- United States

- /

- Banks

- /

- NasdaqGS:SFNC

Simmons First National's (NASDAQ:SFNC three-year decrease in earnings delivers investors with a 18% loss

For many investors, the main point of stock picking is to generate higher returns than the overall market. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term Simmons First National Corporation (NASDAQ:SFNC) shareholders, since the share price is down 27% in the last three years, falling well short of the market return of around 15%. The falls have accelerated recently, with the share price down 16% in the last three months. But this could be related to the weak market, which is down 16% in the same period.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

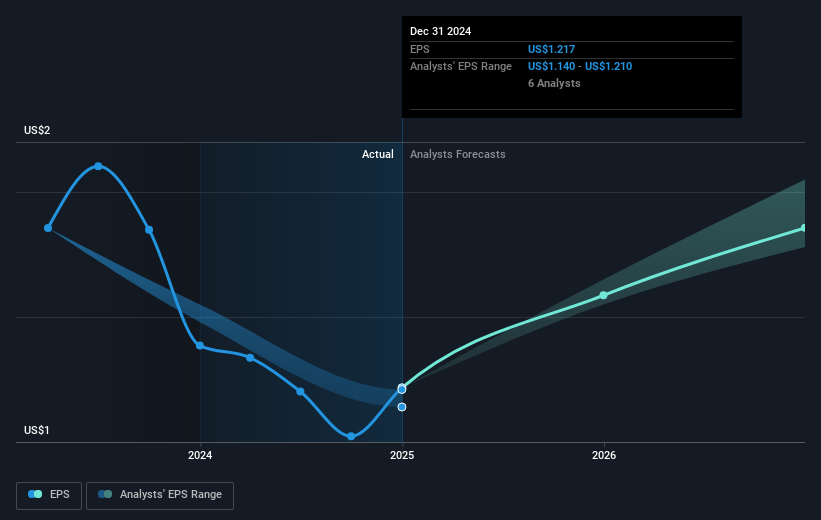

Simmons First National saw its EPS decline at a compound rate of 21% per year, over the last three years. This fall in the EPS is worse than the 10% compound annual share price fall. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Simmons First National's earnings, revenue and cash flow .

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Simmons First National's TSR for the last 3 years was -18%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While it's never nice to take a loss, Simmons First National shareholders can take comfort that , including dividends,their trailing twelve month loss of 0.8% wasn't as bad as the market loss of around 2.0%. Longer term investors wouldn't be so upset, since they would have made 3%, each year, over five years. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. Before spending more time on Simmons First National it might be wise to click here to see if insiders have been buying or selling shares.

Of course Simmons First National may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SFNC

Simmons First National

Operates as the bank holding company for Simmons Bank that provides banking and other financial products and services to individuals and businesses.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives