- United States

- /

- Banks

- /

- NasdaqCM:NKSH

National Bankshares (NKSH): Net Margins Rise to 22.7%, Challenging Sentiment on Five-Year Earnings Decline

Reviewed by Simply Wall St

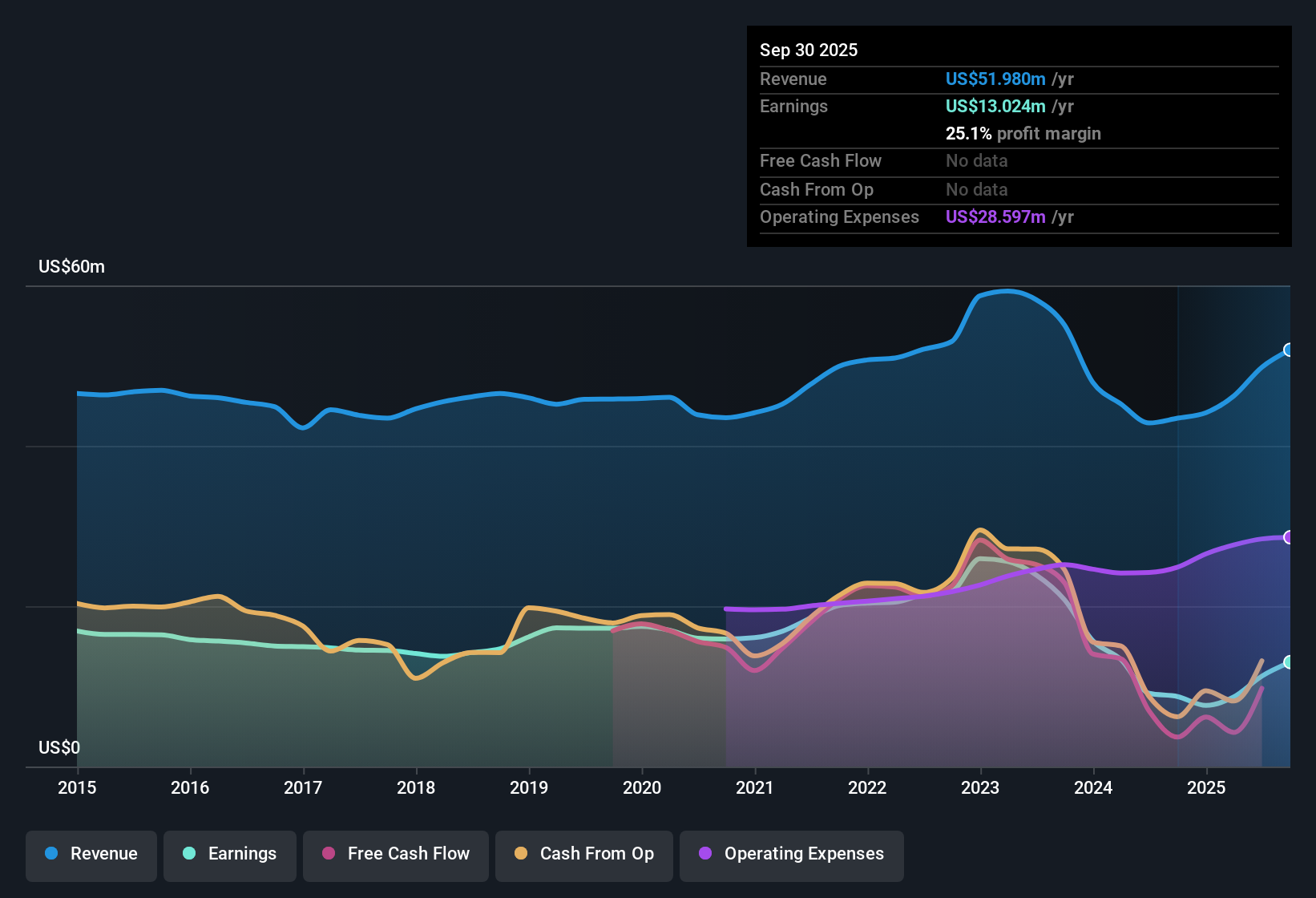

National Bankshares (NKSH) posted net profit margins of 22.7%, up from last year's 21.3% mark, while defying a challenging five-year stretch where earnings fell at an average pace of 12.2% per year. The most recent year flipped the script, with earnings growing by 23.6% and profit quality judged to be high. Investors are focusing on the positive shift in margins and earnings, even as the longer-term trend remains under pressure.

See our full analysis for National Bankshares.Now, let’s see how these numbers compare to the narratives shaping investor views. Where do they reinforce the stories, and where do they raise fresh questions?

Curious how numbers become stories that shape markets? Explore Community Narratives

Premium on Stability: P/E at 16.4x vs Industry 11.2x

- NKSH trades at a price-to-earnings ratio of 16.4x, materially higher than both the US Banks industry average of 11.2x and its peer group average of 10x. This makes it relatively expensive despite recent operational gains.

- The prevailing market view highlights that stability and defensiveness are driving NKSH’s premium. However, this valuation gap comes with clear trade-offs:

- Bulls may cite the company’s stable and attractive dividend along with high margin performance as justification for the premium multiple.

- Critics point to the 12.2% average annual earnings decline over the past five years as a warning sign that upside may be capped if growth does not return.

DCF Fair Value Points to Discount Even as Growth Remains Uneven

- Shares are priced at $29.14, well below the DCF fair value estimate of $46.45, hinting that the market may be underappreciating medium-term improvement despite prior years of persistent contraction.

- The prevailing market view notes a nuanced contradiction:

- The 23.6% rebound in earnings over the past year heavily supports a narrative that the business is recovering and that valuation upside may exist for patient investors.

- However, the five-year average rate of earnings decline creates enough lingering uncertainty that not all investors are willing to re-rate the stock just yet.

Dividend Track Record and Profit Quality Foster Income Appeal

- NKSH is highlighted as having a history of attractive dividends and high quality earnings, both seen as material rewards for those seeking consistent income even as broader growth metrics lag.

- The prevailing market view supports the appeal for income-focused investors:

- The company's ability to expand net profit margins from 21.3% to 22.7% reinforces perceptions of disciplined management and underlying profit quality.

- Still, skeptics remain cautious given the backdrop of five straight years of negative earnings growth, making continued income delivery dependent on stable operative trends.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on National Bankshares's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite NKSH’s recent improvement in profit margins, its persistent five-year earnings decline and uncertain growth outlook raise red flags for long-term investors.

If stable growth matters most to you, consider checking out stable growth stocks screener (2099 results) where you'll find companies with reliable earnings expansions that could better fit a consistent strategy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if National Bankshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NKSH

National Bankshares

Operates as the bank holding company for the National Bank of Blacksburg that provides retail and commercial banking products and services to individuals, businesses, non-profits, and local governments.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)