- United States

- /

- Banks

- /

- NasdaqGS:TCBK

Mercantile Bank And 2 Other Top Dividend Stocks To Consider

Reviewed by Simply Wall St

In the midst of a highly volatile trading environment marked by uncertainties surrounding tariffs and their potential impact on economic growth, investors are seeking stability through dividend stocks. A good dividend stock can provide consistent income and potentially mitigate some market volatility, making it an attractive option for those looking to navigate the current economic landscape.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Douglas Dynamics (NYSE:PLOW) | 5.42% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 6.93% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 5.76% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 8.82% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 7.77% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.90% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 5.41% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 7.88% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.96% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 5.82% | ★★★★★★ |

Click here to see the full list of 177 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Mercantile Bank (NasdaqGS:MBWM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mercantile Bank Corporation, with a market cap of $646.64 million, operates as the bank holding company for Mercantile Bank, offering commercial and retail banking services to small- to medium-sized businesses and individuals in the United States.

Operations: Mercantile Bank Corporation generates revenue of $224.08 million from its banking products, services, and investment securities.

Dividend Yield: 3.7%

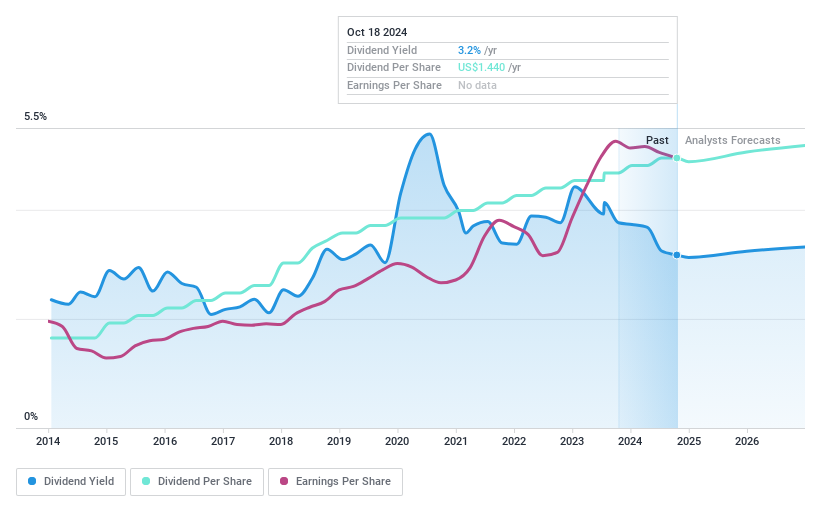

Mercantile Bank's dividends have been stable and growing over the past decade, with a recent increase to $0.37 per share. The payout ratio is low at 28.8%, indicating sustainable dividends well-covered by earnings, even as net income slightly declined in 2024 to $79.59 million from $82.22 million in 2023. Trading below its estimated fair value and with insider selling noted recently, it offers a reliable dividend yield of 3.75%, though below top-tier US dividend payers.

- Take a closer look at Mercantile Bank's potential here in our dividend report.

- Our valuation report here indicates Mercantile Bank may be undervalued.

PCB Bancorp (NasdaqGS:PCB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PCB Bancorp is the bank holding company for PCB Bank, offering a range of banking products and services to small to medium-sized businesses, individuals, and professionals in Southern California, with a market cap of $245.44 million.

Operations: PCB Bancorp generates revenue of $96.31 million from its operations in the banking industry, serving Southern California's small to medium-sized businesses, individuals, and professionals.

Dividend Yield: 4.8%

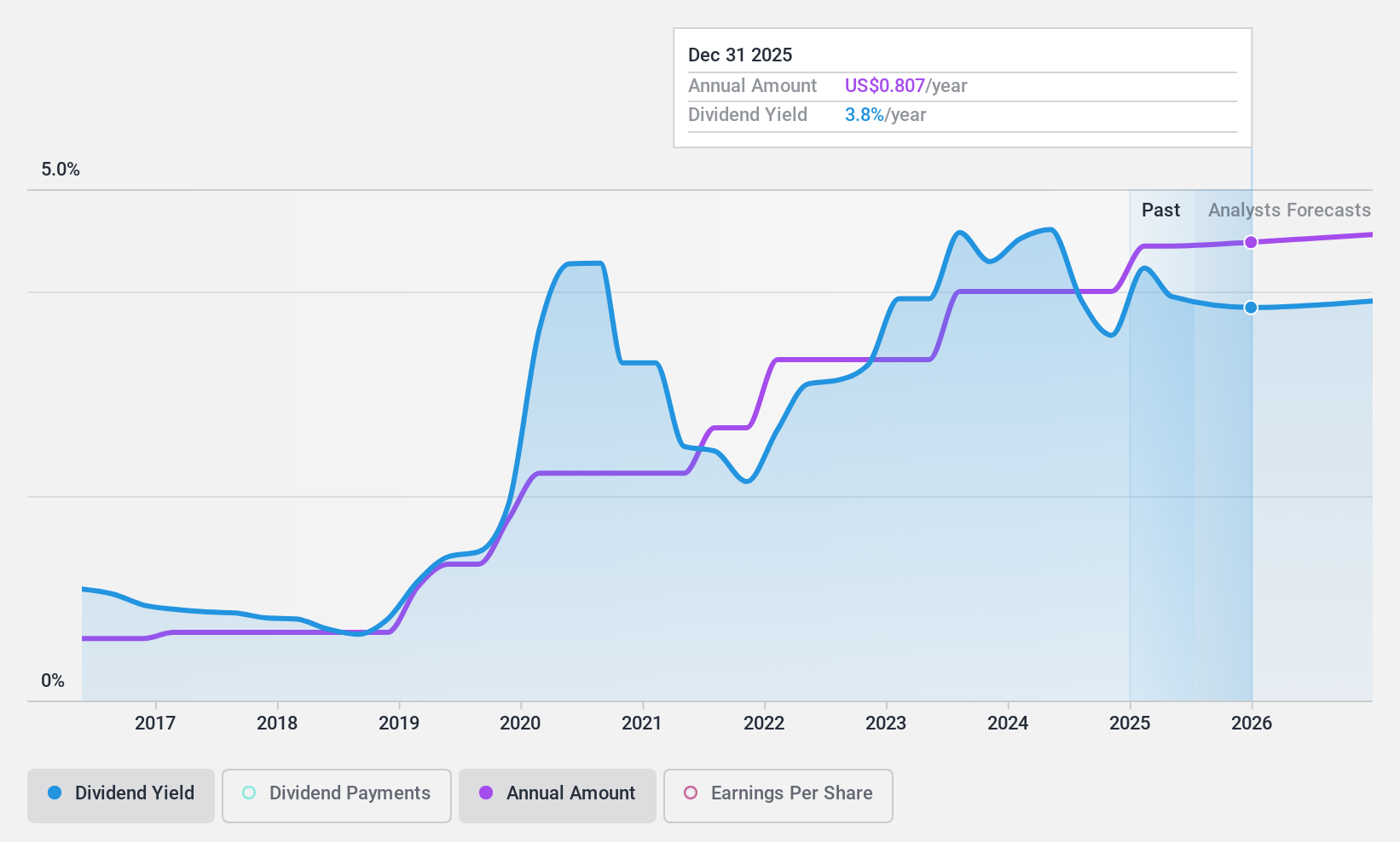

PCB Bancorp's dividends have been stable and growing over the past decade, with a recent increase to $0.20 per share, reflecting a reliable yield of 4.76%. The payout ratio is 41.1%, suggesting sustainability as earnings cover dividends well, with future coverage expected to improve. Trading significantly below its fair value and reporting increased net income of $7.03 million for Q4 2024, PCB offers attractive value despite not being among the top US dividend payers.

- Unlock comprehensive insights into our analysis of PCB Bancorp stock in this dividend report.

- The analysis detailed in our PCB Bancorp valuation report hints at an deflated share price compared to its estimated value.

TriCo Bancshares (NasdaqGS:TCBK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TriCo Bancshares is a bank holding company for Tri Counties Bank, offering commercial banking services to individual and corporate customers, with a market cap of approximately $1.19 billion.

Operations: TriCo Bancshares generates its revenue primarily through its Community Banking segment, which accounted for $389.19 million.

Dividend Yield: 3.7%

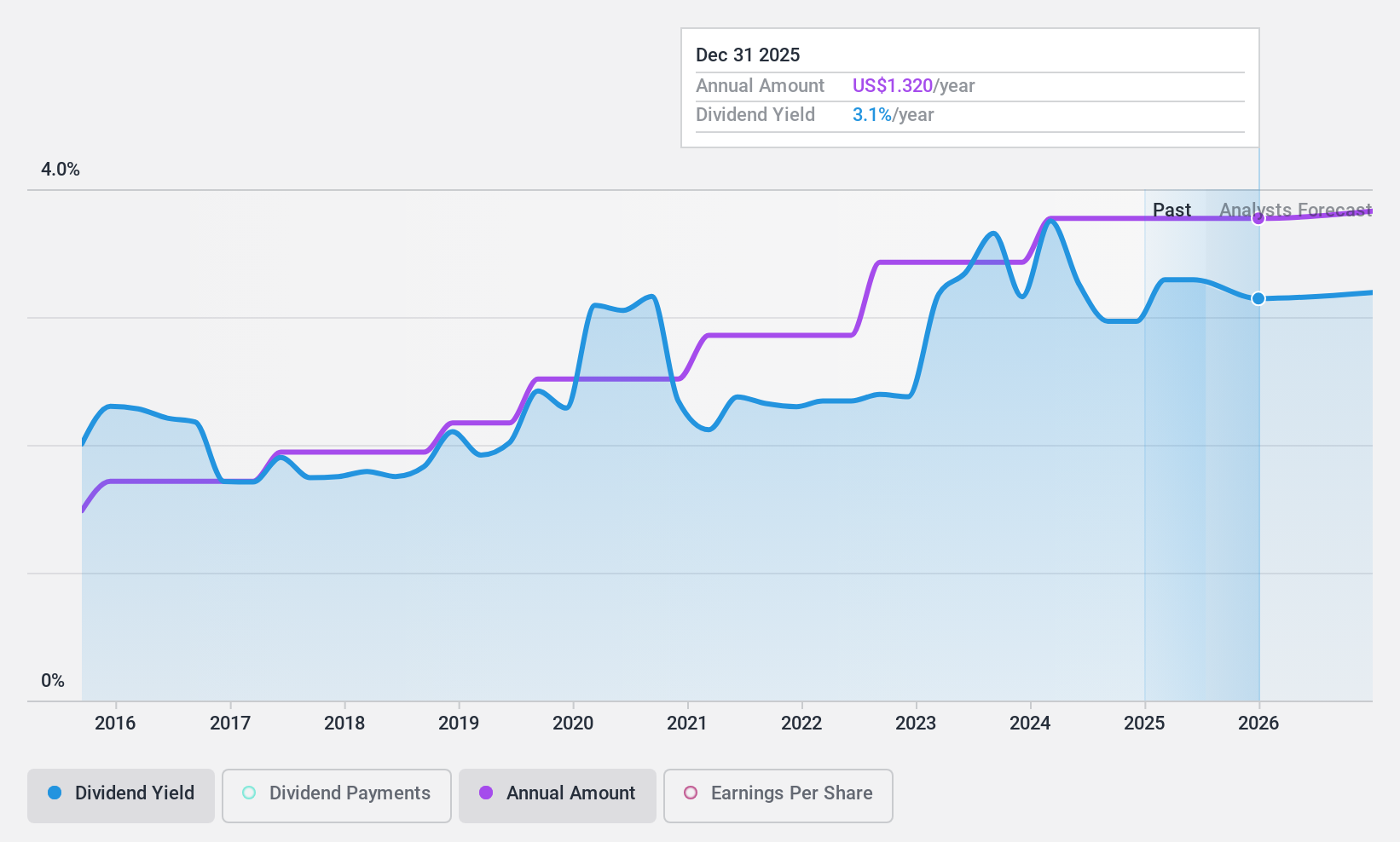

TriCo Bancshares has maintained stable and growing dividends over the past decade, offering a yield of 3.65%. The payout ratio is a sustainable 38%, indicating dividends are well covered by earnings and expected to remain so. Recent board affirmation of a $0.33 per share dividend underscores reliability, though the yield is lower than top-tier US dividend payers. Trading at nearly half its estimated fair value, TriCo presents good relative value despite recent marginal declines in net income.

- Click here to discover the nuances of TriCo Bancshares with our detailed analytical dividend report.

- Our valuation report unveils the possibility TriCo Bancshares' shares may be trading at a discount.

Where To Now?

- Take a closer look at our Top US Dividend Stocks list of 177 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TriCo Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TCBK

TriCo Bancshares

Operates as a bank holding company for Tri Counties Bank that provides commercial banking services to individual and corporate customers.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives