- United States

- /

- Banks

- /

- NasdaqGS:WABC

Wave of Analyst Downgrades and Investor Shifts Might Change the Case for Investing in Westamerica Bancorporation (WABC)

Reviewed by Sasha Jovanovic

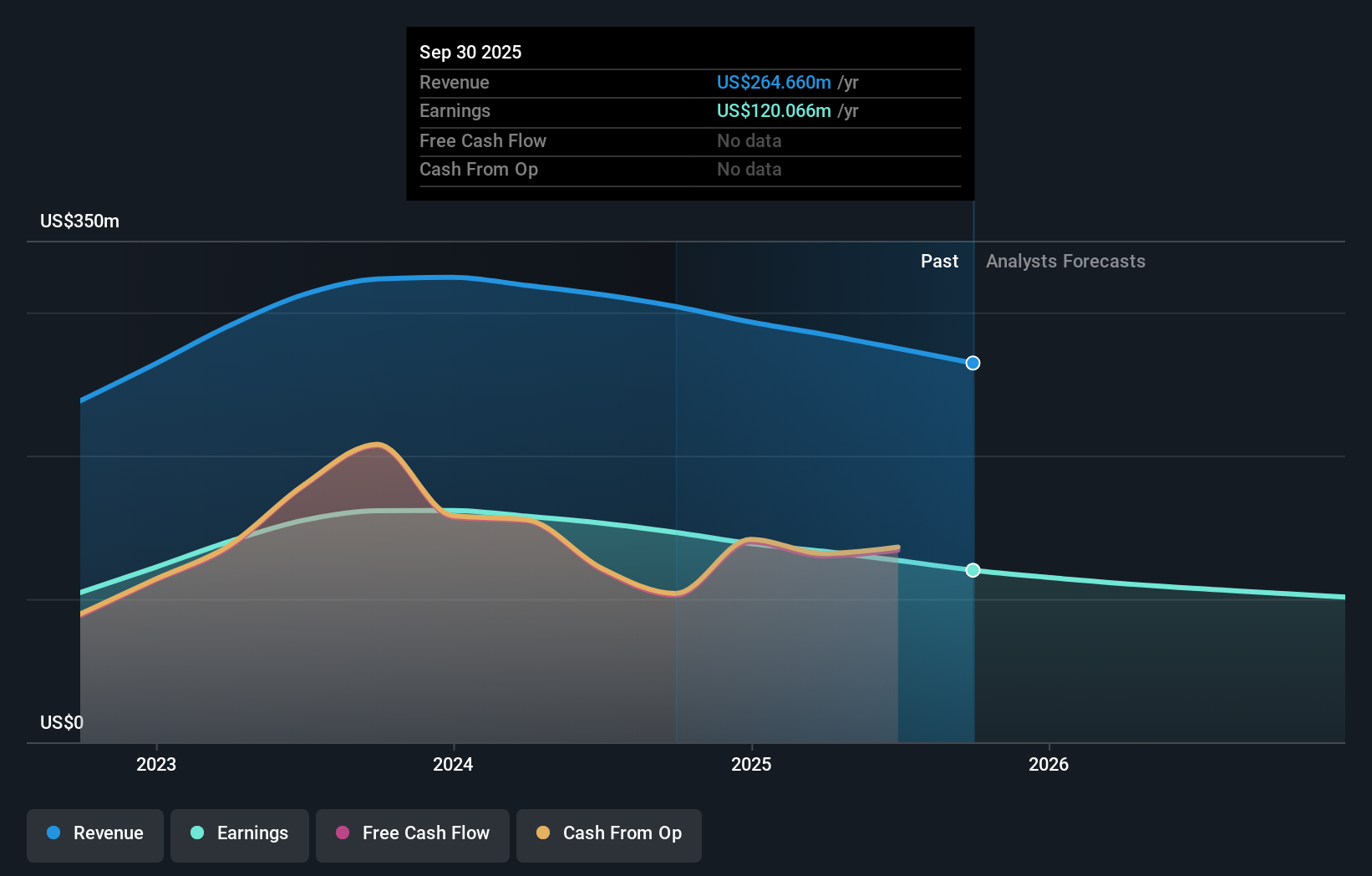

- Westamerica Bancorporation was recently downgraded from a "hold" to a "sell" rating by analysts at Wall Street Zen, with other equity research firms also expressing more cautious views.

- This shift in analyst sentiment was accompanied by significant adjustments in institutional investor positions, signaling changing perceptions of the bank's outlook.

- We'll explore how the wave of analyst caution and shifting institutional stances could affect Westamerica Bancorporation's investment narrative.

These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Westamerica Bancorporation's Investment Narrative?

To be a shareholder in Westamerica Bancorporation right now, you’d need confidence in the bank’s ability to maintain its reliable dividend and disciplined cost controls despite challenged earnings growth and a tougher outlook for the sector. Institutional moves and the recent downgrade to "sell" from Wall Street Zen add weight to existing concerns over shrinking net interest income, declining net income, and recent underperformance relative to industry peers. While the board remains experienced and the dividend yield attractive, the company faces meaningful pressure on both revenues and earnings in the near term. The new analyst sentiment now increases the risk that short-term catalysts, like share buybacks or further dividend rises, might be overshadowed as markets shift focus to the sustainability of fundamentals and future earnings power. This shift in perception could affect both market sentiment and support for the stock going forward.

Yet, as fundamentals come under more scrutiny, there’s also the question of whether the declining earnings trend has further to go. Despite retreating, Westamerica Bancorporation's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 2 other fair value estimates on Westamerica Bancorporation - why the stock might be worth as much as 48% more than the current price!

Build Your Own Westamerica Bancorporation Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Westamerica Bancorporation research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Westamerica Bancorporation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Westamerica Bancorporation's overall financial health at a glance.

No Opportunity In Westamerica Bancorporation?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westamerica Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WABC

Westamerica Bancorporation

Operates as a bank holding company for the Westamerica Bank that provides various banking products and services to individual and commercial customers in the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives