- United States

- /

- Banks

- /

- NasdaqCM:LMST

How Much Are Limestone Bancorp, Inc. (NASDAQ:LMST) Insiders Spending On Buying Shares?

We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So we'll take a look at whether insiders have been buying or selling shares in Limestone Bancorp, Inc. (NASDAQ:LMST).

Do Insider Transactions Matter?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, most countries require that the company discloses such transactions to the market.

Insider transactions are not the most important thing when it comes to long-term investing. But equally, we would consider it foolish to ignore insider transactions altogether. For example, a Columbia University study found that 'insiders are more likely to engage in open market purchases of their own company’s stock when the firm is about to reveal new agreements with customers and suppliers'.

Check out our latest analysis for Limestone Bancorp

Limestone Bancorp Insider Transactions Over The Last Year

In the last twelve months, the biggest single purchase by an insider was when Chairman of the Board William Hogan bought US$195k worth of shares at a price of US$11.09 per share. We do like to see buying, but this purchase was made at well below the current price of US$15.06. Because it occurred at a lower valuation, it doesn't tell us much about whether insiders might find today's price attractive.

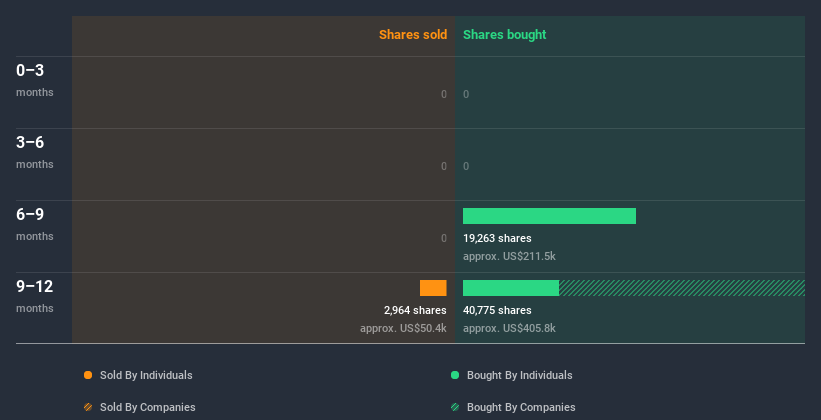

In the last twelve months insiders purchased 30.04k shares for US$312k. But insiders sold 2.96k shares worth US$51k. In total, Limestone Bancorp insiders bought more than they sold over the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

Limestone Bancorp is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Does Limestone Bancorp Boast High Insider Ownership?

Many investors like to check how much of a company is owned by insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Limestone Bancorp insiders own about US$23m worth of shares. That equates to 20% of the company. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Do The Limestone Bancorp Insider Transactions Indicate?

The fact that there have been no Limestone Bancorp insider transactions recently certainly doesn't bother us. However, our analysis of transactions over the last year is heartening. Insiders own shares in Limestone Bancorp and we see no evidence to suggest they are worried about the future. If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

But note: Limestone Bancorp may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade Limestone Bancorp, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:LMST

Limestone Bancorp

Limestone Bancorp, Inc. operates as the bank holding company for Limestone Bank, Inc.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.