- United States

- /

- Banks

- /

- NasdaqGM:LSBK

Lake Shore Bancorp (NASDAQ:LSBK) stock falls 24% in past week as three-year earnings and shareholder returns continue downward trend

As an investor its worth striving to ensure your overall portfolio beats the market average. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term Lake Shore Bancorp, Inc. (NASDAQ:LSBK) shareholders, since the share price is down 13% in the last three years, falling well short of the market return of around 67%. On top of that, the share price is down 24% in the last week.

Since Lake Shore Bancorp has shed US$21m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

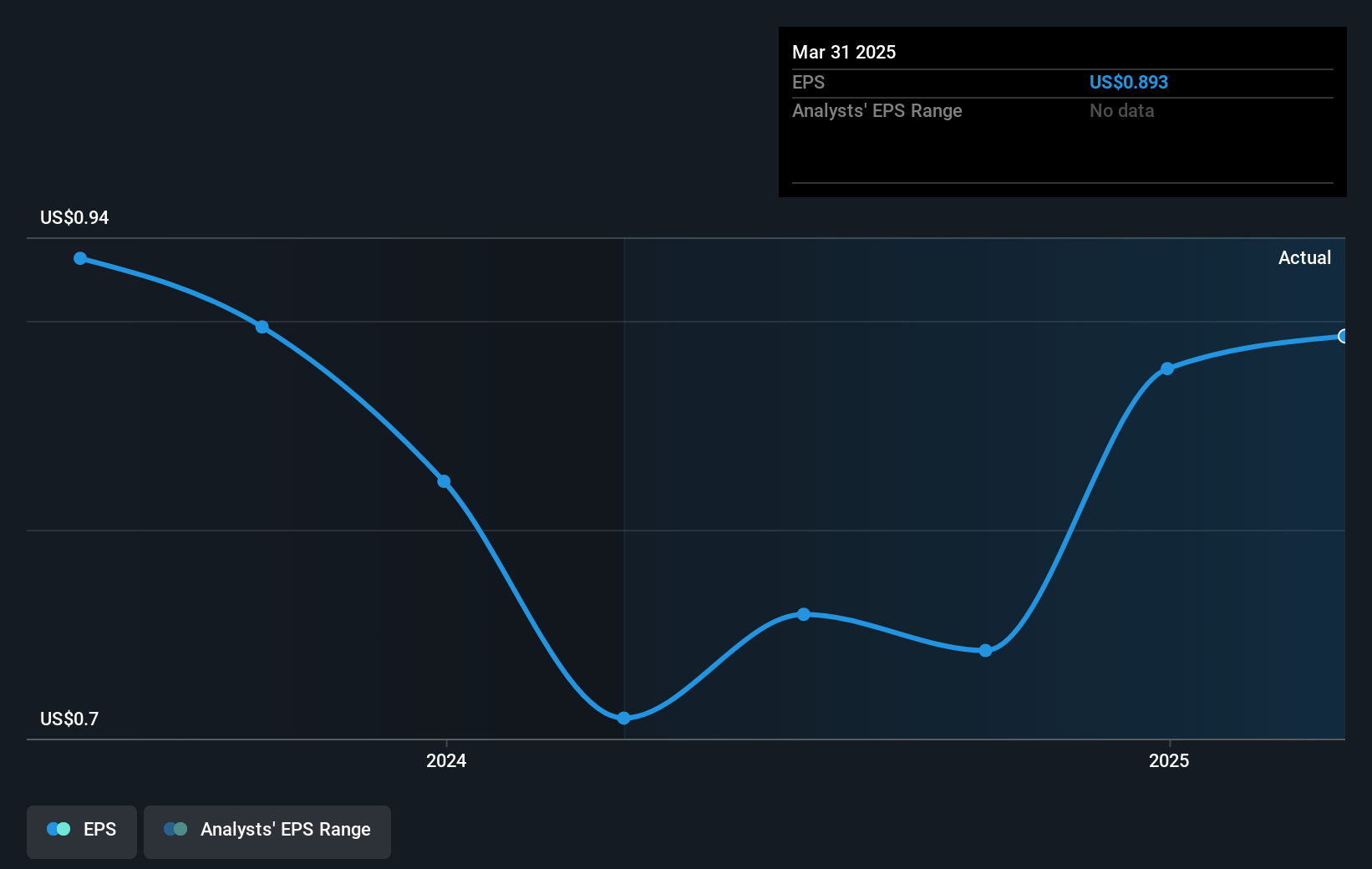

During the three years that the share price fell, Lake Shore Bancorp's earnings per share (EPS) dropped by 2.6% each year. The share price decline of 5% is actually steeper than the EPS slippage. So it seems the market was too confident about the business, in the past.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Lake Shore Bancorp's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Lake Shore Bancorp's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Lake Shore Bancorp shareholders, and that cash payout explains why its total shareholder loss of 5.7%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

Lake Shore Bancorp shareholders are up 0.8% for the year. But that return falls short of the market. If we look back over five years, the returns are even better, coming in at 4% per year for five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. It's always interesting to track share price performance over the longer term. But to understand Lake Shore Bancorp better, we need to consider many other factors. For instance, we've identified 2 warning signs for Lake Shore Bancorp (1 shouldn't be ignored) that you should be aware of.

Lake Shore Bancorp is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:LSBK

Lake Shore Bancorp

Operates as the savings and loan holding company for Lake Shore Savings Bank that provides banking products and services in New York.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success