- United States

- /

- Banks

- /

- NasdaqGM:PDLB

Should You Be Adding Ponce Financial Group (NASDAQ:PDLB) To Your Watchlist Today?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Ponce Financial Group (NASDAQ:PDLB). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Ponce Financial Group

How Fast Is Ponce Financial Group Growing Its Earnings Per Share?

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. It is therefore awe-striking that Ponce Financial Group's EPS went from US$0.17 to US$1.03 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

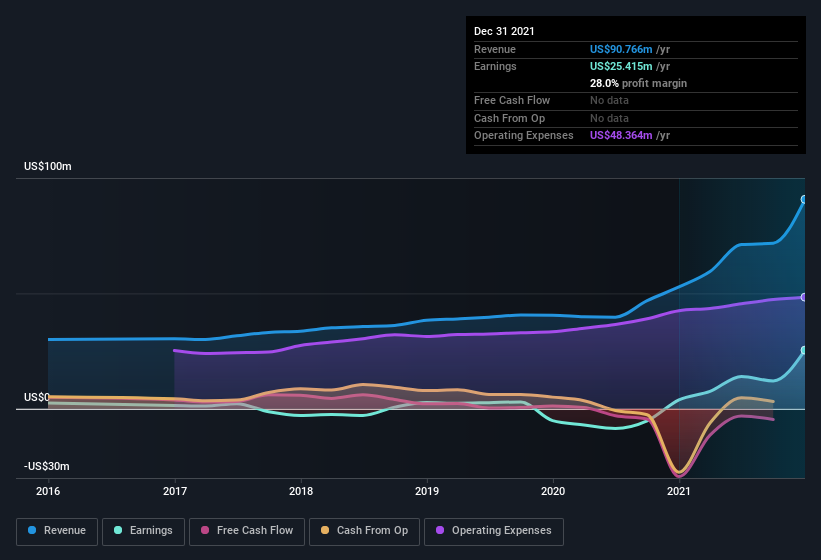

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Ponce Financial Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Ponce Financial Group maintained stable EBIT margins over the last year, all while growing revenue 72% to US$91m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Ponce Financial Group.

Are Ponce Financial Group Insiders Aligned With All Shareholders?

I always like to check up on CEO compensation, because I think that reasonable pay levels, around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalizations between US$100m and US$400m, like Ponce Financial Group, the median CEO pay is around US$1.7m.

Ponce Financial Group offered total compensation worth US$1.1m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Ponce Financial Group Deserve A Spot On Your Watchlist?

Ponce Financial Group's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. Such fast EPS growth makes me wonder if the business has hit an inflection point (and I mean the good kind.) Meanwhile, the very reasonable CEO pay reassures me a little, since it points to an absence profligacy. While I couldn't be sure without a deeper dive, it does seem that Ponce Financial Group has the hallmarks of a quality business; and that would make it well worth watching. We should say that we've discovered 2 warning signs for Ponce Financial Group (1 is a bit concerning!) that you should be aware of before investing here.

Although Ponce Financial Group certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:PDLB

Ponce Financial Group

Operates as the bank holding company for Ponce Bank that provides various banking products and services.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026