- United States

- /

- Banks

- /

- NasdaqGS:THFF

US Market's Undiscovered Gems: 3 Promising Small Caps

Reviewed by Simply Wall St

As the U.S. market navigates a landscape of mixed economic signals and fluctuating indices, small-cap stocks present unique opportunities for investors seeking growth beyond the blue-chip giants. In this environment, identifying promising small caps requires a keen eye for companies with solid fundamentals and potential resilience amidst broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

MetroCity Bankshares (MCBS)

Simply Wall St Value Rating: ★★★★★★

Overview: MetroCity Bankshares, Inc. is the bank holding company for Metro City Bank, offering a range of banking products and services across the United States, with a market capitalization of $666.32 million.

Operations: MetroCity Bankshares generates revenue primarily from its community banking segment, which contributed $147.35 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

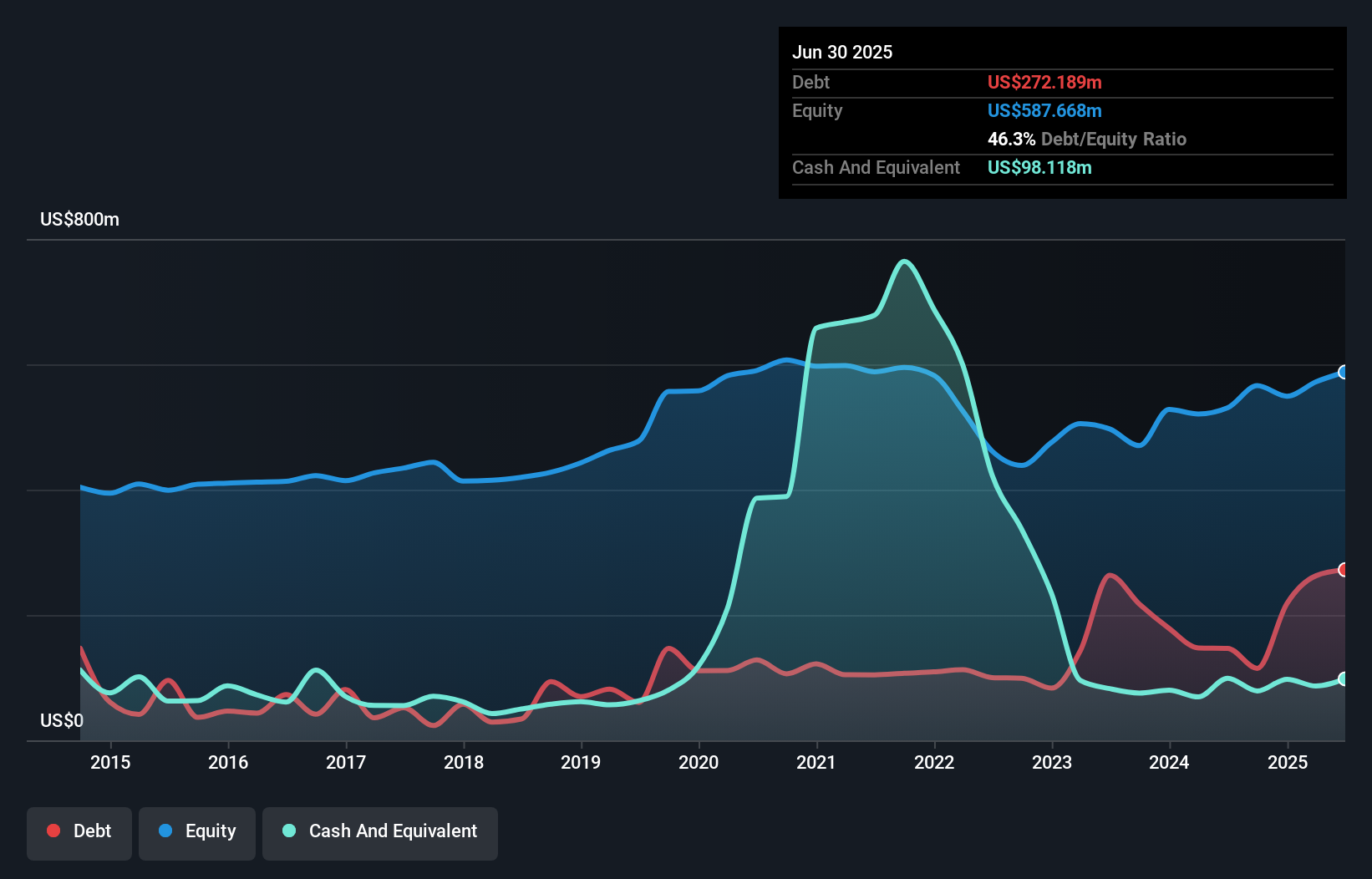

MetroCity Bankshares, with total assets of US$3.6 billion and equity of US$445.9 million, showcases a robust financial profile. Total deposits stand at US$2.7 billion against loans of US$2.9 billion, while maintaining a net interest margin of 3.5%. The bank's allowance for bad loans is sufficient at 0.4% of total loans, reflecting prudent risk management strategies supported by primarily low-risk funding sources like customer deposits (85% liabilities). Although earnings grew by 11.8% last year, they lagged behind the industry average growth rate of 18.1%. Trading at nearly 44% below fair value estimates enhances its appeal among peers in the banking sector.

Gibraltar Industries (ROCK)

Simply Wall St Value Rating: ★★★★★★

Overview: Gibraltar Industries, Inc. is a company that manufactures and provides products and services for the residential, renewable energy, agtech, and infrastructure markets in the United States and internationally with a market cap of approximately $1.40 billion.

Operations: Gibraltar Industries generates revenue primarily from its residential segment at $811.27 million, followed by agtech at $199.45 million and infrastructure at $87.69 million. The company has a market cap of approximately $1.40 billion and includes a segment adjustment of $285.41 million in its financials, which impacts overall revenue reporting.

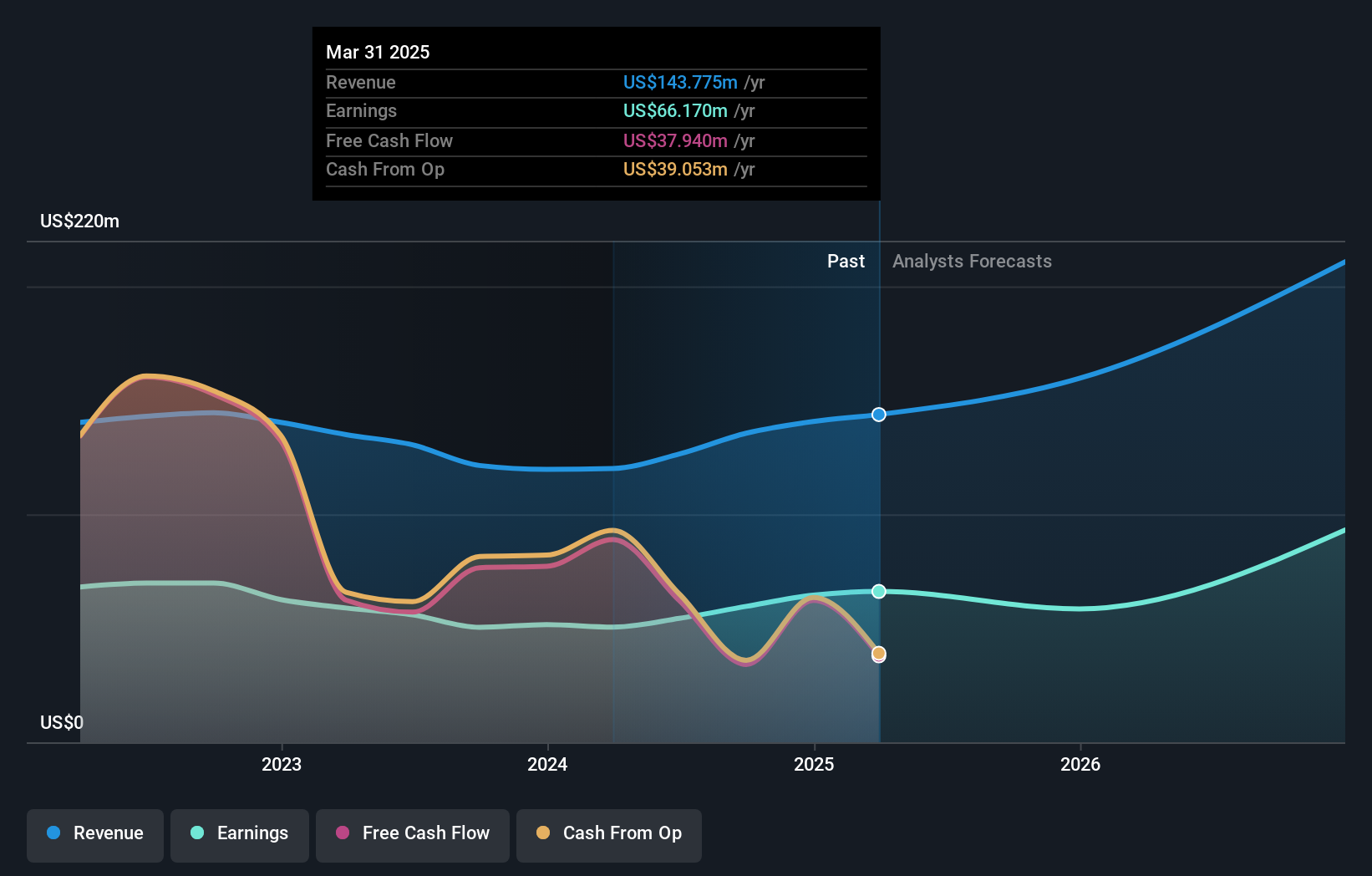

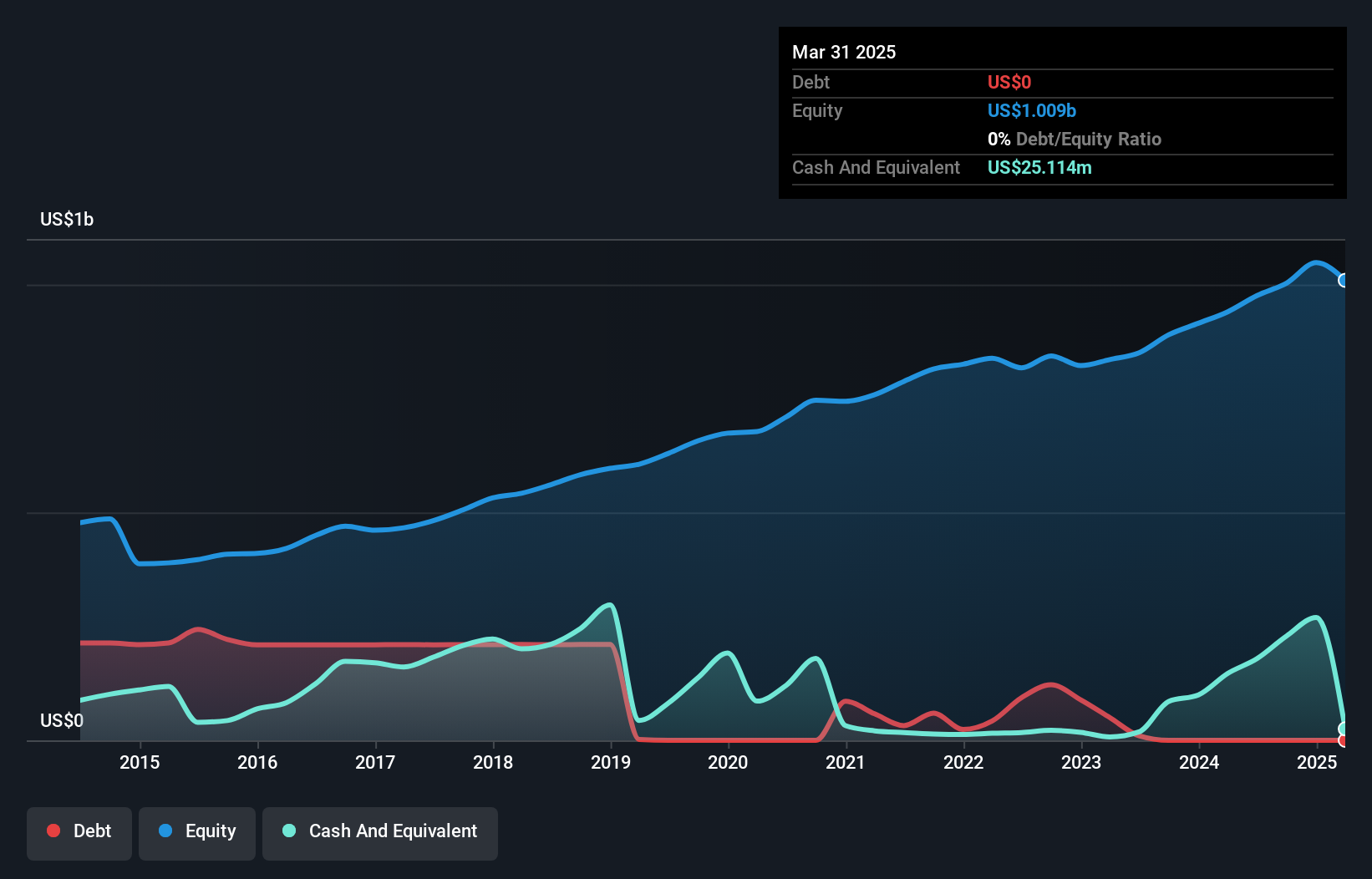

Gibraltar Industries, with a market focus on infrastructure and Agtech, has seen its earnings grow by 26% over the past year, outpacing the building industry's -5.5%. Despite reporting a net loss of US$89 million in Q3 2025 compared to a net income of US$34 million last year, sales rose to US$310.94 million from US$277.13 million. The company is debt-free and trading at a favorable price-to-earnings ratio of 10.5x versus the market's 18.1x, positioning it well for future growth despite potential M&A integration challenges and economic pressures in mature markets.

First Financial (THFF)

Simply Wall St Value Rating: ★★★★★★

Overview: First Financial Corporation operates through its subsidiaries to offer a range of financial products and services across regions including west-central Indiana, east-central Illinois, western Kentucky, central and eastern Tennessee, and northern Georgia with a market capitalization of $680.46 million.

Operations: First Financial generates revenue primarily from its banking segment, amounting to $245.26 million. The company's market capitalization is $680.46 million.

First Financial, with assets totaling US$5.7 billion and equity of US$622.2 million, showcases a robust financial standing. The bank's total deposits stand at US$4.6 billion against loans of US$3.9 billion, highlighting strong customer trust and engagement. Its allowance for bad loans is more than adequate at 246%, with non-performing loans maintained at a low 0.5%. Recent earnings surged by 70% over the past year, outpacing the industry average of 18%, while trading remains undervalued by about 55% compared to its fair value estimate, suggesting potential for future appreciation in share price.

- Take a closer look at First Financial's potential here in our health report.

Understand First Financial's track record by examining our Past report.

Turning Ideas Into Actions

- Explore the 296 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:THFF

First Financial

Through its subsidiaries, provides various financial products and services in west-central Indiana, east-central Illinois, western Kentucky, central and eastern Tennessee, and northern Georgia.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.