- United States

- /

- Banks

- /

- NasdaqCM:SBT

Sterling Bancorp (Southfield MI) (NASDAQ:SBT) sheds US$55m, company earnings and investor returns have been trending downwards for past five years

We think intelligent long term investing is the way to go. But no-one is immune from buying too high. Zooming in on an example, the Sterling Bancorp, Inc. (Southfield, MI) (NASDAQ:SBT) share price dropped 54% in the last half decade. That's not a lot of fun for true believers. And some of the more recent buyers are probably worried, too, with the stock falling 21% in the last year. Unfortunately the share price momentum is still quite negative, with prices down 19% in thirty days.

Since Sterling Bancorp (Southfield MI) has shed US$55m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for Sterling Bancorp (Southfield MI)

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Sterling Bancorp (Southfield MI) moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

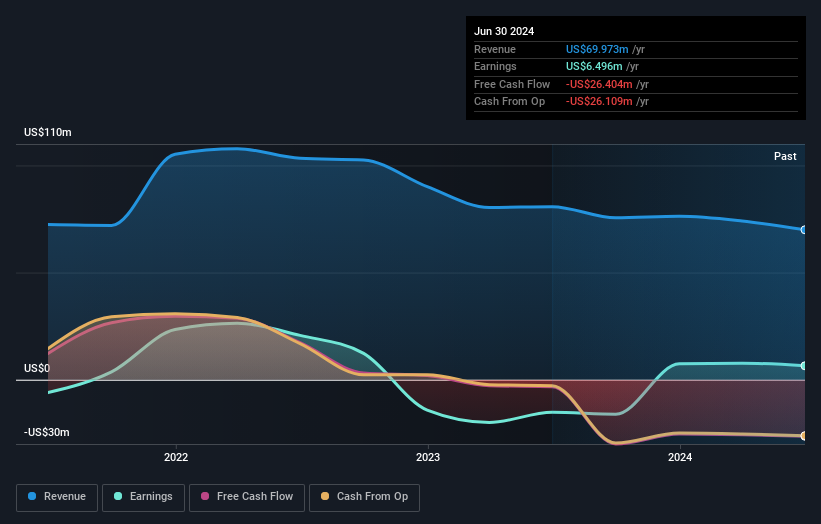

Arguably, the revenue drop of 9.7% a year for half a decade suggests that the company can't grow in the long term. That could explain the weak share price.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Sterling Bancorp (Southfield MI) shareholders are down 21% for the year, but the market itself is up 27%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Sterling Bancorp (Southfield MI) (1 is a bit unpleasant) that you should be aware of.

We will like Sterling Bancorp (Southfield MI) better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SBT

Sterling Bancorp (Southfield MI)

Operates as the unitary thrift holding company for Sterling Bank and Trust, F.S.B.

Flawless balance sheet very low.

Market Insights

Community Narratives