- United States

- /

- Banks

- /

- NasdaqGS:INTR

How Investors Are Reacting To Inter & Co (INTR) Expanding Its Low-Cost Lending Model into the U.S.

Reviewed by Simply Wall St

- Earlier this month, investor commentary highlighted Inter & Co's position as Brazil's second-largest neo-bank and its expanding presence in Latin America and the United States, with a business model built on low-cost lending.

- This expansion is viewed by market watchers as a way for Inter & Co to tap into new, sizable markets and support longer-term earnings potential through geographic diversification.

- We'll examine how Inter & Co's growth ambitions in the U.S. could influence the company's investment outlook going forward.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Inter & Co Investment Narrative Recap

To own Inter & Co, you need to believe that its rapid expansion outside Brazil, particularly into the U.S., will ultimately drive sustainable profit growth, even as competition and credit quality remain closely watched issues. While the latest market commentary underscores the company's geographic ambitions and low-cost lending strengths, these developments do not materially shift the most important near-term catalyst: Inter & Co’s ability to maintain high-quality loan growth despite a risky credit portfolio. The biggest risk remains potential spikes in non-performing loans if macroeconomic or credit conditions worsen.

The most relevant recent announcement is Inter & Co's Q2 2025 earnings report, showing continued year-over-year gains in net income and interest income. This performance provides some reassurance that operational execution is on track, supporting the catalyst of ongoing growth amid geographic and product expansion. However, as Inter & Co moves further into higher-growth markets and riskier lending segments, investors will need to monitor shifts in

Read the full narrative on Inter & Co (it's free!)

Inter & Co's narrative projects R$13.8 billion revenue and R$2.9 billion earnings by 2028. This requires 37.6% yearly revenue growth and an increase of R$1.8 billion in earnings from R$1.1 billion today.

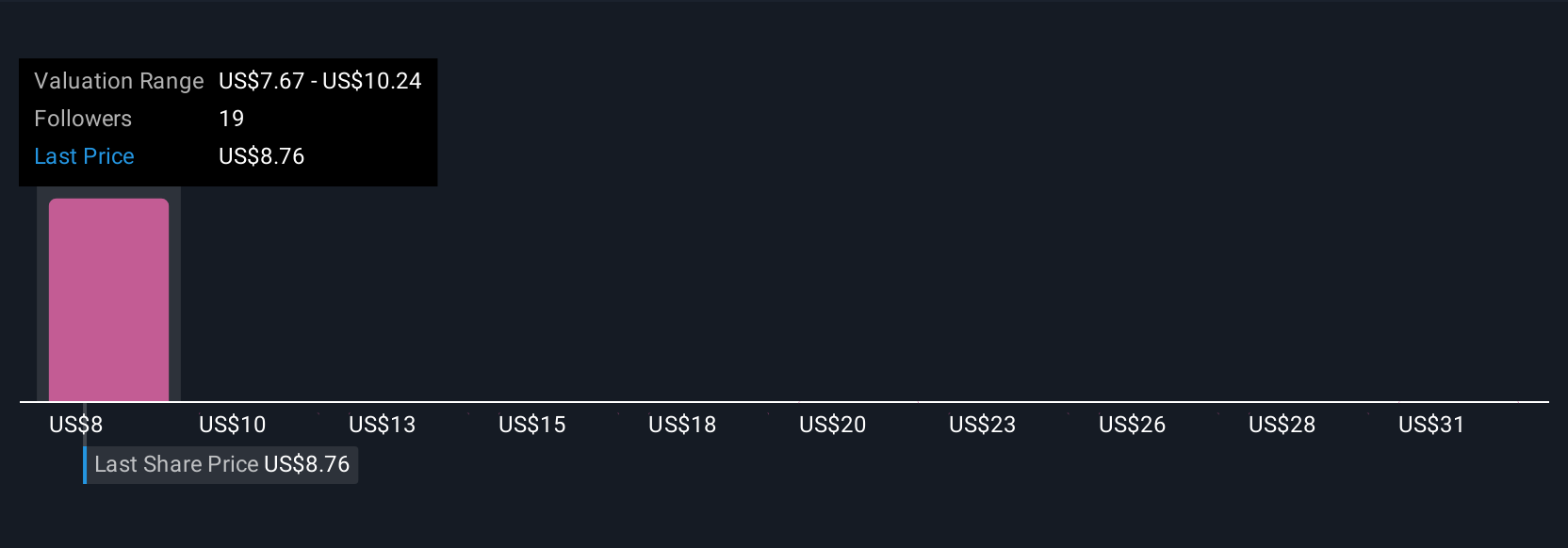

Uncover how Inter & Co's forecasts yield a $8.38 fair value, a 7% downside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community place Inter & Co’s fair value anywhere from R$7.65 to R$33.30 per share. While ongoing customer and revenue growth are seen as positives by many, you should consider how increased competition could impact future returns, explore these diverse opinions to widen your view.

Explore 5 other fair value estimates on Inter & Co - why the stock might be worth over 3x more than the current price!

Build Your Own Inter & Co Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Inter & Co research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Inter & Co research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Inter & Co's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTR

Inter & Co

Through its subsidiaries, engages in the banking and spending, investments, insurance brokerage, and inter shop businesses in Brazil and the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives