- United States

- /

- Machinery

- /

- NYSE:GHM

Discovering US Market Gems In April 2025

Reviewed by Simply Wall St

Amidst the turmoil in the United States stock market, with major indices like the S&P 500 and Nasdaq experiencing significant declines due to escalating trade tensions, investors are grappling with heightened uncertainty. In this challenging environment, identifying resilient stocks becomes crucial as they often exhibit strong fundamentals and adaptability to withstand economic pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.72% | 4.94% | 6.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Nanophase Technologies | 33.45% | 23.87% | -3.75% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Semler Scientific (NasdaqCM:SMLR)

Simply Wall St Value Rating: ★★★★★★

Overview: Semler Scientific, Inc. offers technology solutions aimed at improving the clinical effectiveness and efficiency of healthcare providers in the United States, with a market cap of $324.84 million.

Operations: Revenue for Semler Scientific primarily comes from its diagnostic kits and equipment, totaling $56.29 million.

Semler Scientific, a nimble player in the medical equipment sector, showcases impressive earnings growth of 98.7% over the past year, outpacing industry averages. Despite a volatile share price recently, it trades at 55.8% below estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. The company's net income surged to US$40.9 million from US$20.58 million last year, reflecting high-quality earnings and robust financial health with no debt concerns in sight. However, shareholders faced significant dilution recently which could be a point of caution moving forward despite its strong cash flow position and profitability prospects.

Southern First Bancshares (NasdaqGM:SFST)

Simply Wall St Value Rating: ★★★★★★

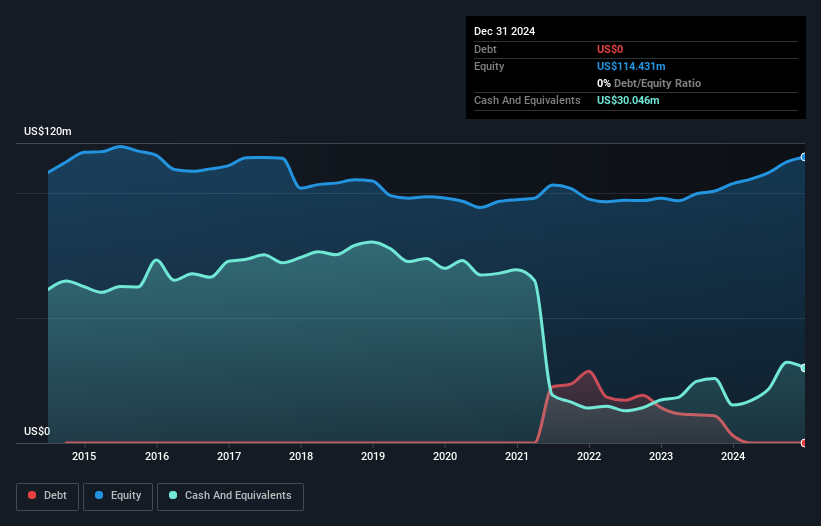

Overview: Southern First Bancshares, Inc. is a bank holding company for Southern First Bank, offering commercial, consumer, and mortgage loans in South Carolina, North Carolina, and Georgia with a market cap of $254.97 million.

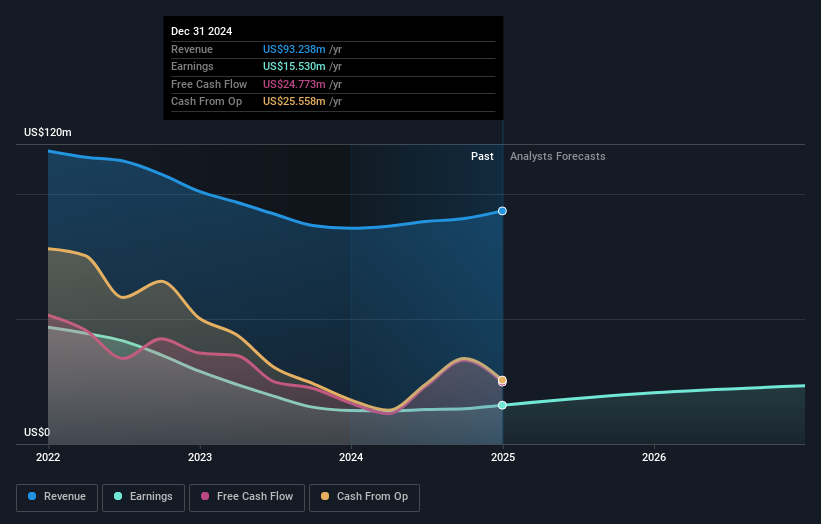

Operations: Southern First Bancshares generates revenue primarily through its banking operations, amounting to $93.24 million. The company operates in South Carolina, North Carolina, and Georgia, focusing on commercial, consumer, and mortgage loans.

Southern First Bancshares, with assets totaling $4.1 billion and equity of $330.4 million, stands out for its robust financial health. The bank's total deposits are at $3.4 billion against loans of $3.6 billion, showcasing a well-managed balance sheet bolstered by a net interest margin of 2.1%. Its allowance for bad loans is impressive at 367%, while non-performing loans are just 0.3%—indicative of prudent risk management practices primarily funded through low-risk customer deposits (91%). Recent earnings growth exceeded industry averages by 15.7%, highlighting its strong performance amidst executive changes and strategic leadership appointments in retail banking operations.

Graham (NYSE:GHM)

Simply Wall St Value Rating: ★★★★★★

Overview: Graham Corporation, with a market cap of $293.07 million, designs and manufactures fluid, power, heat transfer, and vacuum technologies for industries such as chemical processing, defense, space exploration, petroleum refining, cryogenics, and energy.

Operations: Graham Corporation generates revenue primarily from its design and manufacture of heat transfer and vacuum equipment, totaling $199.62 million.

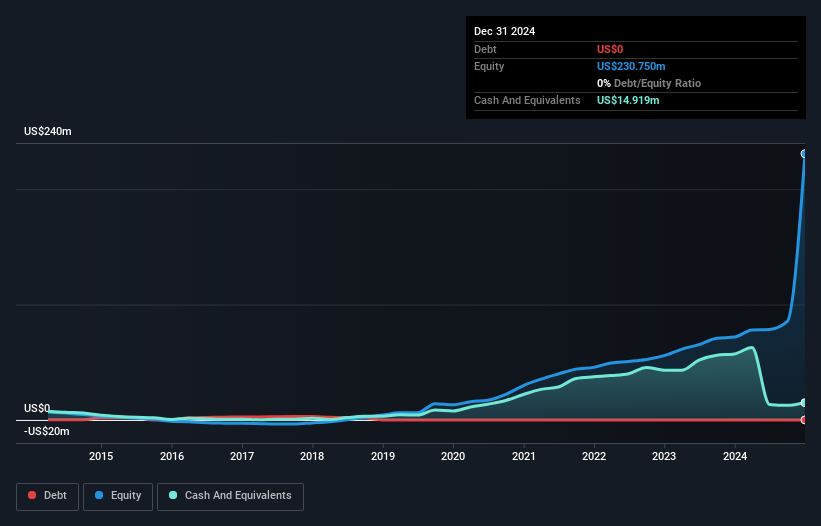

Graham Corporation is making waves with its strategic expansion into defense and space sectors, backed by a robust $385 million backlog in defense orders. The company reported earnings growth of 235.5% over the past year, significantly outpacing the machinery industry's 8.9%. With no debt on its books, Graham's financial health seems solid as it continues to invest in new facilities like the Batavia site for naval work and a cryogenic test facility. Analysts predict annual revenue growth of 9.7% over three years, though challenges such as order volatility and rising expenses could impact these projections.

Key Takeaways

- Delve into our full catalog of 284 US Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Graham, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GHM

Graham

Designs and manufactures fluid, power, heat transfer, and vacuum technologies for chemical and petrochemical processing, defense, space, petroleum refining, cryogenic, energy, and other industries.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives