- United States

- /

- Banks

- /

- NYSE:CBAN

Undervalued Small Caps With Insider Action To Consider In November 2025

Reviewed by Simply Wall St

In recent weeks, the U.S. stock market has experienced significant volatility, with major indices like the Nasdaq and S&P 500 posting sharp losses despite initial rallies driven by strong earnings from key players such as Nvidia. Amidst this turbulent backdrop, small-cap stocks in the United States present a unique opportunity for investors seeking value, especially those companies that have seen insider activity suggesting potential confidence in their future prospects. Identifying promising small caps involves looking at factors such as financial health and market position, which can be particularly relevant during periods of broader market uncertainty.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Infinity Natural Resources | NA | 0.6x | 47.09% | ★★★★★★ |

| Hanmi Financial | 10.9x | 3.2x | 32.90% | ★★★★★☆ |

| Shore Bancshares | 9.4x | 2.5x | 46.51% | ★★★★★☆ |

| PCB Bancorp | 8.7x | 2.8x | 31.37% | ★★★★★☆ |

| Peoples Bancorp | 9.9x | 1.8x | 47.28% | ★★★★★☆ |

| S&T Bancorp | 10.9x | 3.7x | 40.33% | ★★★★☆☆ |

| Farmland Partners | 6.2x | 7.6x | -34.55% | ★★★★☆☆ |

| Citizens & Northern | 12.6x | 3.1x | 36.45% | ★★★☆☆☆ |

| MVB Financial | 10.1x | 1.9x | -8.47% | ★★★☆☆☆ |

| Granite Ridge Resources | 17.4x | 1.5x | 25.87% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

MVB Financial (MVBF)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: MVB Financial operates as a financial holding company providing core banking services and other financial solutions, with a market capitalization of $0.27 billion.

Operations: Core Banking, excluding Professional Services & Edge Ventures, is the primary revenue stream at $126.58 million. The company has consistently achieved a gross profit margin of 100%, indicating no direct costs recorded against its revenue. Operating expenses are primarily driven by general and administrative costs, which have been significant over time.

PE: 10.1x

MVB Financial, a smaller U.S. financial entity, demonstrates potential for value with its consistent dividend of US$0.17 per share and strategic share repurchase program totaling US$10 million. Insider confidence is evident as Michael Giorgio increased their holdings by 5,700 shares at a transaction value of US$100,320. Despite the low bad loan allowance at 89%, MVB's net income surged to US$17.14 million in Q3 2025 from US$2.08 million the previous year, indicating profitability growth prospects amidst industry challenges.

Shore Bancshares (SHBI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shore Bancshares operates as a community banking organization, primarily offering financial services and products, with a market capitalization of approximately $0.19 billion.

Operations: Shore Bancshares generates its revenue primarily from community banking, with recent figures showing $212.49 million in revenue. Operating expenses are a significant component of the cost structure, with general and administrative expenses being the largest at $104.25 million in the latest period. The company has consistently achieved a gross profit margin of 100%, while the net income margin has shown variability, reaching 26.78% recently.

PE: 9.4x

Shore Bancshares, a smaller U.S. financial institution, recently issued $60 million in subordinated notes with a 6.25% interest rate due 2035, reflecting strategic debt management aimed at general corporate purposes and debt repayment. Their Q3 net income rose to $14.35 million from $11.19 million last year, indicating financial growth despite increased charge-offs driven by a marine loan write-down. Insider confidence is evident as insiders have been purchasing shares throughout the past year, suggesting potential value recognition within the company’s stock.

- Click here to discover the nuances of Shore Bancshares with our detailed analytical valuation report.

Understand Shore Bancshares' track record by examining our Past report.

Colony Bankcorp (CBAN)

Simply Wall St Value Rating: ★★★☆☆☆

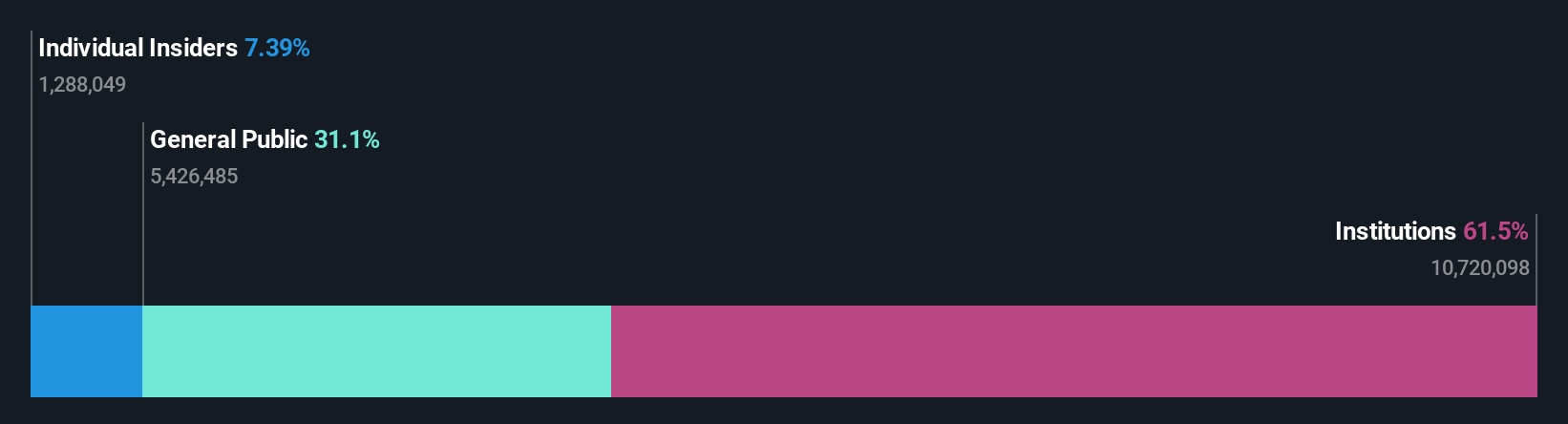

Overview: Colony Bankcorp operates as a financial holding company providing a range of banking services through its divisions, with a focus on traditional banking, mortgage banking, and small business specialty lending, and has a market capitalization of approximately $0.19 billion.

Operations: Colony Bankcorp derives its revenue primarily from the Banking Division, with additional contributions from Mortgage Banking and Small Business Specialty Lending. The company has consistently achieved a gross profit margin of 100%, indicating that it incurs no cost of goods sold. Operating expenses are largely driven by general and administrative costs, which have been a significant portion of total expenses over time. The net income margin has shown variability, reaching as high as 23.33% in recent periods, reflecting changes in profitability relative to revenue growth and expense management.

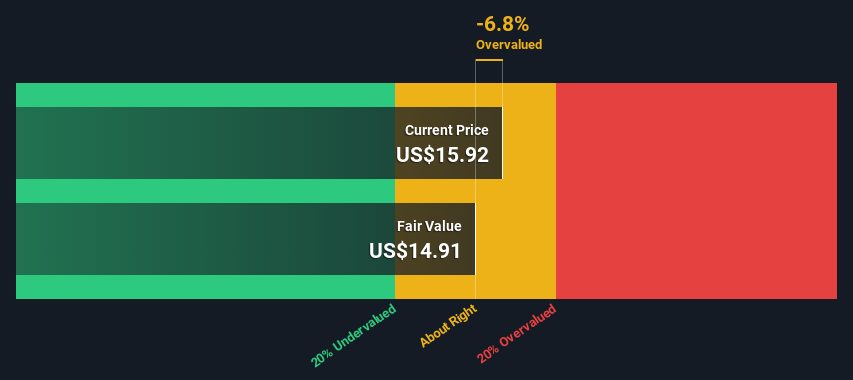

PE: 10.2x

Colony Bankcorp, a smaller player in the financial sector, is catching attention with a projected earnings growth of 27.67% annually. Recent insider confidence is evident as they increased their holdings over the past year, hinting at potential value. Despite reporting net loan charge-offs of US$1.83 million for Q3 2025, Colony's net interest income rose to US$22.7 million from US$18.54 million last year. The company also declared a quarterly dividend of $0.115 per share payable on November 19, 2025, signaling stability amidst challenges and future growth prospects bolstered by strategic equity offerings totaling $40 million and shelf registration filings amounting to $150 million earlier this month.

- Delve into the full analysis valuation report here for a deeper understanding of Colony Bankcorp.

Examine Colony Bankcorp's past performance report to understand how it has performed in the past.

Make It Happen

- Dive into all 67 of the Undervalued US Small Caps With Insider Buying we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBAN

Colony Bankcorp

Operates as the bank holding company for Colony Bank that provides various banking products and services to retail and commercial customers in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives