- United States

- /

- Banks

- /

- NasdaqGS:INTR

3 US Stocks Estimated To Be Trading At Discounts Of 24.2% To 39.8%

Reviewed by Simply Wall St

In the wake of a stronger-than-expected December jobs report, U.S. stock futures have slid as investors grapple with concerns about interest rate cuts amid rising Treasury yields. In this climate of economic resilience and market uncertainty, identifying undervalued stocks can be a strategic move, offering potential opportunities for investors looking to navigate these challenging conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | $27.16 | $53.39 | 49.1% |

| Dime Community Bancshares (NasdaqGS:DCOM) | $31.31 | $61.51 | 49.1% |

| Afya (NasdaqGS:AFYA) | $15.08 | $29.71 | 49.2% |

| Ally Financial (NYSE:ALLY) | $35.61 | $69.79 | 49% |

| Constellium (NYSE:CSTM) | $10.77 | $21.02 | 48.8% |

| Sociedad Química y Minera de Chile (NYSE:SQM) | $39.04 | $75.26 | 48.1% |

| Bilibili (NasdaqGS:BILI) | $16.78 | $32.73 | 48.7% |

| Vasta Platform (NasdaqGS:VSTA) | $2.30 | $4.41 | 47.8% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.78 | $30.71 | 48.6% |

| Coeur Mining (NYSE:CDE) | $6.44 | $12.66 | 49.1% |

Let's uncover some gems from our specialized screener.

Symbotic (NasdaqGM:SYM)

Overview: Symbotic Inc. is an automation technology company that develops technologies to enhance operating efficiencies in modern warehouses, with a market cap of approximately $15.54 billion.

Operations: The company generates revenue from its Industrial Automation & Controls segment, amounting to $1.79 billion.

Estimated Discount To Fair Value: 33%

Symbotic is trading at US$26.45, below its estimated fair value of US$39.47, suggesting it may be undervalued based on cash flows. Despite a class action lawsuit alleging improper revenue recognition, Symbotic's earnings are forecast to grow significantly and become profitable in three years. Recent leadership changes with the appointment of Dr. James Kuffner as CTO aim to bolster technological advances and strategic growth amid volatile share prices and delayed SEC filings.

- In light of our recent growth report, it seems possible that Symbotic's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Symbotic.

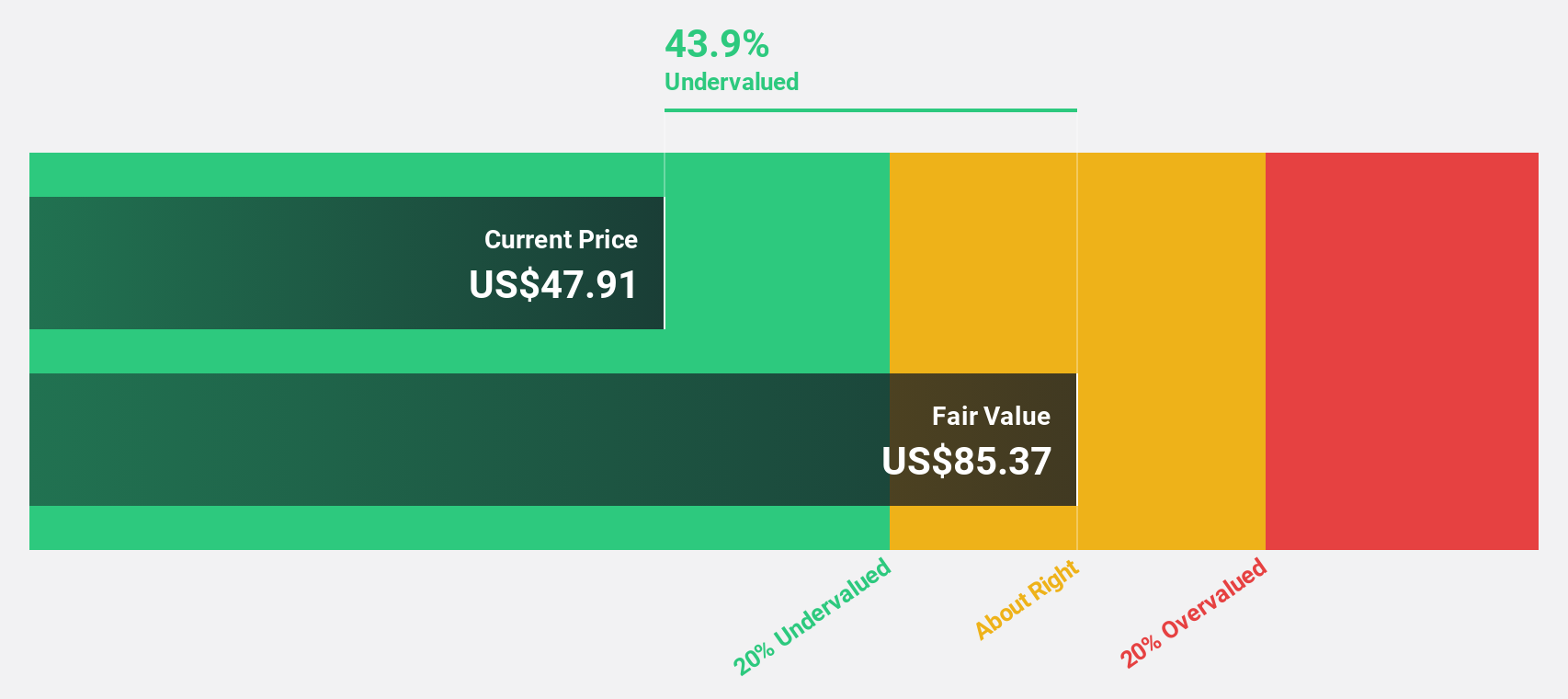

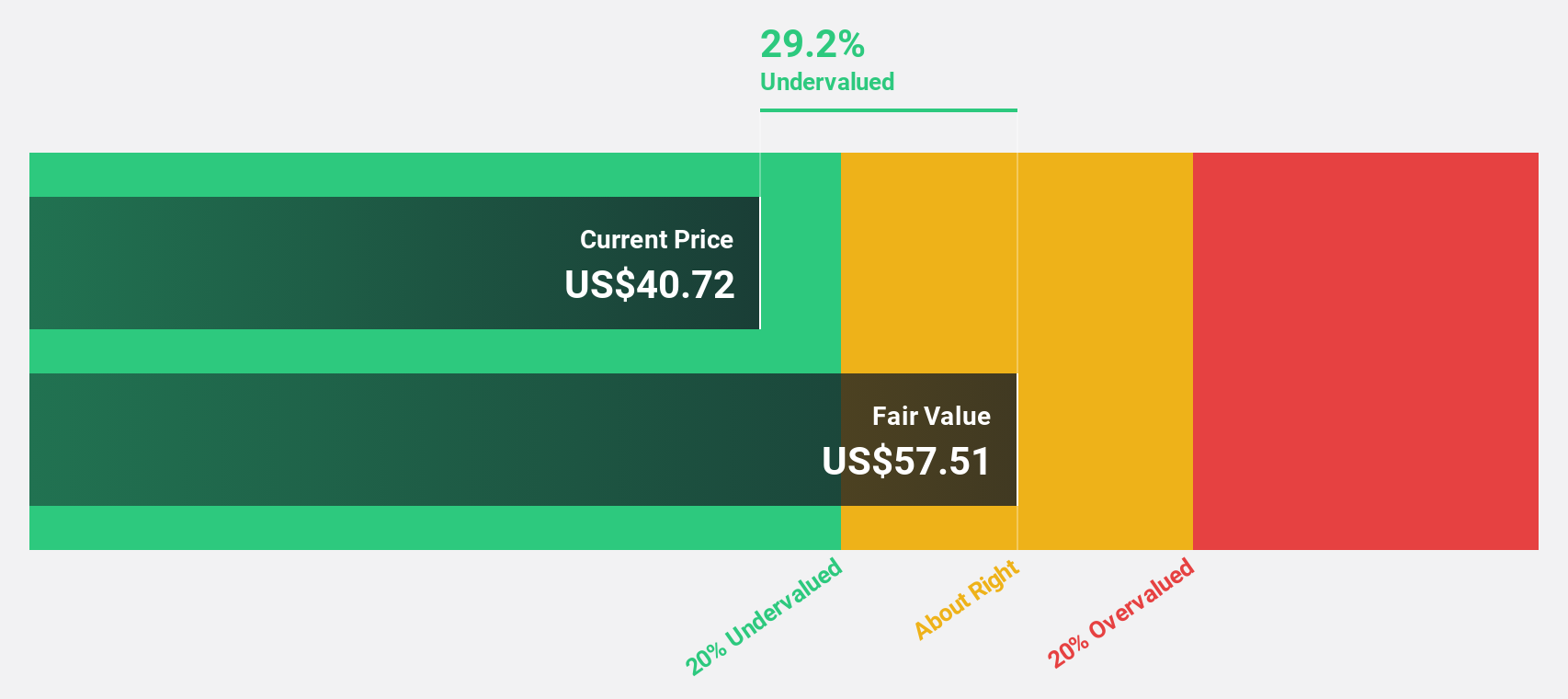

ExlService Holdings (NasdaqGS:EXLS)

Overview: ExlService Holdings, Inc. is a company that provides data analytics and digital operations solutions both in the United States and internationally, with a market cap of approximately $7.28 billion.

Operations: The company's revenue segments include Analytics at $770.51 million, Insurance at $591.10 million, Healthcare at $110.80 million, and Emerging Business at $298.59 million.

Estimated Discount To Fair Value: 24.2%

ExlService Holdings is trading at US$45.28, below its estimated fair value of US$59.72, indicating potential undervaluation based on cash flows. The company has shown consistent earnings growth and forecasts suggest continued outperformance compared to the broader market. Recent initiatives include a share buyback program and strategic M&A pursuits, alongside launching an AI platform to enhance client services. Despite these positive indicators, investors should consider market conditions and competitive pressures when evaluating ExlService's valuation prospects.

- Our expertly prepared growth report on ExlService Holdings implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of ExlService Holdings stock in this financial health report.

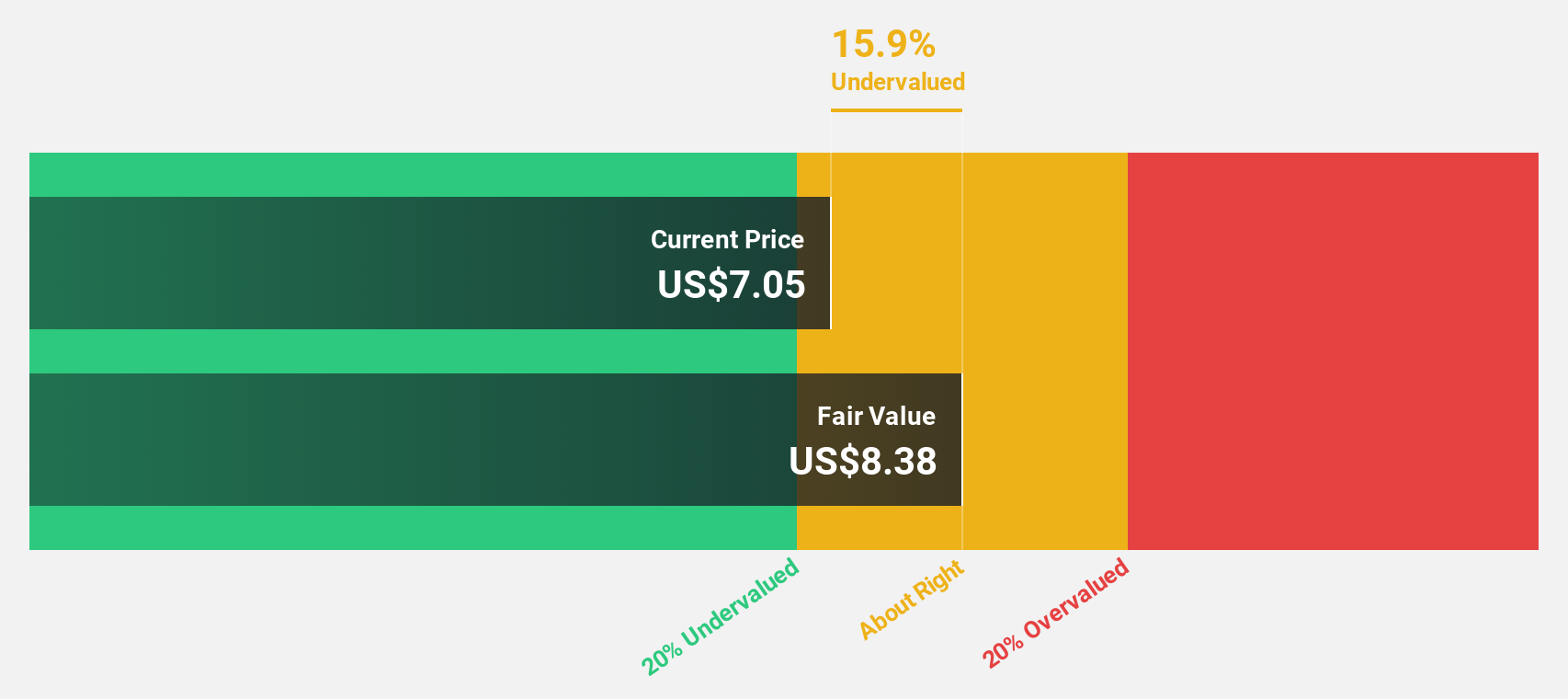

Inter & Co (NasdaqGS:INTR)

Overview: Inter & Co, Inc., with a market cap of $1.87 billion, operates through its subsidiaries in banking and spending, investments, and insurance brokerage businesses.

Operations: The company's revenue segments include Banking & Spending (R$3.57 billion), Inter Shop (R$272.22 million), Investments (R$243.48 million), and Insurance Brokerage (R$181.21 million).

Estimated Discount To Fair Value: 39.8%

Inter & Co. is trading at $4.25, significantly below its estimated fair value of $7.06, suggesting undervaluation based on cash flows. The company reported strong earnings growth of 326.2% over the past year and forecasts indicate continued robust earnings and revenue growth above market averages. However, challenges include a high level of bad loans (8.6%) with a low allowance (68%), alongside recent shareholder dilution impacting equity returns forecasted to be modest in three years.

- Our growth report here indicates Inter & Co may be poised for an improving outlook.

- Get an in-depth perspective on Inter & Co's balance sheet by reading our health report here.

Summing It All Up

- Take a closer look at our Undervalued US Stocks Based On Cash Flows list of 170 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTR

Inter & Co

Through its subsidiaries, engages in the banking and spending, investments, insurance brokerage, and inter shop businesses in Brazil and the United States.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.