- United States

- /

- Banks

- /

- NasdaqGS:OCFC

A Fresh Look at OceanFirst Financial (OCFC) Valuation Following Analyst Upgrade

Reviewed by Kshitija Bhandaru

Keefe, Bruyette & Woods recently shifted their rating for OceanFirst Financial (OCFC) from Market Perform to Outperform, signaling renewed optimism about the company’s outlook. Such upgrades often prompt investors to take a closer look at prospects.

See our latest analysis for OceanFirst Financial.

After a stretch of subdued trading, OceanFirst Financial’s shares are showing glimpses of renewed interest as the recent rating upgrade helped reinforce confidence among investors. The 1-year total shareholder return of 1.41% suggests steady, if modest, progress. Longer-term investors have benefited from a robust 45% total return over five years. Near-term price momentum is still searching for direction, but the broader trend points to gradual value creation for patient shareholders.

If you’re looking to explore beyond familiar names in banking, consider broadening your investing horizons with fast growing stocks with high insider ownership

The recent analyst upgrade and a share price still trading at a discount to targets raise a crucial question: Is OceanFirst Financial currently undervalued, or is the market already factoring in its future growth prospects?

Most Popular Narrative: 12.6% Undervalued

OceanFirst Financial’s most widely followed narrative calculates a fair value of $20.29, which stands about 12.6% above the latest closing price of $17.73. This suggests that the company’s current market price may not reflect its full potential, according to the consensus behind this valuation.

Ongoing digital initiatives and technology investments, including fintech partnerships, are enhancing operating leverage by reducing the incremental cost to serve and driving engagement with younger, tech-savvy demographics. These efforts could potentially increase fee-based income and improve net margins over time. OceanFirst's continued focus on prudent credit risk management and conservatively structured portfolios, especially as it diversifies away from riskier CRE segments, provides resilience against rising economic uncertainty. This safeguards asset quality and reduces potential future provision expenses and credit losses, thereby supporting more stable long-term earnings growth.

Want to know the secret behind this bullish price target? It hinges on assumptions about accelerating revenues, rising profit margins, and a declining share count. Which projection tips the scale in OceanFirst’s favor? Uncover the full story and the numbers that could change your outlook only in the complete narrative.

Result: Fair Value of $20.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower-than-expected deposit growth or underperformance from recent commercial hires could limit OceanFirst’s ability to achieve the projected earnings trajectory.

Find out about the key risks to this OceanFirst Financial narrative.

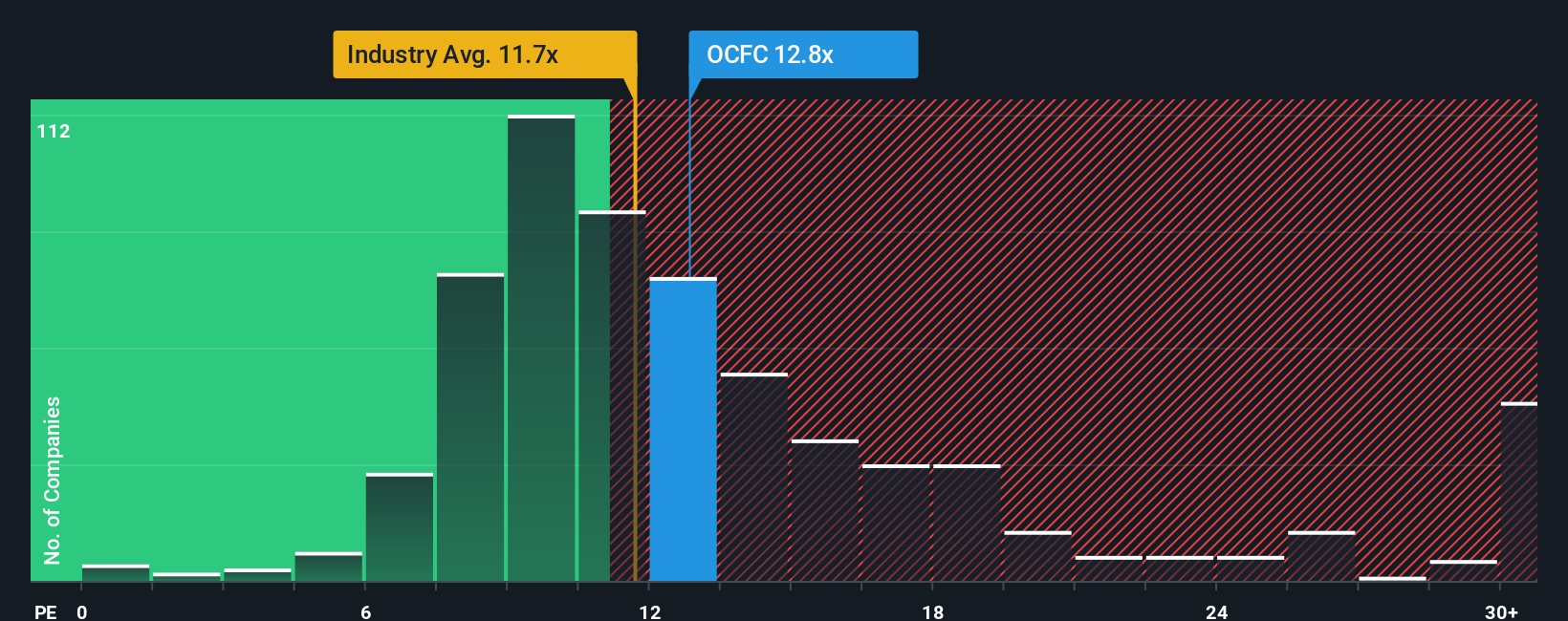

Another View: Looking Through the Earnings Lens

While analyst consensus suggests OceanFirst Financial is undervalued, a quick look at its earnings valuation tells a slightly different story. OCFC's current price-to-earnings ratio is 12.5x, which is higher than the US Banks industry average of 11.6x but below its peer average of 35.4x. It is also trading below a fair ratio of 13.6x, implying the market might still see some upside, yet not without risks if sentiment changes. Could the crowd be missing something, or is caution still warranted here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own OceanFirst Financial Narrative

If you have a different perspective or enjoy digging deeper into the numbers, you can shape your own take in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding OceanFirst Financial.

Looking for more investment ideas?

Don’t let incredible opportunities pass you by while others uncover unique stocks. Broaden your investment horizons and boost your portfolio’s potential with these tailored ideas:

- Tap into the unmatched upside of high-yielding assets by checking out these 19 dividend stocks with yields > 3%. These consistently deliver 3%+ returns and reward patient investors.

- Accelerate your exposure to the future of computing with these 26 quantum computing stocks. This gives you direct access to trailblazers in quantum breakthroughs and innovation.

- Seize the chance to invest in innovation leaders among these 24 AI penny stocks, which are pioneering artificial intelligence solutions transforming every industry they touch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OCFC

OceanFirst Financial

Operates as the bank holding company for OceanFirst Bank N.A.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives