- United States

- /

- Banks

- /

- NasdaqGS:SSBK

Uncovering Three Undiscovered Gems in the United States Market

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 3.0% decline, yet it has shown resilience with an 18% rise over the past year and anticipated earnings growth of 14% per annum in the coming years. In this dynamic environment, identifying stocks that are undervalued or overlooked can offer unique opportunities for investors seeking to capitalize on potential growth amidst fluctuating market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.72% | 4.93% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Citizens & Northern (NasdaqCM:CZNC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Citizens & Northern Corporation is a bank holding company for Citizens & Northern Bank, offering a range of banking and related services to individual and corporate clients, with a market cap of $321.79 million.

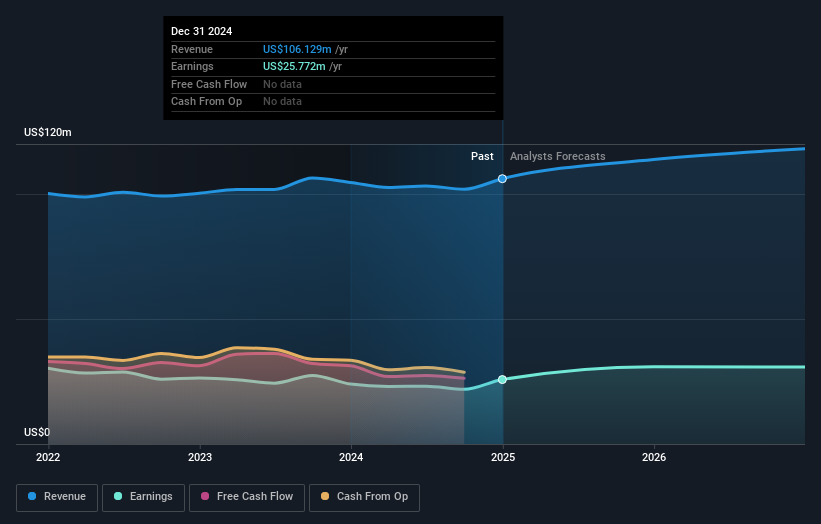

Operations: Citizens & Northern generates revenue primarily from its community banking segment, which contributed $106.13 million. The company's financial performance is reflected in its net profit margin trends over recent periods.

Citizens & Northern, with total assets of US$2.6 billion and equity of US$275.3 million, offers a compelling narrative in the banking sector. Total deposits stand at US$2.1 billion against loans of US$1.9 billion, showcasing its robust lending position with a net interest margin of 3.3%. The bank's bad loans are at an appropriate 1.3%, though the allowance for these is low at 84%. Earnings growth over the past year has been strong at 7.6%, outpacing industry averages and reflecting high-quality earnings potential, while trading significantly below estimated fair value by 41.7%.

- Get an in-depth perspective on Citizens & Northern's performance by reading our health report here.

Understand Citizens & Northern's track record by examining our Past report.

First Bank (NasdaqGM:FRBA)

Simply Wall St Value Rating: ★★★★★★

Overview: First Bank offers a range of banking products and services tailored to small to mid-sized businesses and individuals, with a market capitalization of $372.75 million.

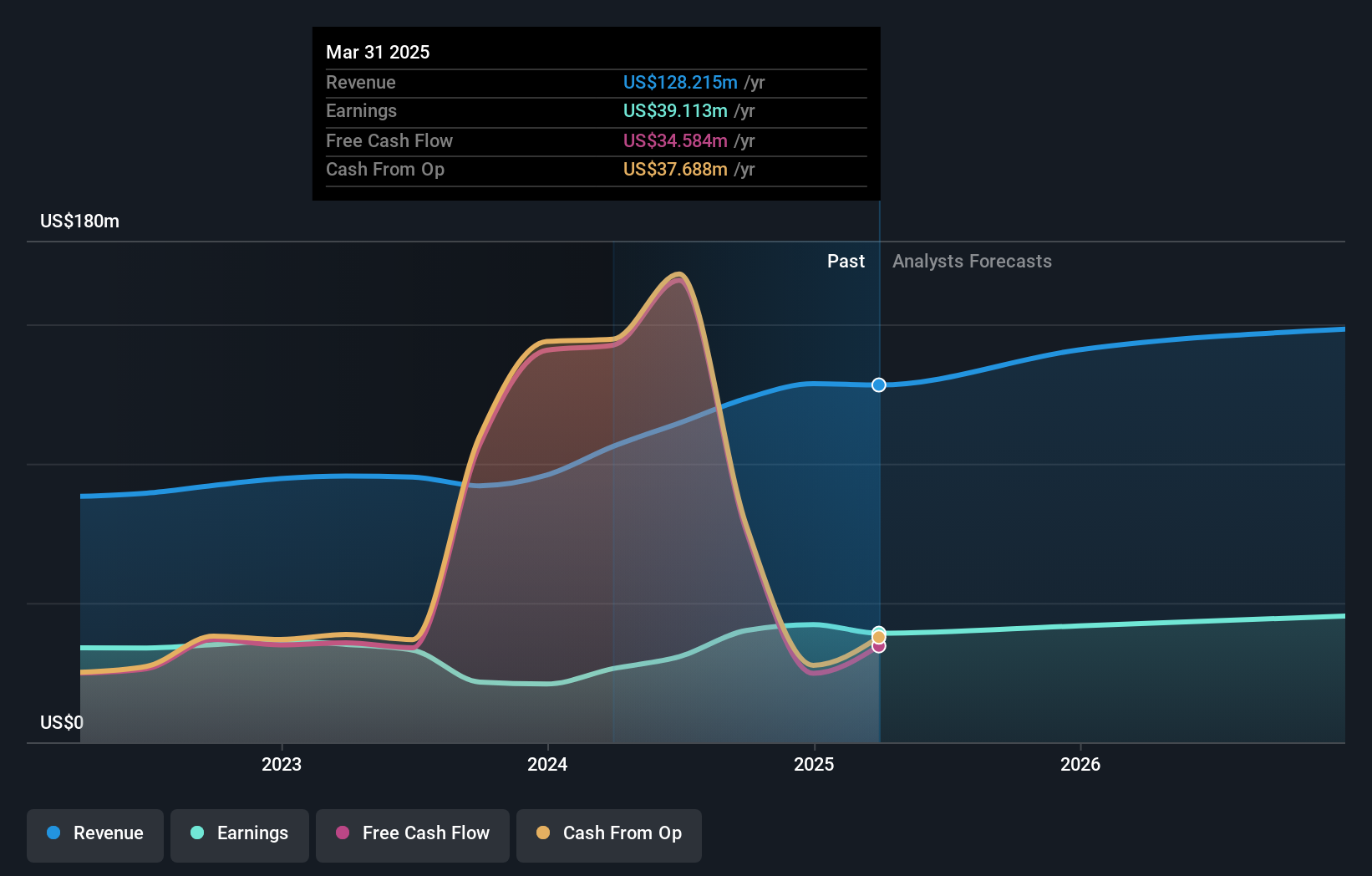

Operations: Revenue for First Bank primarily comes from its community banking segment, totaling $128.68 million.

First Bank, with assets totaling US$3.8 billion and equity of US$409.2 million, demonstrates robust financial health through its low 0.4% bad loans ratio and a solid allowance for such loans at 323%. The bank's total deposits and loans each stand at US$3.1 billion, reflecting balanced growth supported by a net interest margin of 3.6%. Recent earnings surged by 102%, outpacing the industry average significantly, while trading at an attractive valuation below fair value estimates suggests potential investment appeal. The company repurchased shares in the past year, indicating confidence in its market position and future prospects.

Southern States Bancshares (NasdaqGS:SSBK)

Simply Wall St Value Rating: ★★★★★★

Overview: Southern States Bancshares, Inc. is a bank holding company for Southern States Bank, offering community banking services to businesses and individuals, with a market cap of $313 million.

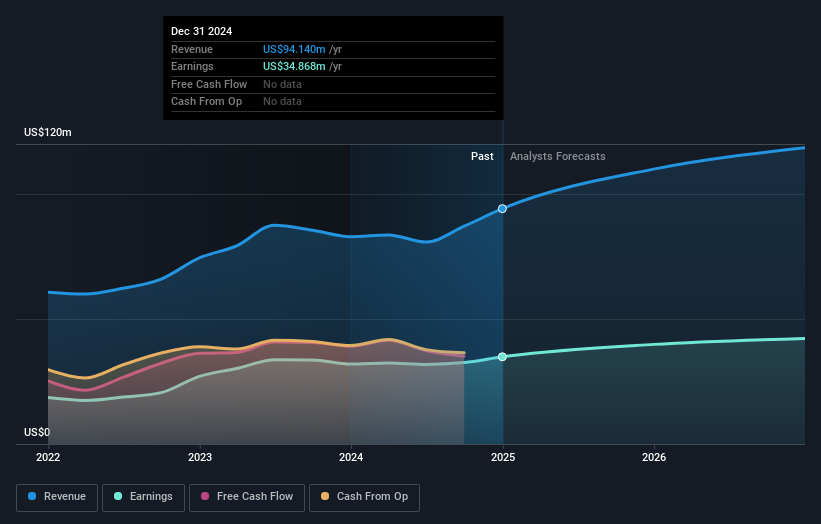

Operations: Southern States Bancshares generates revenue primarily through its banking segment, totaling $94.14 million.

Southern States Bancshares, with assets totaling US$2.8 billion and equity of US$279.9 million, stands out due to its strong financial foundation. It boasts total deposits of US$2.4 billion and loans amounting to US$2.2 billion, while maintaining a net interest margin of 3.6%. The company shows prudent risk management with an allowance for bad loans at 0.3% of total loans, reflecting high-quality earnings and low-risk funding sources—94% from customer deposits. Recent earnings growth at 9.1% surpasses the industry average, highlighting robust performance despite executive board changes anticipated in the upcoming shareholder meeting.

Where To Now?

- Click through to start exploring the rest of the 281 US Undiscovered Gems With Strong Fundamentals now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SSBK

Southern States Bancshares

Operates as the bank holding company for Southern States Bank that provides community banking services to businesses and individuals in the United States.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives