- United States

- /

- Biotech

- /

- NasdaqGS:BMEA

3 US Penny Stocks With Market Caps Up To $2B

Reviewed by Simply Wall St

As the U.S. stock market experiences a mixed performance with investors closely watching economic indicators and interest rate decisions, attention turns to the potential opportunities within penny stocks. Despite their reputation as a relic of past market eras, penny stocks continue to offer intriguing possibilities for growth, especially when supported by robust financials. These smaller or newer companies can present a unique blend of affordability and potential for expansion, making them an appealing option for investors looking to explore under-the-radar opportunities in today's complex market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.81 | $5.79M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.25 | $1.93B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $100.69M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.7257 | $11.81M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.32 | $11.77M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.41 | $46.86M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.49 | $44.59M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.37 | $28.91M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.97 | $91.74M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.45 | $365.18M | ★★★★☆☆ |

Click here to see the full list of 727 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

So-Young International (NasdaqGM:SY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: So-Young International Inc. operates an online platform for consumption healthcare services in the People’s Republic of China and has a market cap of $87.41 million.

Operations: The company's revenue segment consists of CN¥1.49 billion generated from its operations in China.

Market Cap: $87.41M

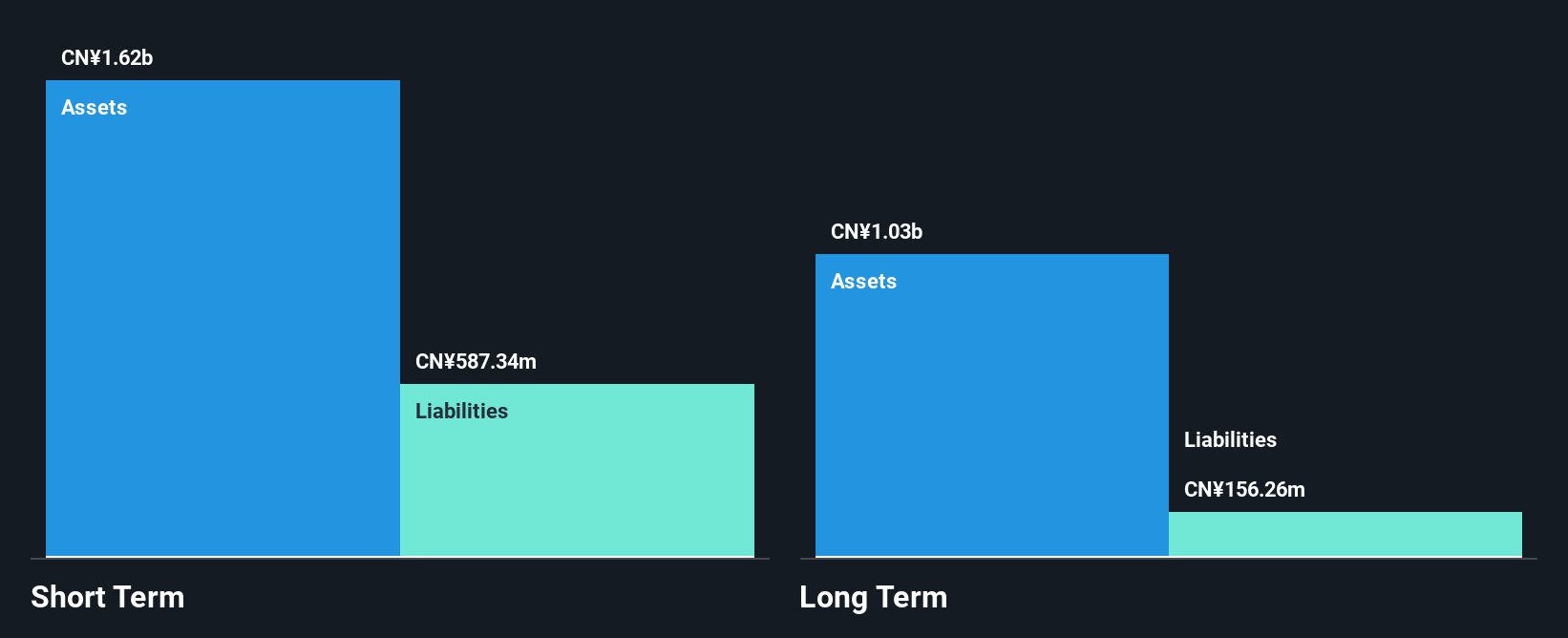

So-Young International Inc., with a market cap of US$87.41 million, operates primarily in China and has shown some financial resilience despite challenges. The company reported CN¥1.49 billion in revenue, though earnings have declined by 30.1% annually over the past five years, indicating volatility typical of penny stocks. Short-term assets significantly exceed liabilities, suggesting solid liquidity management; however, shareholder dilution occurred last year with a 3.2% increase in shares outstanding. Earnings grew modestly by 1.4% last year but are forecast to grow substantially at 43.56%. Recent guidance indicates expected revenue decline for Q4 2024 compared to the previous year.

- Click here and access our complete financial health analysis report to understand the dynamics of So-Young International.

- Gain insights into So-Young International's future direction by reviewing our growth report.

Biomea Fusion (NasdaqGS:BMEA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Biomea Fusion, Inc. is a clinical-stage biopharmaceutical company specializing in the discovery and development of covalent small molecule drugs for genetically defined cancers and metabolic diseases, with a market cap of $145.32 million.

Operations: No revenue segments have been reported.

Market Cap: $145.32M

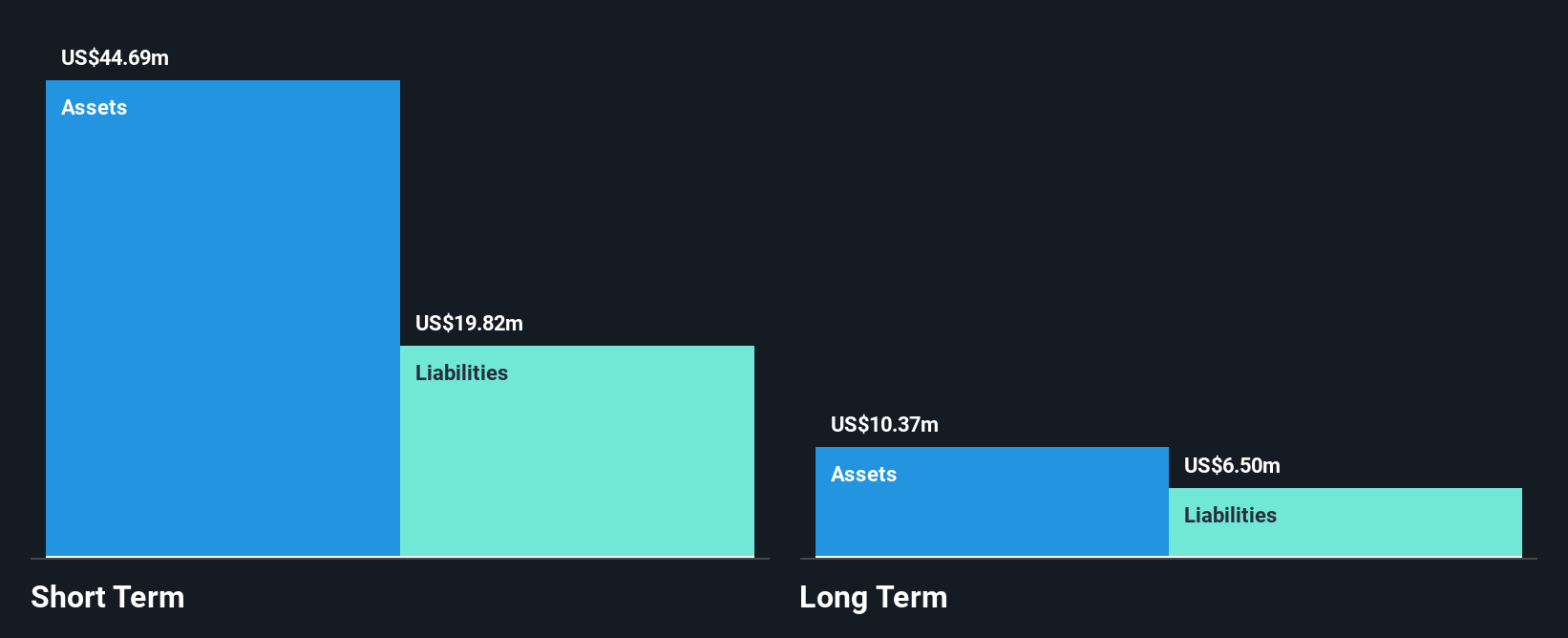

Biomea Fusion, Inc., a clinical-stage biopharmaceutical company with a market cap of US$145.32 million, is pre-revenue and focuses on developing covalent small molecule drugs for cancer and metabolic diseases. Recent announcements highlighted promising preclinical results for icovamenib in combination with semaglutide, showcasing potential benefits in diabetes management by improving insulin secretion and reducing side effects. The company also reported positive topline results from its COVALENT-111 study on type 2 diabetes patients, demonstrating significant HbA1c reductions without serious adverse events. Despite these advancements, Biomea faces challenges typical of penny stocks such as high volatility and limited cash runway.

- Take a closer look at Biomea Fusion's potential here in our financial health report.

- Examine Biomea Fusion's earnings growth report to understand how analysts expect it to perform.

Inter & Co (NasdaqGS:INTR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Inter & Co, Inc. operates through its subsidiaries in banking and spending, investments, and insurance brokerage businesses with a market cap of $1.93 billion.

Operations: The company's revenue segments include Banking & Spending (R$3.57 billion), Inter Shop (R$272.22 million), Investments (R$243.48 million), and Insurance Brokerage (R$181.21 million).

Market Cap: $1.93B

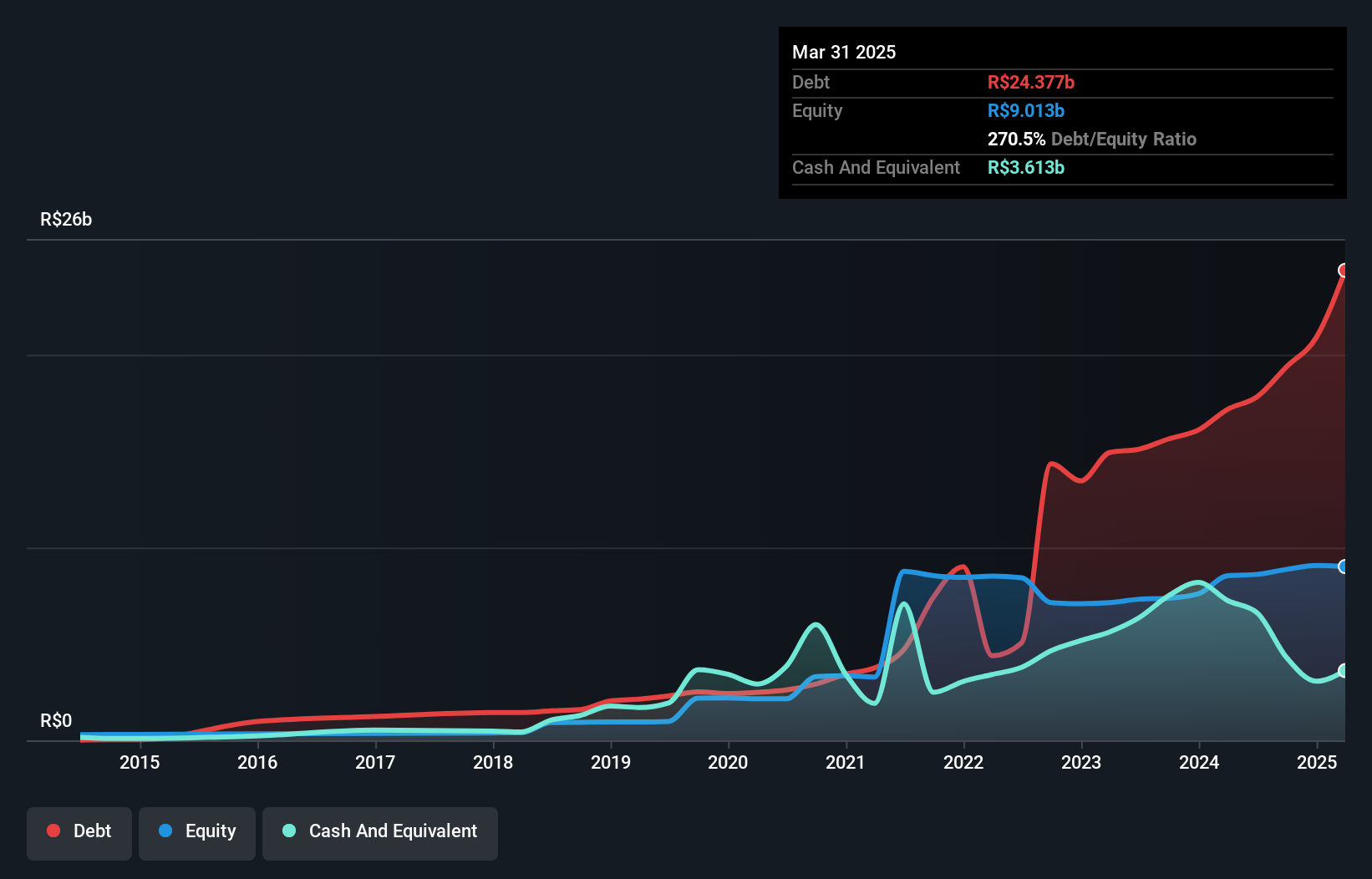

Inter & Co, Inc. has shown strong financial performance with significant earnings growth of 326.2% over the past year, outpacing the banking industry. The company reported a net income increase to BRL 242.67 million in Q3 2024 from BRL 91.29 million a year ago, reflecting improved profit margins and high-quality earnings. While primarily funded by low-risk customer deposits, Inter & Co faces challenges with a high bad loans ratio of 8.6% and shareholder dilution over the past year. Despite these issues, it trades below its estimated fair value and maintains an appropriate loans-to-deposits ratio of 92%.

- Jump into the full analysis health report here for a deeper understanding of Inter & Co.

- Learn about Inter & Co's future growth trajectory here.

Turning Ideas Into Actions

- Click here to access our complete index of 727 US Penny Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Biomea Fusion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BMEA

Biomea Fusion

A clinical-stage diabetes and obesity medicines company, focuses on the discovery and development of covalent small molecule drugs to treat patients with genetically defined cancers and metabolic diseases.

Medium-low with adequate balance sheet.

Market Insights

Community Narratives