- United States

- /

- Insurance

- /

- NYSE:HMN

Exploring 3 Undiscovered Gems in the US Market

Reviewed by Simply Wall St

The United States market has shown a steady upward trend, climbing 1.3% over the last week and gaining 15% over the past year, with earnings projected to grow by an impressive 15% annually. In this dynamic environment, identifying stocks that combine strong fundamentals with potential for growth can uncover promising opportunities for investors seeking to enhance their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Wilson Bank Holding | 0.00% | 7.88% | 8.09% | ★★★★★★ |

| FineMark Holdings | 115.14% | 2.22% | -28.34% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Senstar Technologies | NA | -20.82% | 14.32% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Rich Sparkle Holdings | 26.73% | -6.13% | 1.75% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Republic Bancorp (RBCA.A)

Simply Wall St Value Rating: ★★★★★★

Overview: Republic Bancorp, Inc. is a bank holding company for Republic Bank & Trust Company, offering a range of banking products and services in the United States, with a market capitalization of approximately $1.46 billion.

Operations: Republic Bancorp generates revenue primarily through its Core Banking segment, including Warehouse Lending ($13.65 million), and the Republic Processing Group, which encompasses Tax Refund Solutions ($33.11 million), Republic Credit Solutions ($46.79 million), and Republic Payment Solutions ($16.17 million).

Republic Bancorp, with total assets of US$7 billion and equity of US$1.1 billion, stands out due to its robust financial health. The bank's total deposits and loans both tally at US$5.3 billion, while it maintains a net interest margin of 4.9%. Impressively, the company has an appropriate level of bad loans at just 0.4% and boasts a sufficient allowance for these potential losses at 378%. Notably, Republic's earnings growth over the past year was a solid 28.1%, surpassing the industry average of 6.3%, highlighting its strong performance despite recent index exclusions.

Horace Mann Educators (HMN)

Simply Wall St Value Rating: ★★★★☆☆

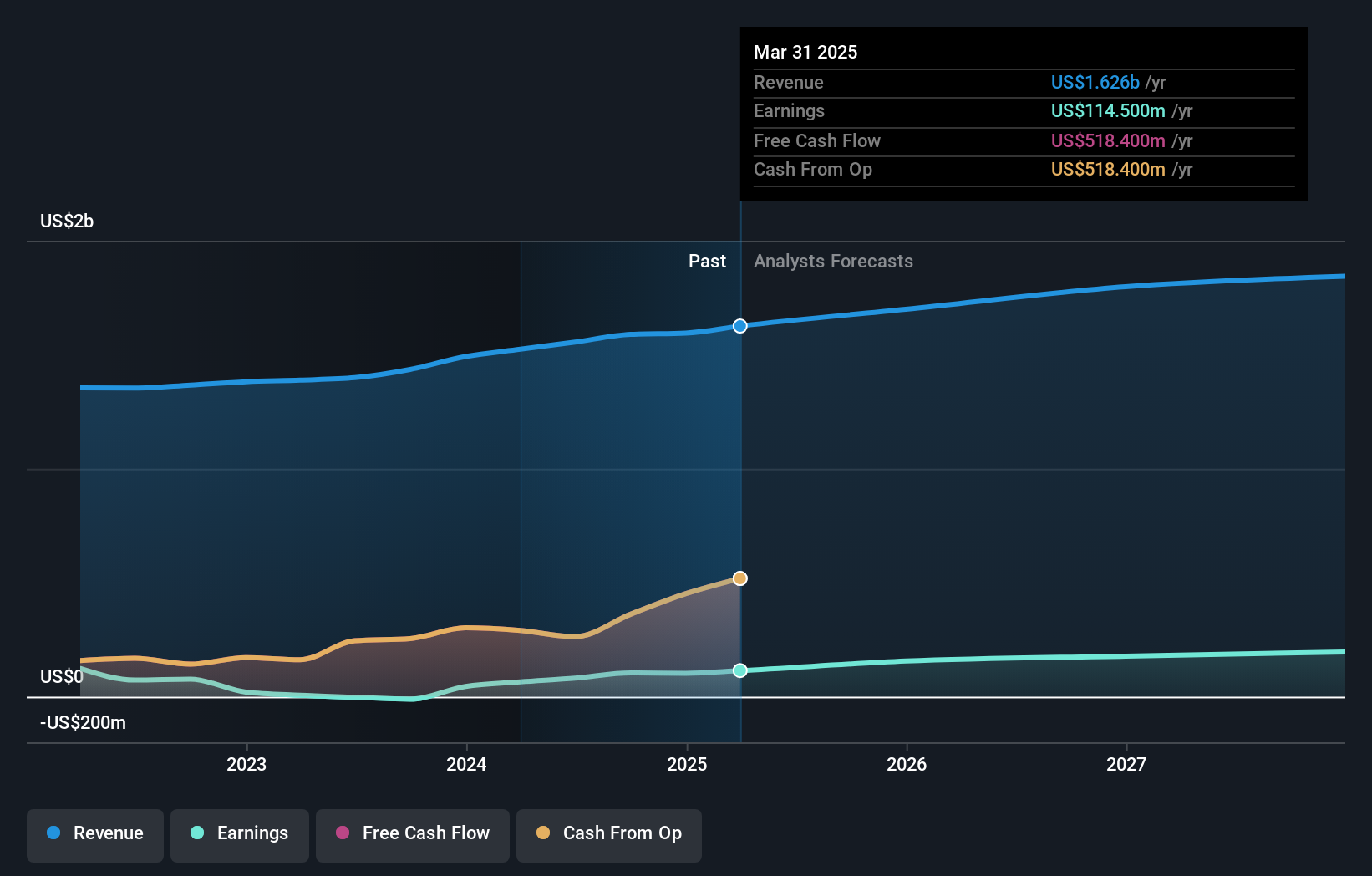

Overview: Horace Mann Educators Corporation, along with its subsidiaries, functions as an insurance holding company in the United States with a market capitalization of approximately $1.67 billion.

Operations: The company's revenue primarily comes from its Property & Casualty segment at $804.30 million and Life & Retirement segment at $542.40 million, supplemented by the Supplemental & Group Benefits segment generating $294.80 million. The Corporate and Other segment contributes a minor portion of $6.90 million to the overall revenue stream.

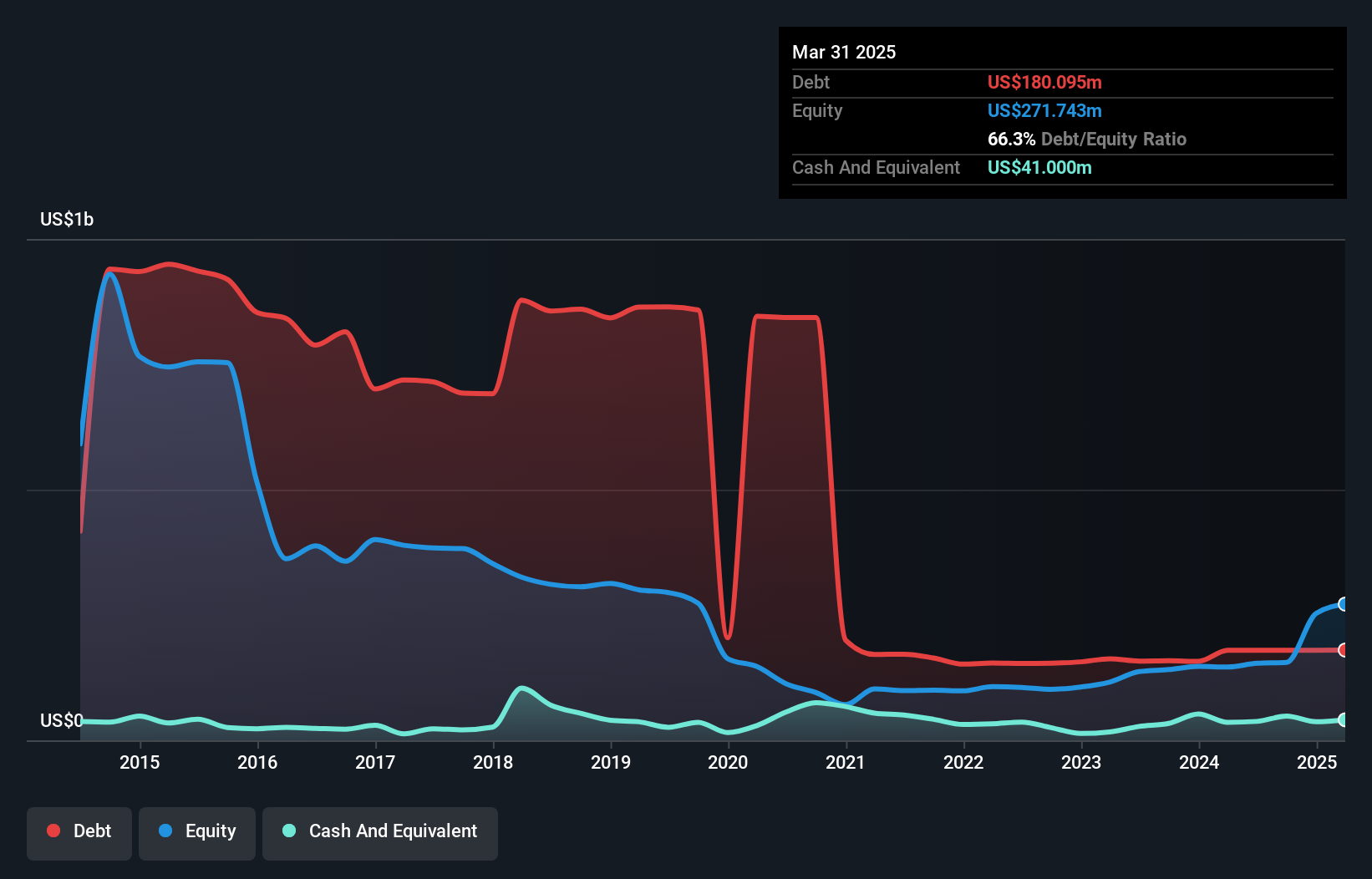

Horace Mann Educators, a notable player in the insurance sector, is making waves with its strategic initiatives and solid financial footing. The company recently reported a 76% earnings growth over the past year, outpacing industry averages. With an interest coverage ratio of 5.1x and a net debt to equity ratio at 29%, Horace Mann demonstrates prudent financial management. Its price-to-earnings ratio of 14.8x also suggests it might be undervalued compared to the broader market's 18.7x. Recent partnerships like the one with Crayola aim to enhance brand visibility while buybacks worth $50 million reflect confidence in future prospects.

TETRA Technologies (TTI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: TETRA Technologies, Inc. operates as an energy services and solutions company with a market capitalization of approximately $449.79 million.

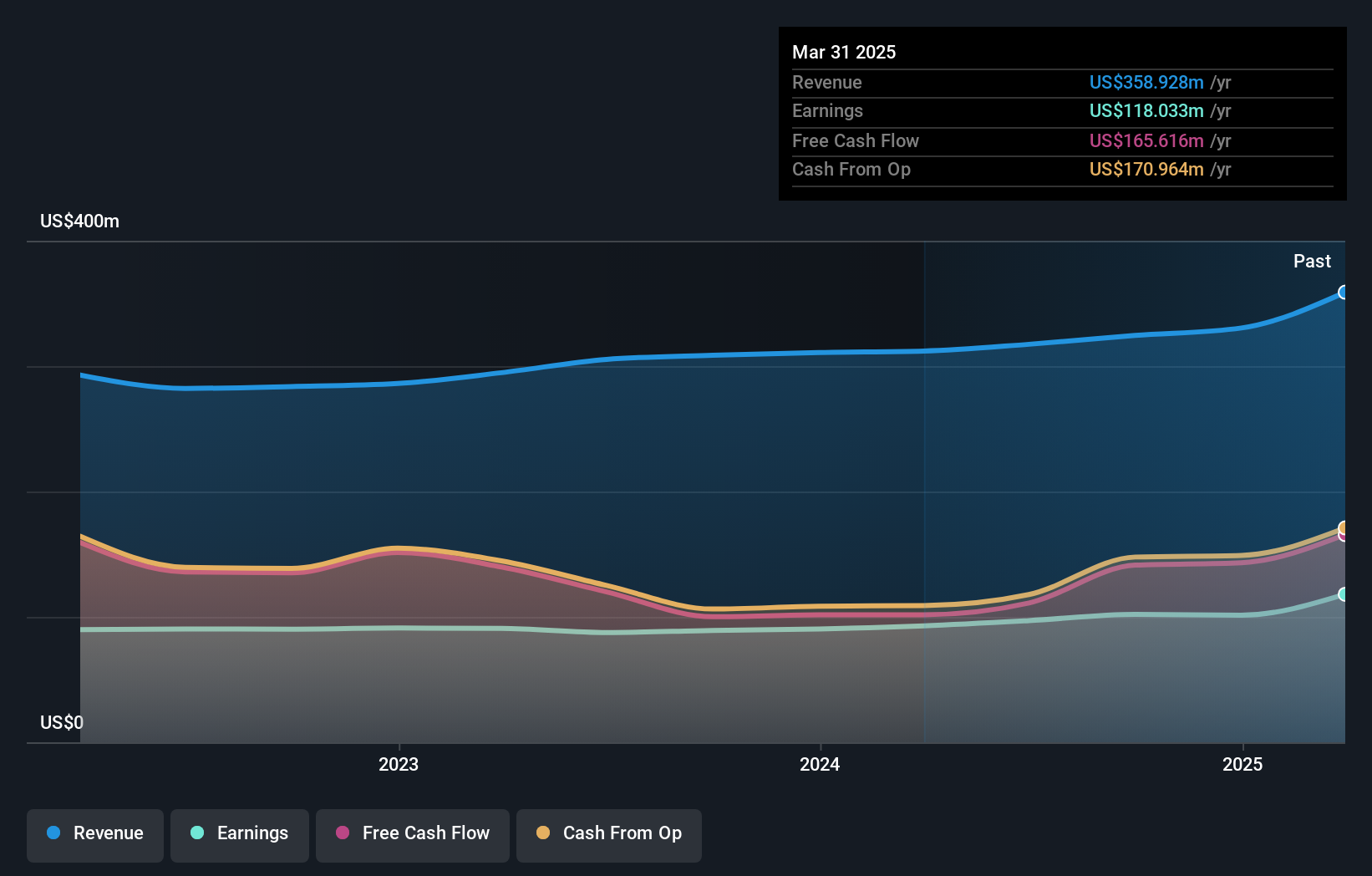

Operations: The company's revenue is primarily derived from two segments: Water & Flowback Services, generating $278.24 million, and Completion Fluids & Products, contributing $327.04 million.

TETRA Technologies, a nimble player in the energy services sector, has seen its earnings skyrocket by 473% over the past year, outpacing industry growth of 9.6%. Despite trading at a significant discount of 52% below estimated fair value, TETRA's financial health raises eyebrows with a high net debt to equity ratio of 51%, and interest payments not fully covered by EBIT (2.8x). Recent shifts in index inclusion highlight its appeal for value investors as it was added to several Russell Value Benchmarks. However, future earnings are projected to decline sharply by an average of 64% annually over the next three years.

Seize The Opportunity

- Unlock more gems! Our US Undiscovered Gems With Strong Fundamentals screener has unearthed 283 more companies for you to explore.Click here to unveil our expertly curated list of 286 US Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Horace Mann Educators might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HMN

Horace Mann Educators

Operates as an insurance holding company in the United States.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives