- United States

- /

- Banks

- /

- NasdaqGS:SRCE

Will Loan Quality Concerns Shift the Investment Narrative for 1st Source (SRCE) Ahead of Q3 Results?

Reviewed by Sasha Jovanovic

- 1st Source (NASDAQ:SRCE) announced it will release its Q3 2025 results after market close on Thursday, October 23rd, following its recent quarterly dividend payment representing a 2.6% yield.

- Recent disclosures from other regional banks about loan quality issues have heightened market concerns about the sector, drawing extra attention to 1st Source ahead of its earnings announcement.

- We'll explore how renewed focus on regional bank loan quality shapes the broader investment narrative for 1st Source.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

What Is 1st Source's Investment Narrative?

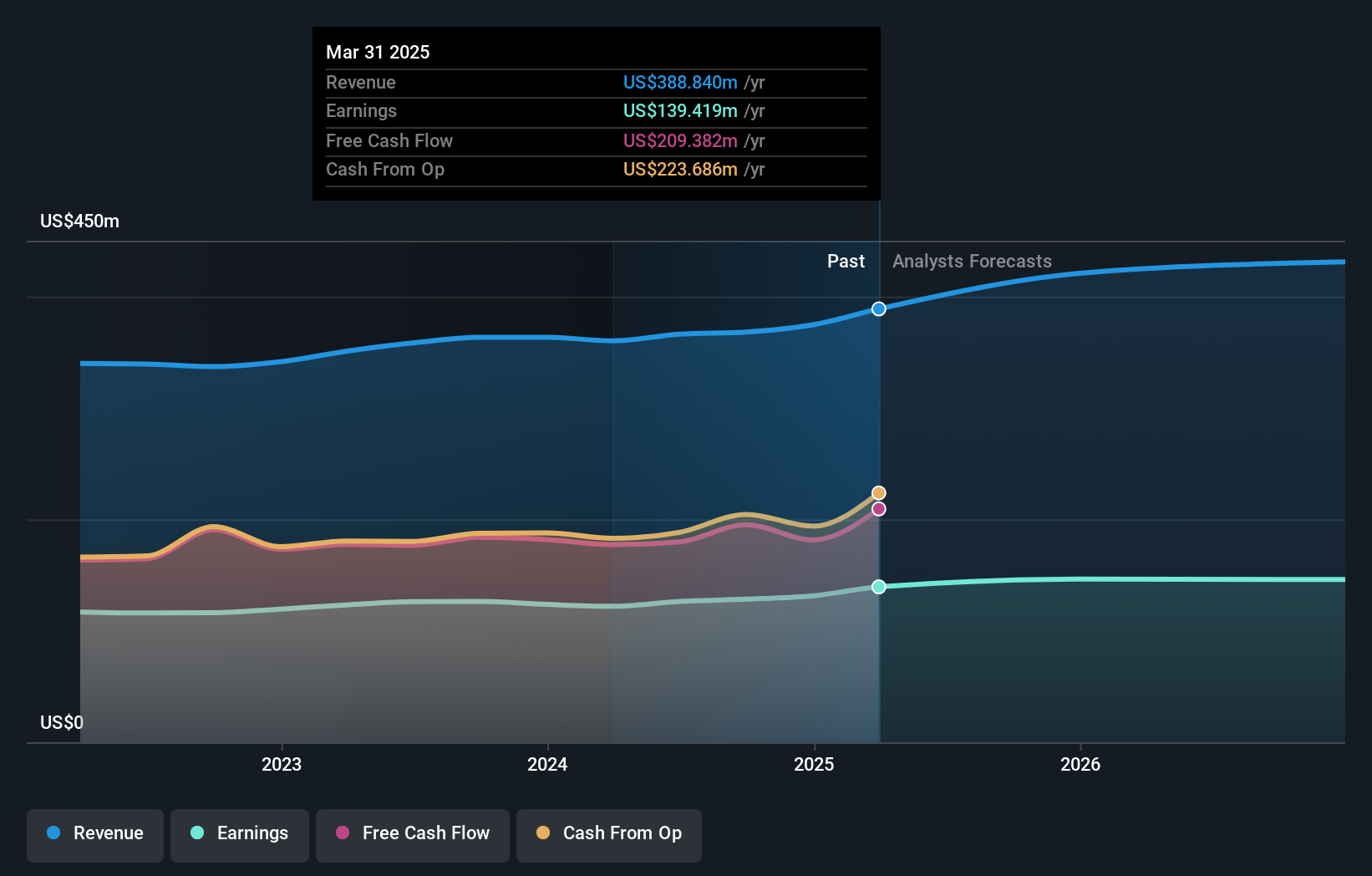

To feel comfortable as a 1st Source shareholder, you want to believe in the resilience of regional banks with sound credit standards and leadership transitions managed for stability. The company’s consistent dividend, buybacks, and string of steady earnings provide clear short-term catalysts, but the recent disclosures of loan quality issues at other regional lenders have brought sharper scrutiny to 1st Source’s own credit portfolio. Previously, the primary risks and catalysts centered on new management’s relative inexperience, modest projected growth rates, and reliable dividends. Now, with sector-wide loan quality anxieties in the spotlight, questions about asset quality and loan performance may prove more influential on near-term sentiment than before, particularly given a recent uptick in charge-offs and ongoing CEO transition. For now, price moves around the news haven’t signaled major direct impact, but attention to loan book details has clearly intensified.

However, even with stable dividends, fresh concerns over loan performance could affect sentiment.

Despite retreating, 1st Source's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 4 other fair value estimates on 1st Source - why the stock might be a potential multi-bagger!

Build Your Own 1st Source Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your 1st Source research is our analysis highlighting 6 key rewards that could impact your investment decision.

- Our free 1st Source research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate 1st Source's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRCE

1st Source

Operates as the bank holding company for 1st Source Bank that provides commercial and consumer banking services, trust and wealth advisory services, and insurance products to individual and business clients in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives