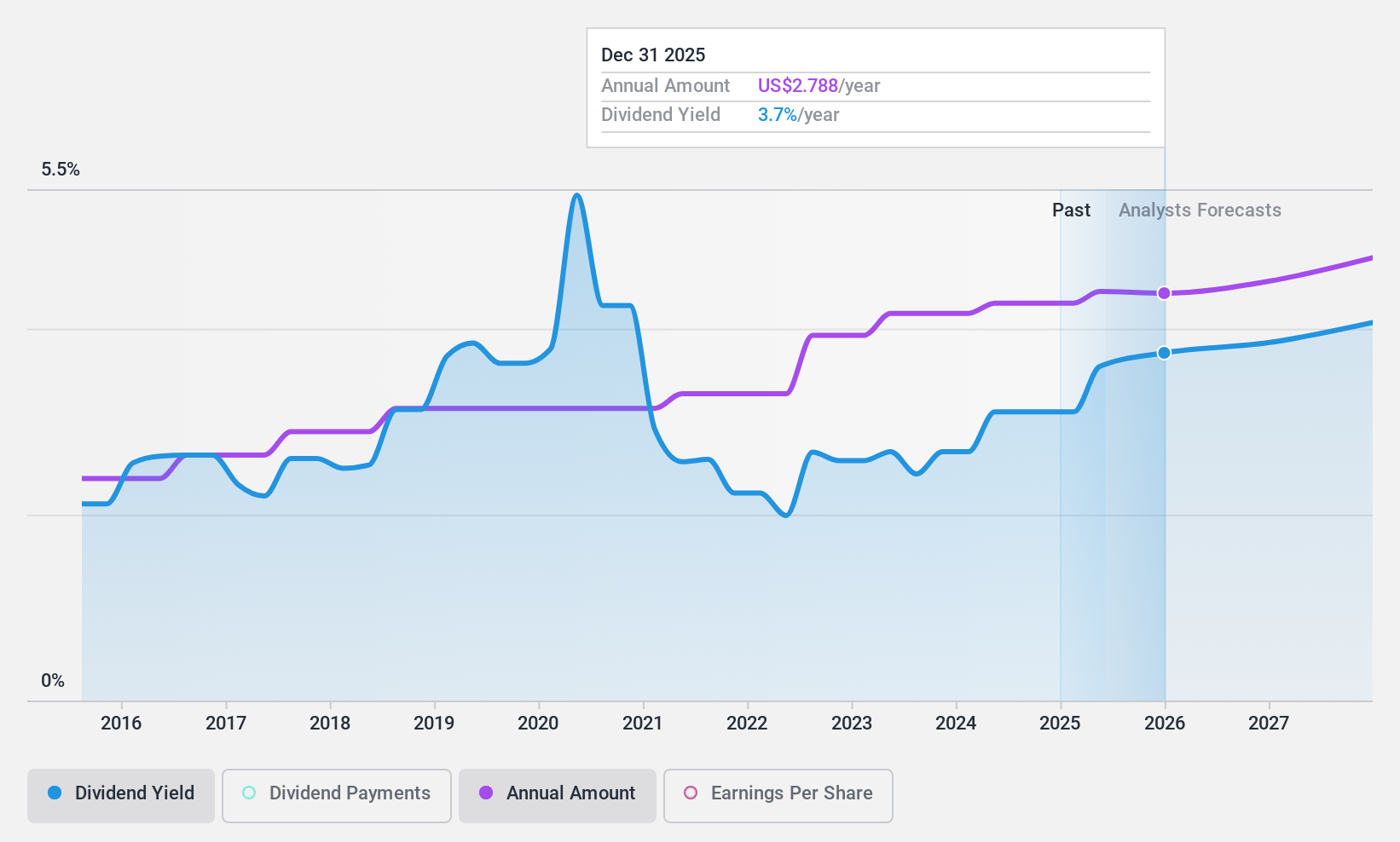

Dividend Yield: 3.9%

Bunge Global maintains a stable dividend history with consistent increases over the past decade and a current yield of 3.94%, though it trails the top quartile of U.S. dividend payers. Its dividends are well-covered by earnings, evidenced by a low payout ratio of 33.8%, and supported by cash flows despite a higher cash payout ratio of 72.5%. Recent buybacks, reducing share count significantly, may bolster future per-share metrics amid modest net income growth to US$602 million in Q4 2024.

- Click here to discover the nuances of Bunge Global with our detailed analytical dividend report.

- According our valuation report, there's an indication that Bunge Global's share price might be on the cheaper side.

Regions Financial (NYSE:RF)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Regions Financial Corporation is a financial holding company that offers banking and bank-related services to individual and corporate customers, with a market cap of approximately $22.17 billion.

Operations: Regions Financial Corporation's revenue is derived from providing a range of banking and bank-related services to both individual and corporate clients.

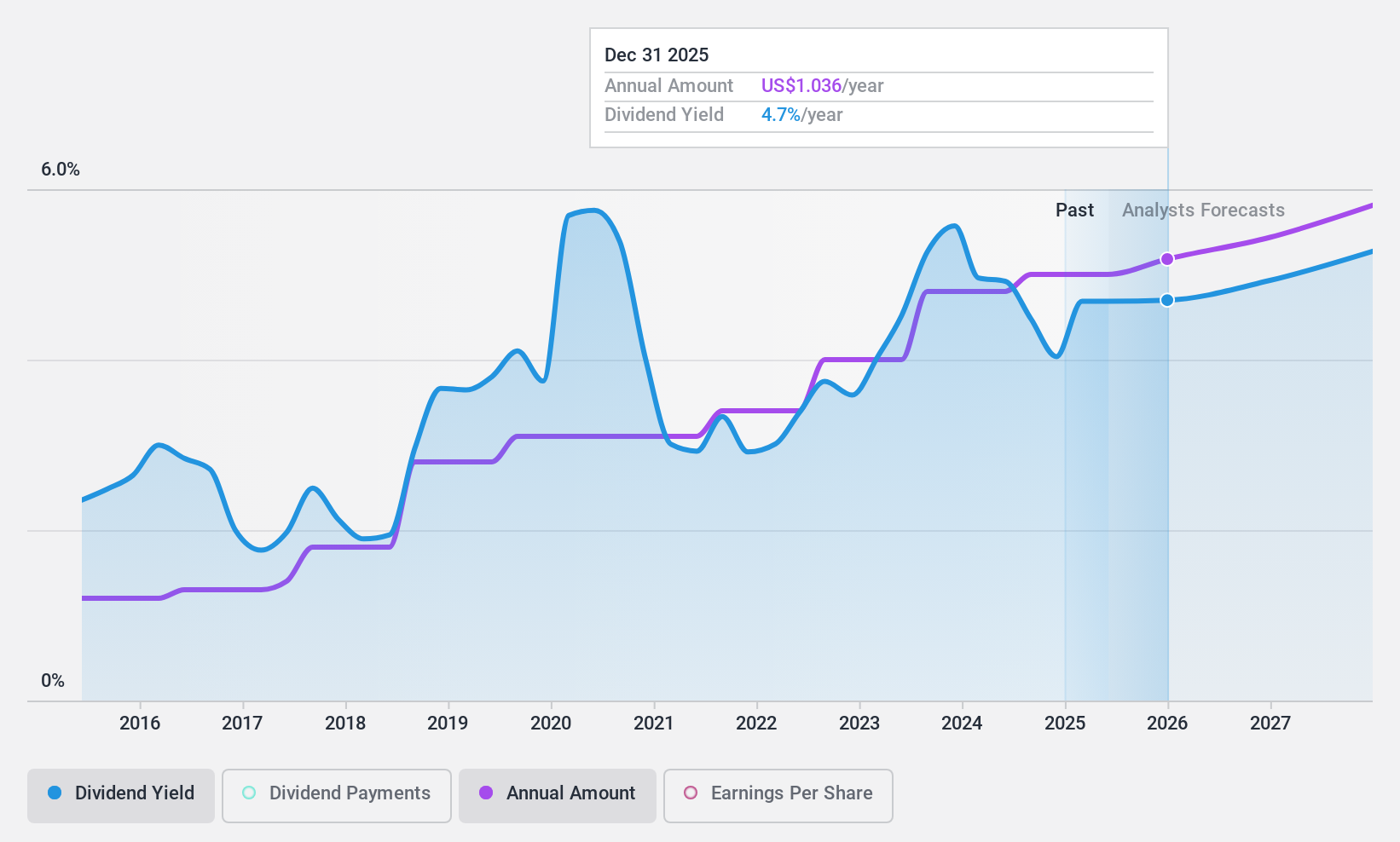

Dividend Yield: 5.9%

Regions Financial offers a high dividend yield of 5.94%, placing it among the top U.S. dividend payers, with stable and reliable distributions over the past decade. Its dividends are well-covered by earnings, reflected in a reasonable payout ratio of 50.6%. Recent announcements affirm continued payments on both common and preferred shares. Despite a decrease in net income to US$1.89 billion for 2024, dividends remain sustainable and supported by ongoing buybacks totaling US$616.78 million since April 2022.

- Click here and access our complete dividend analysis report to understand the dynamics of Regions Financial.

- Our comprehensive valuation report raises the possibility that Regions Financial is priced lower than what may be justified by its financials.

Key Takeaways

- Take a closer look at our Top US Dividend Stocks list of 135 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bunge Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BG

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives