- United States

- /

- Banks

- /

- NasdaqGS:NFBK

Does Northfield Bancorp (Staten Island NY) (NASDAQ:NFBK) Deserve A Spot On Your Watchlist?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Northfield Bancorp (Staten Island NY) (NASDAQ:NFBK). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Northfield Bancorp (Staten Island NY)

How Fast Is Northfield Bancorp (Staten Island NY) Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Northfield Bancorp (Staten Island NY) has grown EPS by 30% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

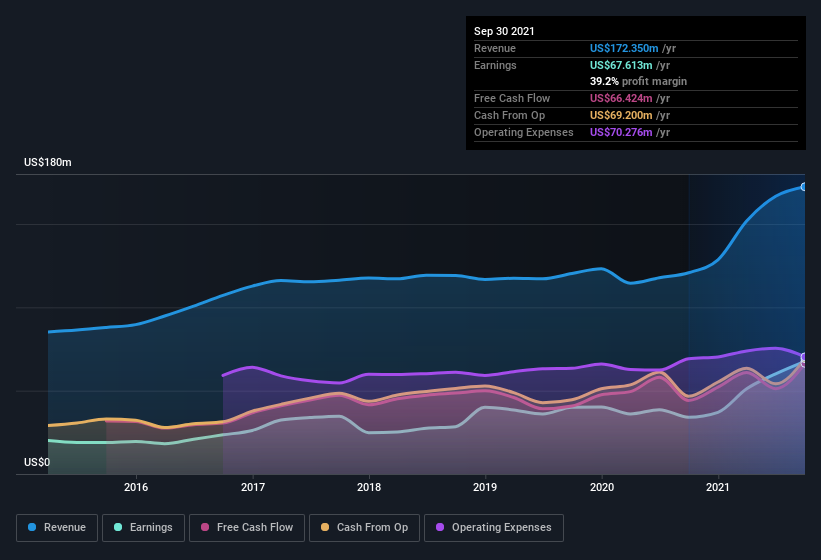

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Northfield Bancorp (Staten Island NY)'s revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note Northfield Bancorp (Staten Island NY)'s EBIT margins were flat over the last year, revenue grew by a solid 43% to US$172m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Northfield Bancorp (Staten Island NY)?

Are Northfield Bancorp (Staten Island NY) Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Northfield Bancorp (Staten Island NY) insiders have a significant amount of capital invested in the stock. To be specific, they have US$37m worth of shares. That's a lot of money, and no small incentive to work hard. Even though that's only about 4.4% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. A brief analysis of the CEO compensation suggests they are. For companies with market capitalizations between US$400m and US$1.6b, like Northfield Bancorp (Staten Island NY), the median CEO pay is around US$2.3m.

The Northfield Bancorp (Staten Island NY) CEO received US$1.3m in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Northfield Bancorp (Staten Island NY) To Your Watchlist?

You can't deny that Northfield Bancorp (Staten Island NY) has grown its earnings per share at a very impressive rate. That's attractive. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. Each to their own, but I think all this makes Northfield Bancorp (Staten Island NY) look rather interesting indeed. Even so, be aware that Northfield Bancorp (Staten Island NY) is showing 2 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Northfield Bancorp (Staten Island NY), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Northfield Bancorp (Staten Island NY) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:NFBK

Northfield Bancorp (Staten Island NY)

Operates as the bank holding company for Northfield Bank that provides a range of banking services primarily to individuals and corporate customers.

Flawless balance sheet established dividend payer.