- United States

- /

- Banks

- /

- NasdaqGS:WABC

Westamerica Bancorporation (WABC): Reviewing Valuation as Analyst Downgrades and Institutional Shifts Reshape Outlook

Reviewed by Kshitija Bhandaru

Westamerica Bancorporation (WABC) drew investor attention after Wall Street Zen analysts downgraded the stock from hold to sell. This move, combined with more cautious analyst sentiment and shifting institutional positions, points to changing views on the bank’s outlook.

See our latest analysis for Westamerica Bancorporation.

Westamerica’s share price has slid noticeably over the past year, with recent weakness likely accelerated by the rating downgrade and a more cautious tone from analysts and institutions. Its latest close at $45.94 leaves the 1-year total shareholder return down 4.1%, and momentum has been fading as the market reassesses the bank's prospects in light of changing sentiment.

If this shift in sentiment has you wondering what else is gaining attention, now is a good time to widen your search and discover fast growing stocks with high insider ownership

So with a declining stock price and mixed analyst signals, is Westamerica Bancorporation trading below its true worth? Or has the market already accounted for the company’s prospects in the current valuation?

Price-to-Earnings of 9.2x: Is it justified?

Westamerica Bancorporation trades at a price-to-earnings (P/E) ratio of 9.2x, which suggests investors are paying $9.20 for every dollar of current earnings, compared to peers and the sector. With a last close at $45.94, the company’s multiple positions it as more attractively valued than the average bank stock in its peer group.

The price-to-earnings ratio is a key metric for banks, reflecting expectations for future profitability in a sector driven by earnings power. For Westamerica, a lower-than-average P/E could indicate market caution regarding future growth, recent earnings declines, or risks not present in its competitors. It may also present a relative value opportunity if the market is overly pessimistic.

Compared to the peer average P/E of 11.7x and the US Banks industry average of 11.3x, Westamerica is notably cheaper. However, against the estimated fair P/E of 8.7x, the stock appears slightly expensive on a fundamentals basis, suggesting room for the market to move lower or for earnings to recover.

Explore the SWS fair ratio for Westamerica Bancorporation

Result: Price-to-Earnings of 9.2x (ABOUT RIGHT)

However, continued net income declines and weak medium-term returns could further weigh on sentiment and challenge the case for a recovery in Westamerica's valuation.

Find out about the key risks to this Westamerica Bancorporation narrative.

Another View: Discounted Cash Flow Tells a Different Story

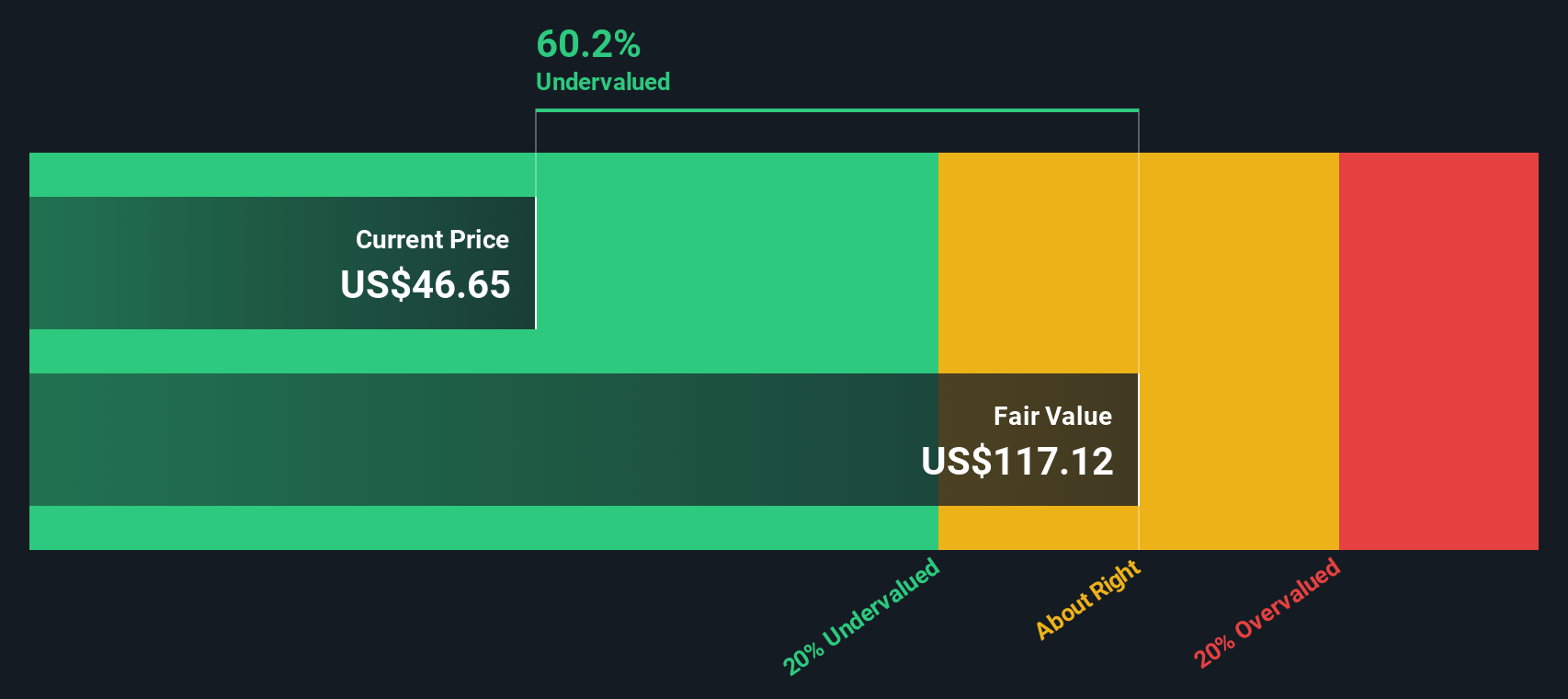

While the market’s focus is often on earnings multiples, the SWS DCF model presents a strikingly different picture. According to this approach, Westamerica Bancorporation’s shares are trading about 61% below our calculated fair value. This could suggest a potential disconnect between market skepticism and fundamental worth.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Westamerica Bancorporation for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Westamerica Bancorporation Narrative

If you'd like a different perspective or prefer your own research path, you can quickly assemble your own view of Westamerica Bancorporation in just a few minutes, and Do it your way.

A great starting point for your Westamerica Bancorporation research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know the advantage of searching beyond the obvious. Don’t settle for the average when you can be the first to spot tomorrow’s winners using Simply Wall Street’s powerful Screeners.

- Boost your income strategy by targeting top firms known for stable payouts. Jump straight to these 18 dividend stocks with yields > 3% with yields above 3%.

- Seize the growth wave in artificial intelligence by checking out these 25 AI penny stocks before the next surge in market excitement.

- Ride the digital currency momentum by tapping into these 79 cryptocurrency and blockchain stocks and uncover those leading the blockchain transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westamerica Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WABC

Westamerica Bancorporation

Operates as a bank holding company for the Westamerica Bank that provides various banking products and services to individual and commercial customers in the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives