- United States

- /

- Banks

- /

- NasdaqGS:TFSL

How Rising Institutional Interest and Rich Dividend Policy Will Impact TFS Financial (TFSL) Investors

Reviewed by Sasha Jovanovic

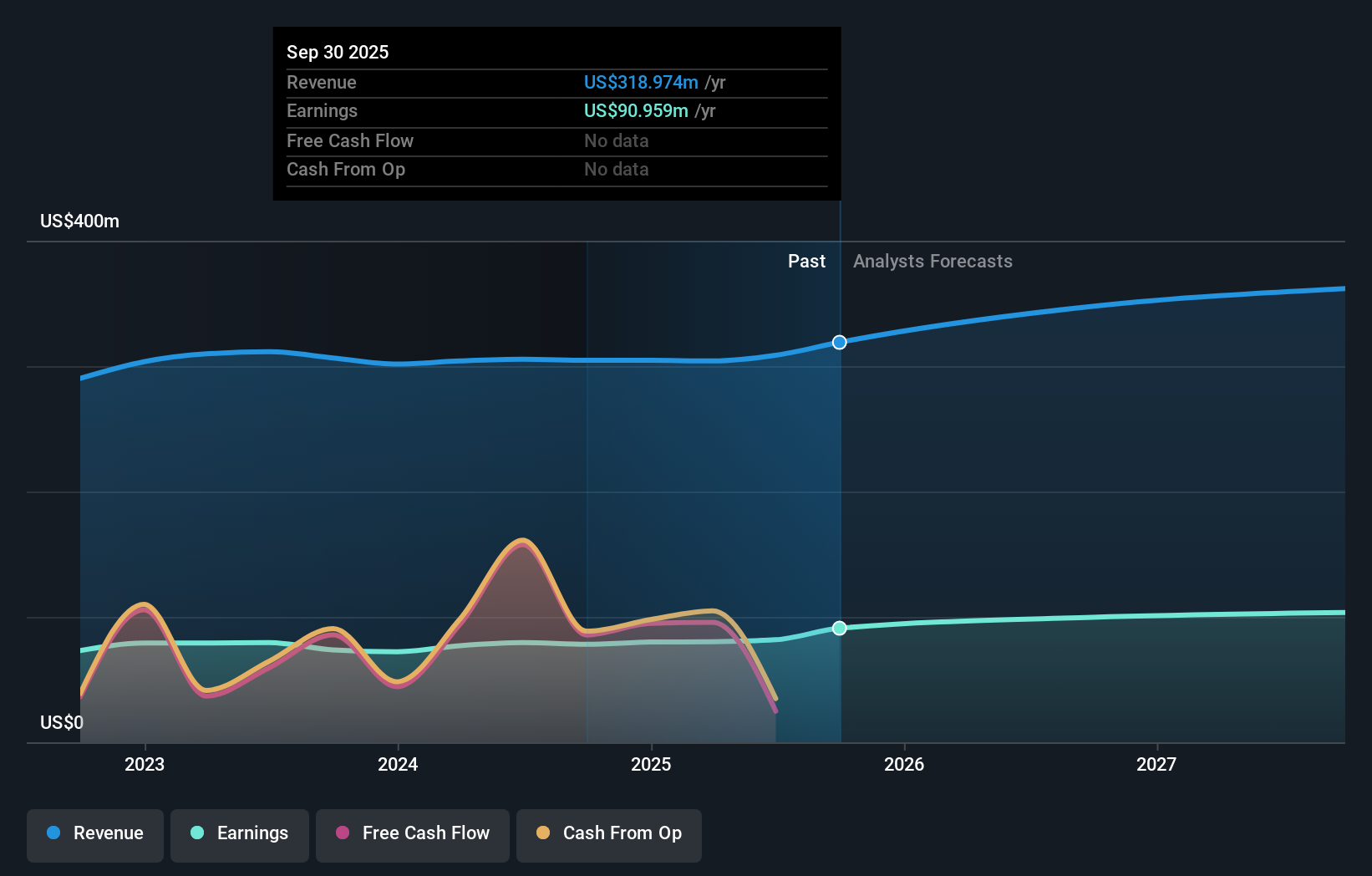

- In recent months, TFS Financial has attracted increased interest from institutional investors such as Creative Planning and Geode Capital Management, while also declaring a high-yield quarterly dividend payable on December 16 and reporting quarterly earnings above analyst expectations.

- These developments, combined with insider share sales and upgrades in analyst ratings, highlight a complex mix of confidence, income appeal, and shifting perceptions around the bank’s prospects.

- Next, we’ll examine how the stronger institutional ownership and generous dividend policy influence TFS Financial’s investment narrative for shareholders.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is TFS Financial's Investment Narrative?

To own TFS Financial, you really have to believe the income story outweighs the valuation and balance sheet questions. The bank continues to lean hard into its generous dividend, which now screens as high-yield but not well covered by earnings, making payout sustainability one of the key short term catalysts and risks. The latest quarter of better-than-expected earnings and steady margin improvement helps, but does not fully resolve concerns around a low forecast return on equity and a price-to-earnings multiple well above both peers and estimated fair value. Recent buying by firms like Creative Planning and Geode suggests some institutions are comfortable with that trade-off, yet the insider selling sends a different signal. Together, these moves sharpen, rather than settle, the risk-reward debate for shareholders.

But there is a less visible risk that income-focused investors should keep in mind. TFS Financial's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Fair value estimates from three Simply Wall St Community members span roughly US$1.39 to US$13.59, underlining how far apart views can be. When you set that against the rich earnings multiple and questions about dividend cover discussed above, it shows why many participants are reassessing what really drives returns here over the next few years. Exploring several of these viewpoints can give a clearer sense of how differently others are weighing income against balance sheet quality and growth.

Explore 3 other fair value estimates on TFS Financial - why the stock might be worth less than half the current price!

Build Your Own TFS Financial Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TFS Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TFS Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TFS Financial's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TFS Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TFSL

TFS Financial

Through its subsidiaries, provides retail consumer banking services in the United States.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026