- United States

- /

- Electrical

- /

- NasdaqGS:FLNC

3 Undervalued Small Caps With Insider Buying Across Various Regions

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, although it has risen 9.9% over the past 12 months, with earnings expected to grow by 14% per annum in the coming years. In this context of steady growth and optimistic forecasts, identifying small-cap stocks that are perceived as undervalued and have insider buying can be an intriguing strategy for investors seeking potential opportunities across various regions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 0.9x | 36.29% | ★★★★★★ |

| Flowco Holdings | 6.9x | 0.7x | 43.42% | ★★★★★☆ |

| Columbus McKinnon | NA | 0.4x | 40.85% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.5x | 49.11% | ★★★★★☆ |

| S&T Bancorp | 10.5x | 3.6x | 44.68% | ★★★★☆☆ |

| Standard Motor Products | 11.5x | 0.4x | -2180.58% | ★★★☆☆☆ |

| Cracker Barrel Old Country Store | 20.1x | 0.3x | -598.25% | ★★★☆☆☆ |

| Farmland Partners | 9.1x | 9.2x | -17.85% | ★★★☆☆☆ |

| BlueLinx Holdings | 13.9x | 0.2x | -73.21% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.2x | -355.13% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

MVB Financial (MVBF)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: MVB Financial operates as a financial holding company with core banking services, mortgage banking, and other financial operations, and has a market capitalization of approximately $0.23 billion.

Operations: Core Banking is the primary revenue stream, generating $141.07 million, with Mortgage Banking and Financial Holding Company contributing smaller amounts. Operating expenses are significant, particularly in General & Administrative areas, which reached $107.70 million recently. The net income margin has shown variation over time but was 13.13% in the latest period analyzed.

PE: 13.8x

MVB Financial, a smaller company in the financial sector, is showing signs of potential value with earnings projected to grow 27.14% annually. Despite a low allowance for bad loans at 95%, insider confidence is evident through their share purchase activities. The recent board appointment of Rick Cordella brings strategic digital expertise from NBC Sports, potentially enhancing MVB's growth prospects. Additionally, the company announced a US$10 million share repurchase program and maintained its quarterly dividend at US$0.17 per share as of June 2025.

Fluence Energy (FLNC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Fluence Energy is a company specializing in energy storage solutions and battery systems, with a market capitalization of approximately $2.55 billion.

Operations: Fluence Energy's revenue primarily comes from its Batteries/Battery Systems segment, with recent revenue reaching $2.33 billion. The company has shown a notable improvement in gross profit margin, which increased to 13.07% as of the latest reporting period. Operating expenses are significant and include key areas such as R&D and sales & marketing, impacting overall profitability.

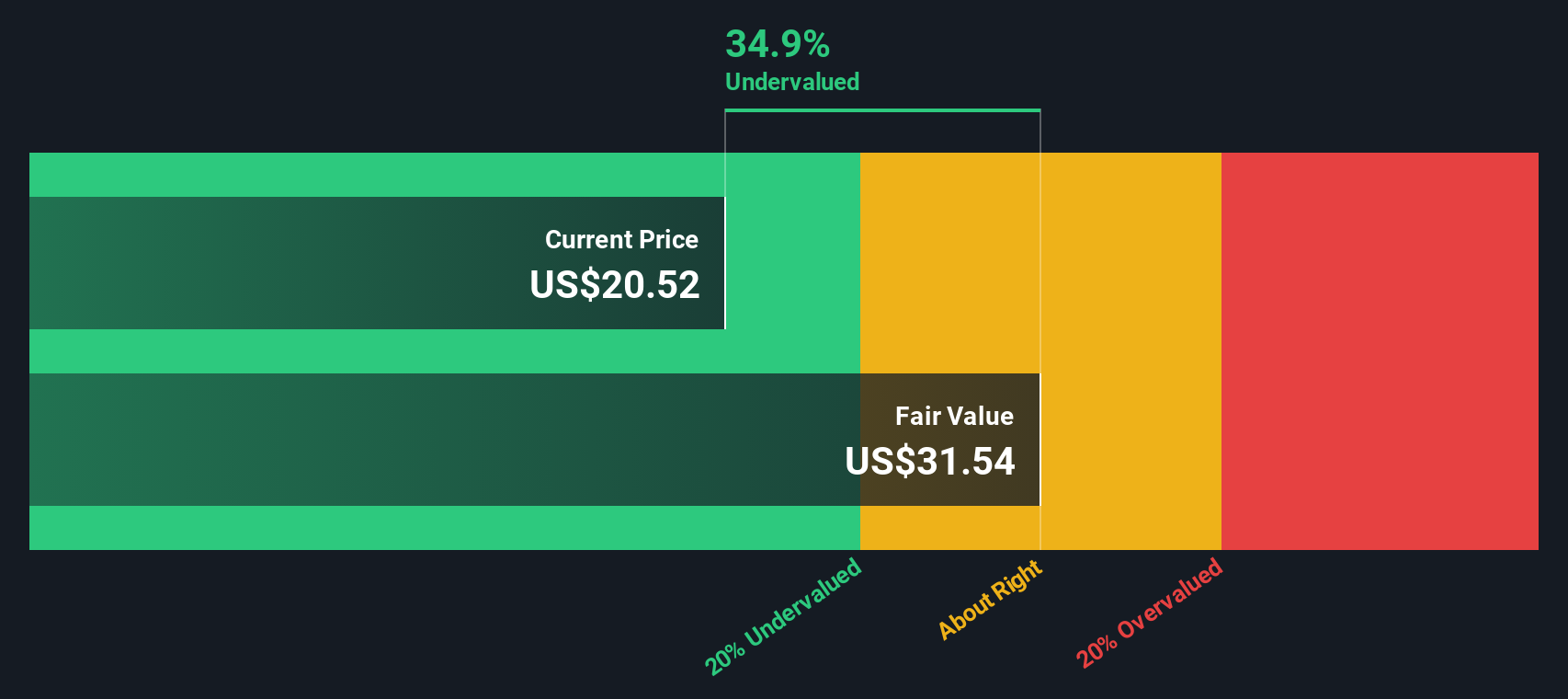

PE: -27.4x

Fluence Energy, a player in the U.S. energy storage sector, is drawing attention as an undervalued investment. Despite recent challenges like lowered revenue guidance for fiscal 2025 due to tariff-related uncertainties, insider confidence is evident with Cynthia Arnold acquiring 33,000 shares valued at approximately US$195K. The company's expansion into a new Arizona facility highlights its commitment to domestic manufacturing and reducing supply chain risks. While facing legal issues over alleged misrepresentations of sales strength, the company remains focused on growth with projected earnings increases and strategic leadership changes aimed at enhancing product development and supply chain efficiency.

- Navigate through the intricacies of Fluence Energy with our comprehensive valuation report here.

Examine Fluence Energy's past performance report to understand how it has performed in the past.

Flowco Holdings (FLOC)

Simply Wall St Value Rating: ★★★★★☆

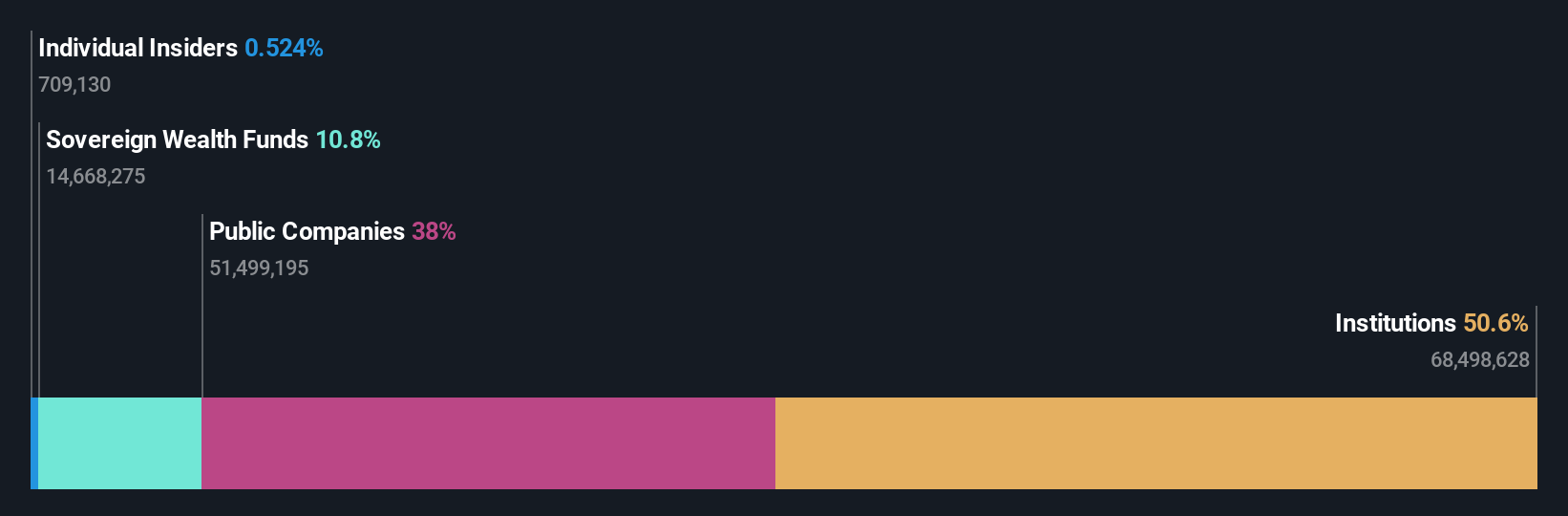

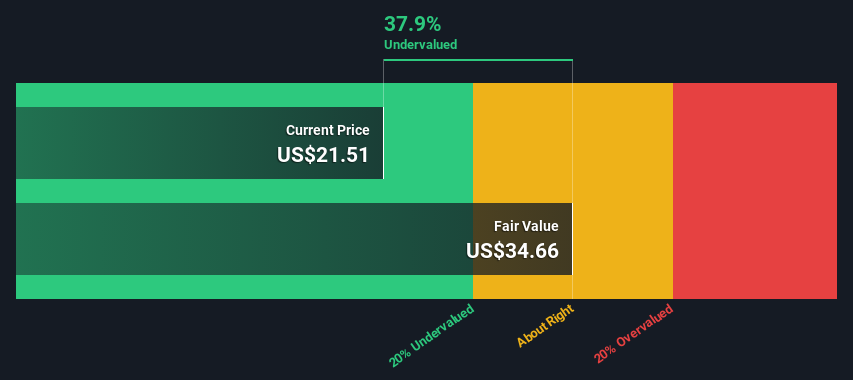

Overview: Flowco Holdings specializes in providing production solutions and natural gas technologies, with a market capitalization of $2.45 billion.

Operations: Flowco Holdings derives its revenue primarily from Production Solutions and Natural Gas Technologies, with the former contributing significantly more. The company's net income margin has shown a varied trend, starting at 22.02% and later decreasing to 10.48%. Operating expenses have increased over time, impacting profitability alongside rising costs of goods sold (COGS).

PE: 6.9x

Flowco Holdings, a small company in the U.S., is catching attention with its recent $50 million share repurchase program, signaling insider confidence. Despite a dip in profit margins from 24.5% to 10.5%, its revenue for Q1 2025 surged to US$192.35 million from US$66.71 million last year, showcasing potential growth amid challenges. The resignation of their Executive VP by August might affect operations short-term, but earnings are forecasted to grow annually by 26.78%.

- Click to explore a detailed breakdown of our findings in Flowco Holdings' valuation report.

Review our historical performance report to gain insights into Flowco Holdings''s past performance.

Turning Ideas Into Actions

- Click this link to deep-dive into the 89 companies within our Undervalued US Small Caps With Insider Buying screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLNC

Fluence Energy

Through its subsidiaries, provides energy storage and optimization software for renewables and storage applications in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives