- United States

- /

- Banks

- /

- NYSE:ASB

3 Stocks That May Be Undervalued In June 2025

Reviewed by Simply Wall St

The United States market has experienced a steady climb, with a 1.7% increase in the last week and a 12% rise over the past year, while earnings are forecast to grow by 15% annually. In this environment, identifying potentially undervalued stocks can be crucial for investors looking to capitalize on opportunities that may offer growth at attractive valuations.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TXO Partners (TXO) | $15.16 | $29.94 | 49.4% |

| Rocket Lab (RKLB) | $32.35 | $63.69 | 49.2% |

| Lyft (LYFT) | $15.56 | $30.58 | 49.1% |

| Insteel Industries (IIIN) | $36.11 | $71.99 | 49.8% |

| Globalstar (GSAT) | $23.21 | $45.61 | 49.1% |

| GeneDx Holdings (WGS) | $88.93 | $176.72 | 49.7% |

| First Busey (BUSE) | $22.95 | $45.56 | 49.6% |

| Brookline Bancorp (BRKL) | $10.34 | $20.56 | 49.7% |

| Berkshire Hills Bancorp (BHLB) | $24.64 | $48.70 | 49.4% |

| Associated Banc-Corp (ASB) | $23.99 | $47.53 | 49.5% |

Let's review some notable picks from our screened stocks.

Verra Mobility (VRRM)

Overview: Verra Mobility Corporation offers smart mobility technology solutions across the United States, Australia, Europe, and Canada with a market cap of $4.02 billion.

Operations: The company generates revenue through three main segments: Parking Solutions ($81.01 million), Commercial Services ($413.18 million), and Government Solutions ($398.54 million).

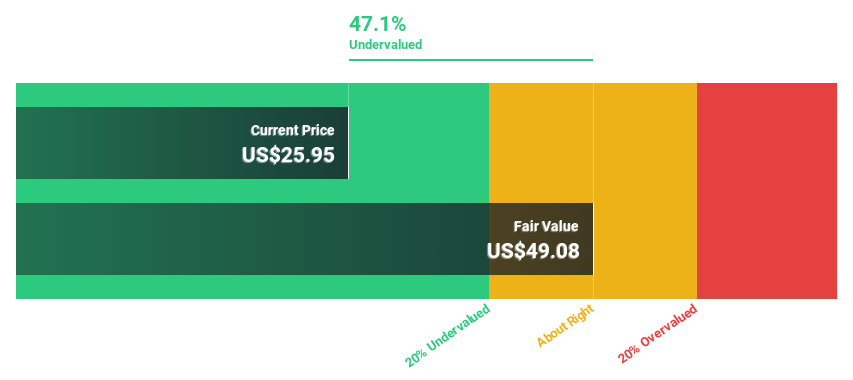

Estimated Discount To Fair Value: 48.3%

Verra Mobility appears undervalued, trading at US$25.01 against a fair value estimate of US$48.35, indicating significant potential based on discounted cash flow analysis. Despite high debt levels and recent profit margin declines from 9.8% to 3.9%, earnings are projected to grow significantly at 46.77% annually over the next three years, outpacing the broader U.S. market's growth forecast of 14.5%. Recent financial maneuvers include an expanded credit facility and share buybacks totaling US$194.18 million since November 2023.

- According our earnings growth report, there's an indication that Verra Mobility might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Verra Mobility.

TransMedics Group (TMDX)

Overview: TransMedics Group, Inc. is a commercial-stage medical technology company focused on transforming organ transplant therapy for end-stage organ failure patients globally, with a market cap of approximately $4.49 billion.

Operations: The company generates revenue from its Surgical & Medical Equipment segment, which amounted to $488.23 million.

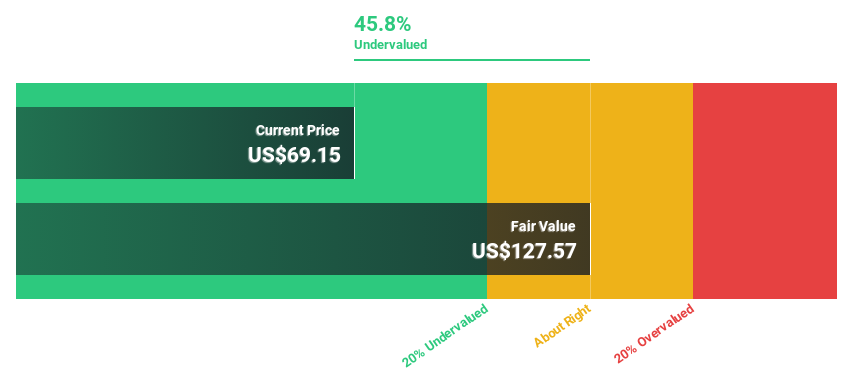

Estimated Discount To Fair Value: 47.9%

TransMedics Group is trading at US$128.58, significantly below its estimated fair value of US$246.79, suggesting it is undervalued based on discounted cash flow analysis. Despite operating cash flow not covering debt well, earnings are expected to grow 25.3% annually over the next three years, surpassing market averages. Recent Q1 results showed revenue of US$143.54 million and net income of US$25.68 million, with raised full-year revenue guidance between US$565 million and US$585 million.

- Our growth report here indicates TransMedics Group may be poised for an improving outlook.

- Get an in-depth perspective on TransMedics Group's balance sheet by reading our health report here.

Associated Banc-Corp (ASB)

Overview: Associated Banc-Corp is a bank holding company offering a range of banking and nonbanking products and services to individuals and businesses across Wisconsin, Illinois, Missouri, and Minnesota with a market cap of approximately $3.93 billion.

Operations: The company's revenue segments include Community, Consumer, and Business at $997.11 million and Corporate and Commercial Specialty at $532.80 million.

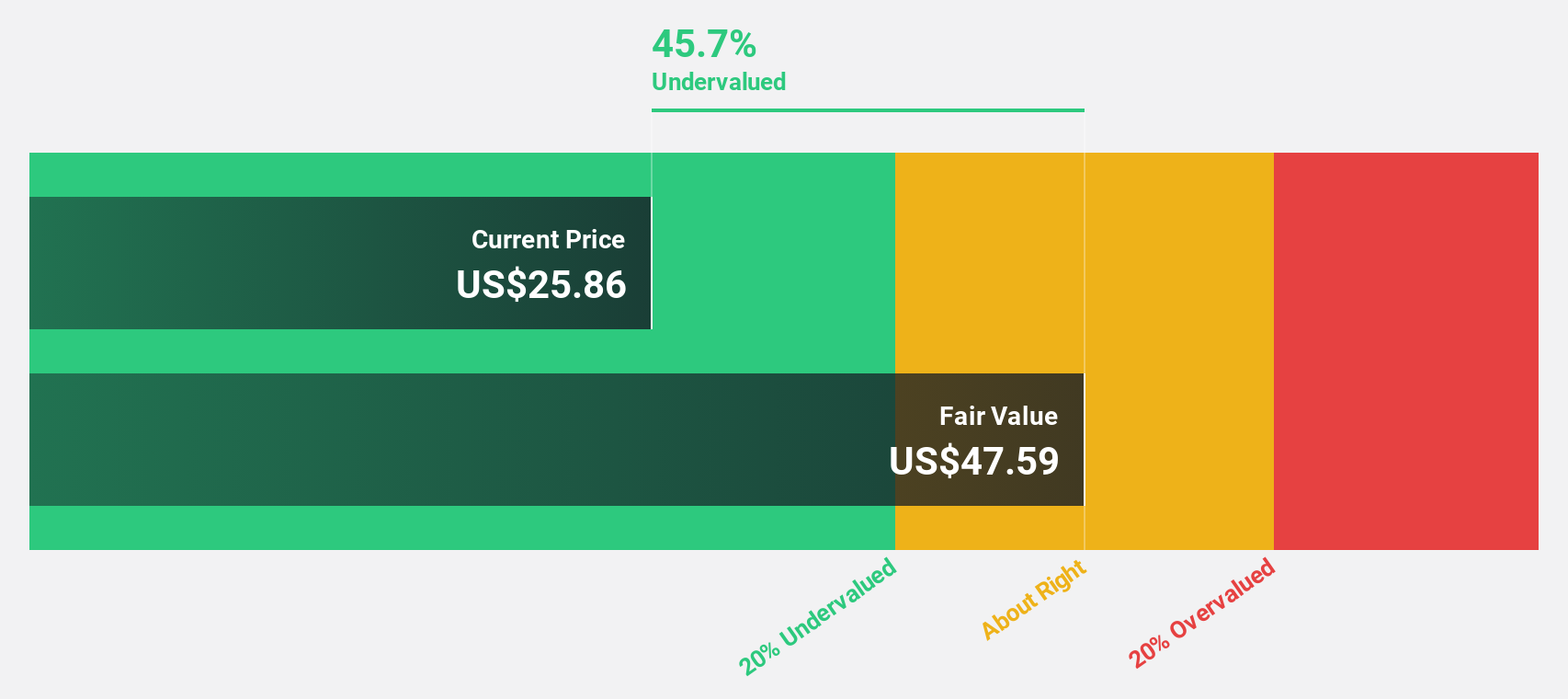

Estimated Discount To Fair Value: 49.5%

Associated Banc-Corp, trading at US$23.99, is significantly undervalued with an estimated fair value of US$47.53 based on discounted cash flow analysis. Earnings are forecast to grow 40.5% annually over the next three years, outpacing the US market's growth rate of 14.5%. Despite a dividend yield of 3.83% that may not be well covered by earnings, recent strategic expansions and executive changes aim to bolster long-term revenue growth and operational efficiency.

- Our expertly prepared growth report on Associated Banc-Corp implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Associated Banc-Corp's balance sheet health report.

Turning Ideas Into Actions

- Gain an insight into the universe of 173 Undervalued US Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASB

Associated Banc-Corp

A bank holding company, provides various banking and nonbanking products and services to individuals and businesses in Wisconsin, Illinois, Missouri, and Minnesota.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives