- United States

- /

- Banks

- /

- NasdaqGS:PCB

Discovering US Market's Undiscovered Gems Through 3 Promising Stocks

Reviewed by Simply Wall St

In the last week, the United States market has been flat, yet it has experienced a 14% rise over the past 12 months with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying stocks that are not only resilient but also poised for growth can uncover promising opportunities within the market's lesser-known corners.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Wilson Bank Holding | 0.00% | 7.88% | 8.09% | ★★★★★★ |

| Senstar Technologies | NA | -20.82% | 14.32% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| China SXT Pharmaceuticals | 64.25% | -29.05% | 10.33% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

MetroCity Bankshares (MCBS)

Simply Wall St Value Rating: ★★★★★★

Overview: MetroCity Bankshares, Inc. is a bank holding company for Metro City Bank, offering a range of banking products and services in the United States, with a market cap of $744.26 million.

Operations: MetroCity Bankshares generates revenue primarily through its banking products and services. The company has a market capitalization of $744.26 million.

MetroCity Bankshares, a smaller player in the banking sector, shows promising value trading at 42.1% below its estimated fair value. With total assets of US$3.6 billion and equity of US$436.1 million, it maintains a solid financial foundation with deposits totaling US$2.7 billion and loans at US$3.1 billion. The bank boasts high-quality earnings with a net profit margin of 21%, alongside sufficient allowance for bad loans at 130% and non-performing loans at just 0.5%. Earnings grew by 21.6% last year, outpacing the industry average of 6.2%, indicating robust performance and potential for future growth.

- Click here and access our complete health analysis report to understand the dynamics of MetroCity Bankshares.

Assess MetroCity Bankshares' past performance with our detailed historical performance reports.

PCB Bancorp (PCB)

Simply Wall St Value Rating: ★★★★★★

Overview: PCB Bancorp is the bank holding company for PCB Bank, offering a range of banking products and services to small and middle-market businesses and individuals, with a market cap of $305.91 million.

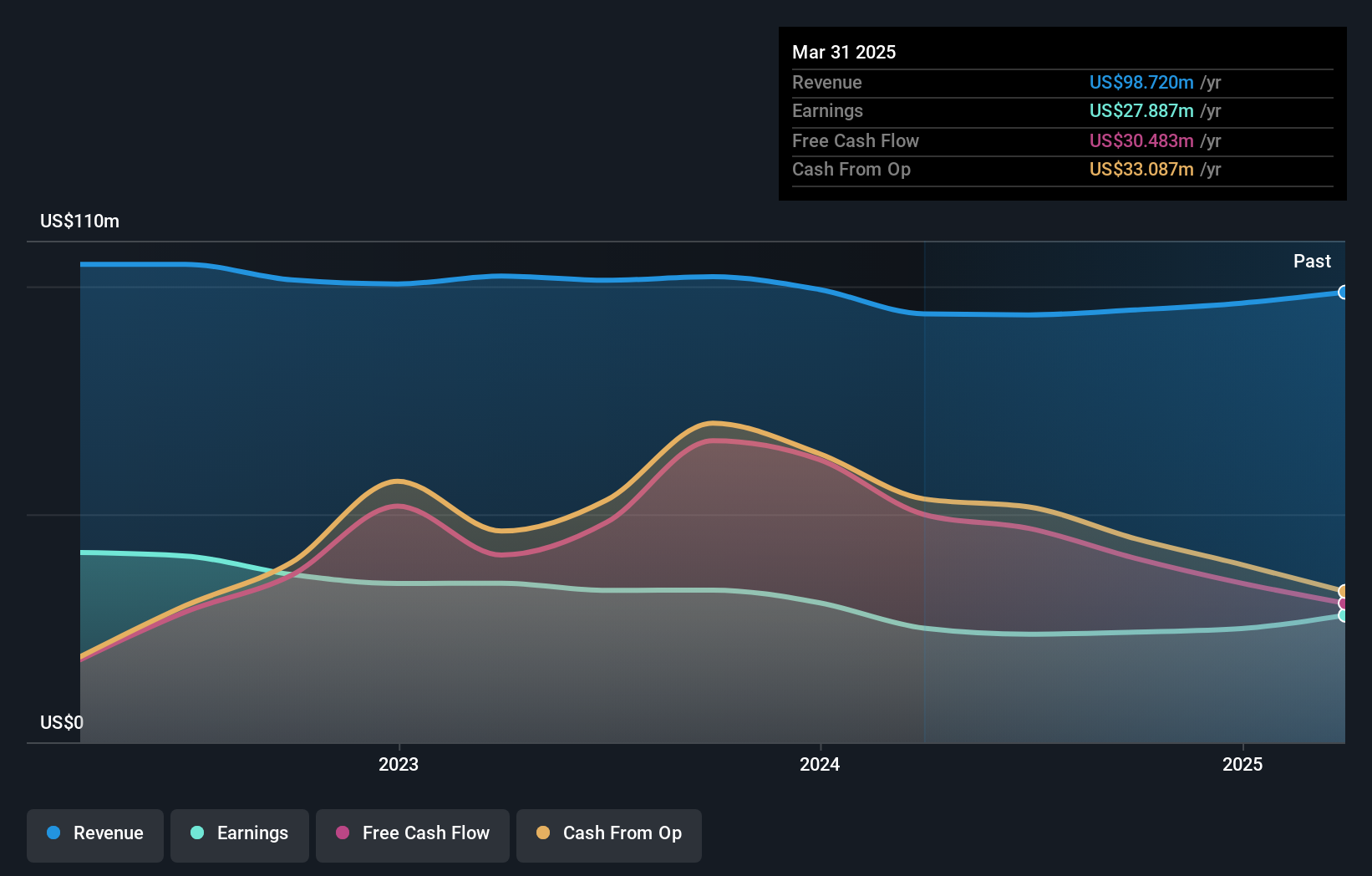

Operations: PCB Bancorp generates revenue primarily from its banking operations, with $98.72 million attributed to this segment. The company's financial performance can be evaluated through its net profit margin, which reflects the profitability of its banking services.

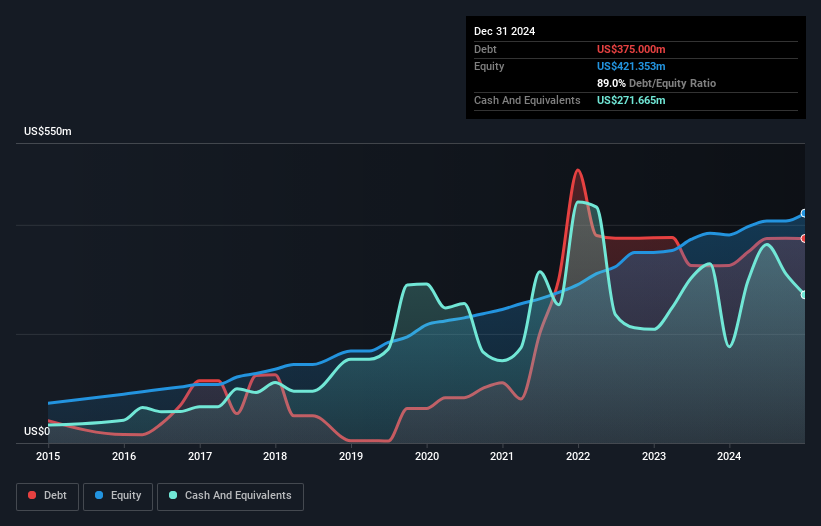

PCB Bancorp, with assets totaling US$3.2 billion and equity of US$406.6 million, showcases a robust financial position. The bank's total deposits and loans each stand at US$2.7 billion, supported by a low-risk funding structure where 96% of liabilities stem from customer deposits. Its non-performing loans are minimal at 0.2%, indicating prudent risk management alongside an allowance for bad loans exceeding 511%. Recent inclusion in multiple Russell Growth Indexes highlights its growing market recognition despite challenges like delayed SEC filings impacting compliance status on Nasdaq. Earnings grew by 11% last year, surpassing industry averages, reflecting strong operational performance amidst these hurdles.

- Take a closer look at PCB Bancorp's potential here in our health report.

Examine PCB Bancorp's past performance report to understand how it has performed in the past.

Sila Realty Trust (SILA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sila Realty Trust, Inc., based in Tampa, Florida, is a net lease real estate investment trust specializing in the healthcare sector with a market capitalization of approximately $1.35 billion.

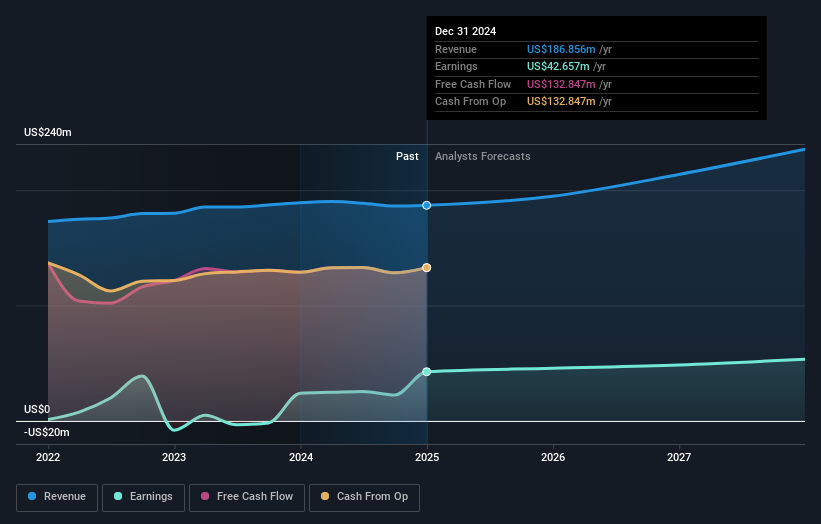

Operations: Sila Realty Trust generates revenue primarily from commercial real estate investments in the healthcare sector, amounting to $184.47 million.

Sila Realty Trust, a Tampa-based net lease REIT, has been gaining traction within the healthcare sector. With its recent addition to several Russell indexes, including the 2000 and 3000 Value benchmarks, its market visibility is on the rise. The company boasts a satisfactory net debt to equity ratio of 37.6% and enjoys well-covered interest payments with an EBIT coverage of 3.1x. Despite a dip in Q1 earnings from US$14.98 million to US$7.1 million year-over-year, Sila's strategic lease extensions and fair value trading position it as an intriguing option for those eyeing sustainable growth in healthcare real estate investments.

Where To Now?

- Take a closer look at our US Undiscovered Gems With Strong Fundamentals list of 280 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PCB

PCB Bancorp

Operates as the bank holding company for PCB Bank that provides various banking products and services to small and middle market businesses and individuals.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives