- United States

- /

- Banks

- /

- NasdaqGS:VLY

A Look at Valley National Bancorp’s (VLY) Valuation Following Share Movement on US-China Trade Tensions

Reviewed by Kshitija Bhandaru

Valley National Bancorp (VLY) shares came under pressure following heightened US-China trade tensions. The US administration signaled possible tariff hikes on Chinese imports, and China introduced new restrictions on critical mineral exports.

See our latest analysis for Valley National Bancorp.

Valley National Bancorp’s share price dipped this week as the broader financial sector reacted to renewed trade friction between the US and China. Even so, it still boasts an 18.14% year-to-date price return and a 19.99% total shareholder return over the past year. That recent momentum reflects both sector swings and renewed interest in regional banks aiming for a turnaround after the volatility of the past year.

If recent market headlines have you looking for the next standout, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With Valley National Bancorp’s stock now trading at a notable discount to analyst targets and showing strong recent growth, investors have to ask whether the current price leaves room for upside or if future gains are already reflected in the valuation.

Most Popular Narrative: 15.6% Undervalued

The most widely followed narrative sees Valley National Bancorp trading well below its calculated fair value of $12.50, with the last close at $10.55. That gap is drawing bullish attention as investors seek out regional banks with compelling upside potential and credible turnaround stories.

Analysts are assuming Valley National Bancorp's revenue will grow by 16.6% annually over the next 3 years. Analysts assume that profit margins will increase from 26.6% today to 31.8% in 3 years time.

Curious how these upbeat growth projections translate into today's undervalued price? The big surprise is that this narrative is anchored by sharply rising profitability and a bold profit multiple, one typically reserved for stronger, fast-growing banks. Dive in to uncover the full set of drivers behind this double-digit valuation gap.

Result: Fair Value of $12.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Valley’s heavy commercial real estate exposure and uncertain pace of digital transformation remain potential risks that could challenge its long-term growth outlook.

Find out about the key risks to this Valley National Bancorp narrative.

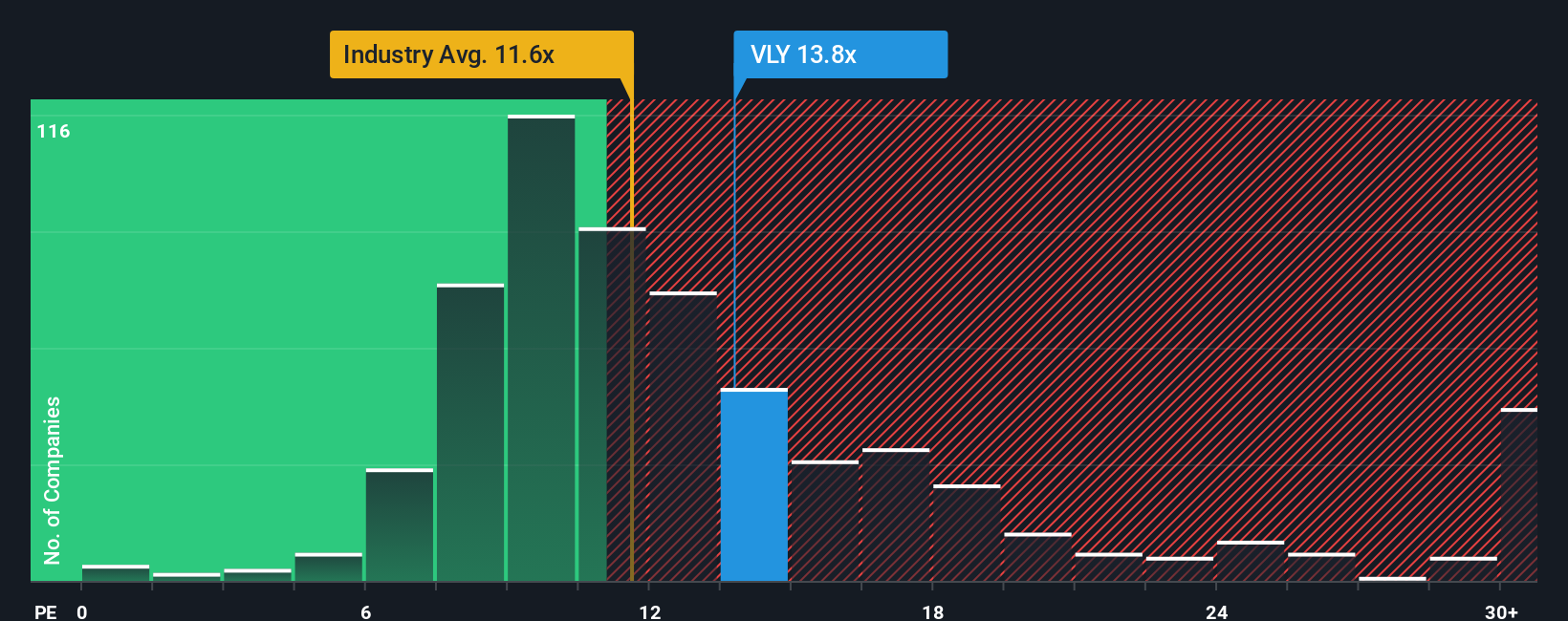

Another View: Using Earnings Ratios

While the current consensus points to Valley National Bancorp being undervalued, a quick look at its price-to-earnings ratio tells a more complicated story. Trading at 13.9x, it looks pricey compared to the US Banks industry average of 11.5x, but actually offers better value than the peer average of 15.3x. Interestingly, this P/E is well below the fair ratio of 15.7x that the market could eventually align with. This hints at potential re-rating risk or upside, depending on how sentiment shifts. How much weight should you put on this difference?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Valley National Bancorp Narrative

If you see things differently or want to dig into the numbers on your own, you can shape your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Valley National Bancorp.

Looking for More Smart Investment Opportunities?

Don’t stop here. Open the door to game-changing stocks you might have missed. The best ideas can give your portfolio an edge right now.

- Benefit from rapid innovation when you track these 25 AI penny stocks that are unlocking the power of artificial intelligence across multiple industries.

- Capture steady income by adding these 18 dividend stocks with yields > 3% with consistently high yields and robust payout histories to your watchlist.

- Seize unique market trends with these 79 cryptocurrency and blockchain stocks riding the momentum in decentralized finance and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VLY

Valley National Bancorp

Operates as the holding company for Valley National Bank that provides various commercial, private banking, retail, insurance, and wealth management financial services products.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives