- United States

- /

- Banks

- /

- NasdaqGS:TCBK

Does Strong Q3 Results and Fed Liquidity Hints Signal a New Chapter for TriCo Bancshares (TCBK)?

Reviewed by Sasha Jovanovic

- Earlier this week, TriCo Bancshares was among several major banks across the sector to report third-quarter earnings that exceeded Wall Street’s expectations, with positive momentum attributed to a rebound in investment banking and robust trading activities.

- Investor confidence was further buoyed by comments from Federal Reserve Chair Jerome Powell suggesting a possible end to the Fed’s quantitative tightening program, pointing toward increased market liquidity.

- We'll consider how optimism around a potential pause in quantitative tightening shapes TriCo Bancshares' investment narrative going forward.

Find companies with promising cash flow potential yet trading below their fair value.

What Is TriCo Bancshares' Investment Narrative?

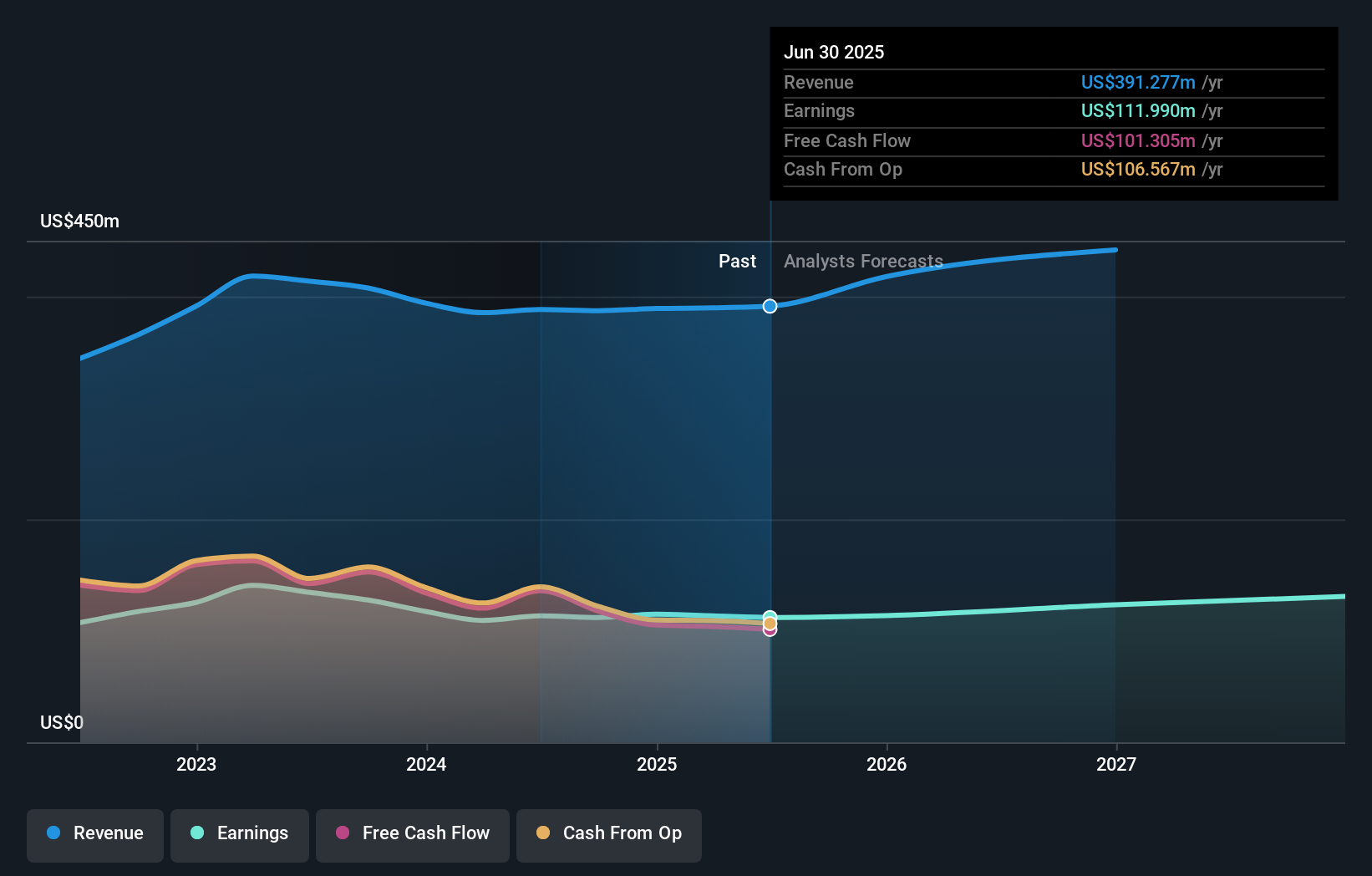

To stay invested in TriCo Bancshares, you’d need to be comfortable with the bank’s steady, if modest, growth prospects and its reputation for reliable capital returns. The recent earnings beat, part of a broader sector rally fueled by resurgent investment banking and anticipation of looser Federal Reserve policies, could serve as a fresh short-term catalyst. Increased market liquidity, if sustained, might encourage loan growth and boost fee income, offering some upside beyond existing forecasts. This shifts attention to the trajectory of net interest margins and whether the company’s moderately growing revenues can offset margin pressure and a recent history of declining earnings per share. That said, investors shouldn’t ignore low return on equity and the risk that sector optimism may not fully resolve profitability concerns. Recent price action suggests the earnings news has been a tailwind, but it remains to be seen whether this materially alters TriCo’s longer-term outlook or simply provides a temporary boost. On the flip side, persistent low returns on equity are an ongoing concern for shareholders.

Despite retreating, TriCo Bancshares' shares might still be trading 35% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on TriCo Bancshares - why the stock might be worth 34% less than the current price!

Build Your Own TriCo Bancshares Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TriCo Bancshares research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free TriCo Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TriCo Bancshares' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TriCo Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TCBK

TriCo Bancshares

Operates as a bank holding company for Tri Counties Bank that provides commercial banking services to individual and corporate customers.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives