- United States

- /

- Banks

- /

- NasdaqGS:HBAN

Is Now the Right Moment for Huntington Shares After Recent 8% Drop?

Reviewed by Bailey Pemberton

If you are staring at Huntington Bancshares and wondering whether now is the right time to get in or to take profits, you are not alone. Over the past year, Huntington’s stock has returned 8.9%, and looking back even further, it is up an impressive 107.1% over the past five years. However, the recent price action has been bumpy. In the last month alone, shares have slid 8.0%, and the past week shows a dip of 2.5%. Still, for those thinking long-term, this year’s performance remains modestly positive, up 0.6% year-to-date.

What is behind these swings? A lot of it boils down to changing sentiment around regional banks and some broad-based market jitters. Investors have become more sensitive to economic pressures, shifting their outlook on risk, which tends to amplify the moves in a stock like Huntington Bancshares. Yet even with this volatility, the fundamentals tell a compelling story.

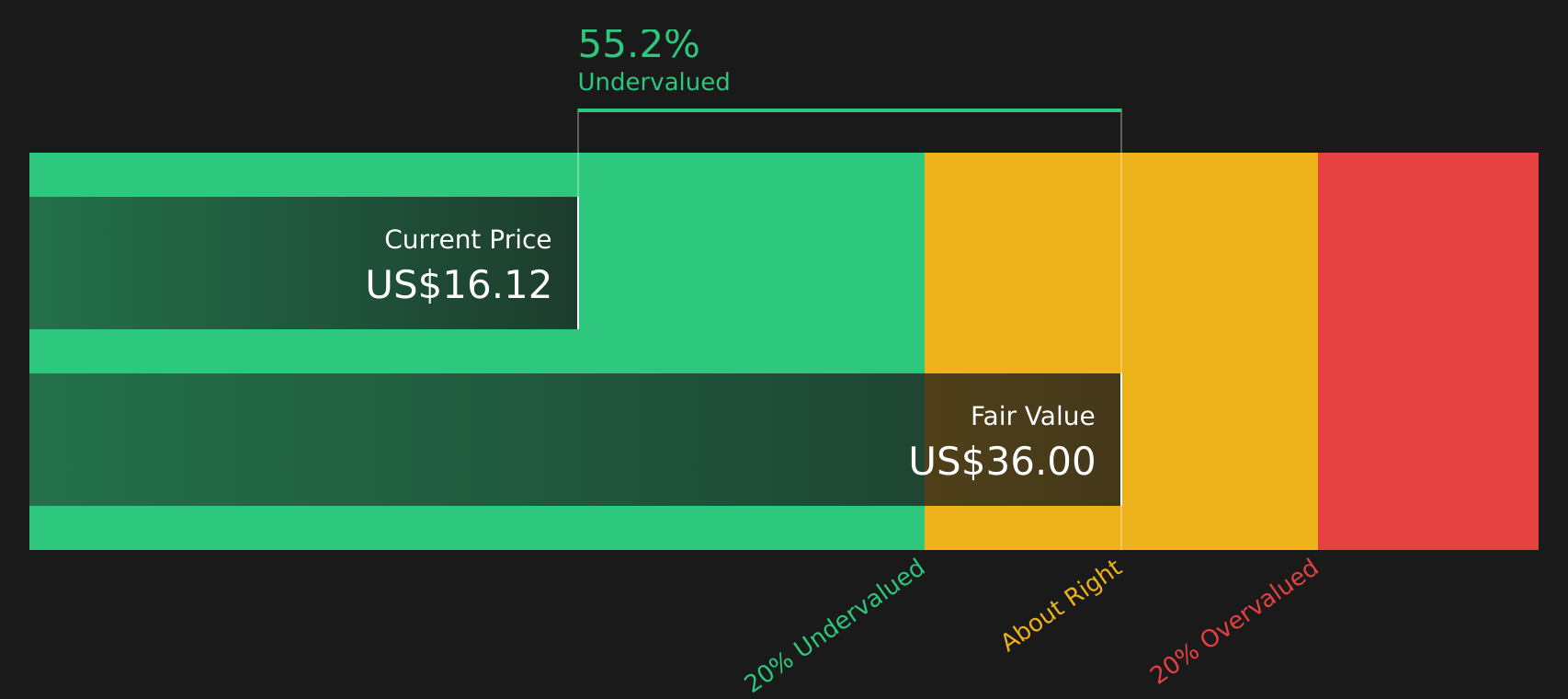

If you are a value-focused investor, here is where things get interesting. Huntington Bancshares racks up a value score of 5 out of a possible 6 on our 6-point undervaluation check, suggesting that the shares may still be trading beneath what they are truly worth. So how are these valuation checks determined, and what can they tell us about where the stock could be headed next? Let’s dig into each approach, and stay tuned because we will save the most revealing lens for understanding Huntington’s value for last.

Why Huntington Bancshares is lagging behind its peers

Approach 1: Huntington Bancshares Excess Returns Analysis

The Excess Returns model takes a closer look at how effectively Huntington Bancshares generates profits from its existing equity, then subtracts the company’s cost of equity to estimate value creation above the minimum required by investors. This approach focuses less on near-term earnings and more on long-term, sustainable profitability and growth.

According to forecasts from 11 analysts, Huntington is expected to generate a stable earnings per share (EPS) of $1.60 and maintain a stable book value of $14.19 per share over time. The company’s cost of equity is $1.04 per share, while its average return on equity stands at a healthy 11.25%. Taking these figures into account, the estimated annual excess return, which is the money made above the cost of equity, comes to $0.56 per share. This suggests the business is consistently generating value beyond the minimum threshold investors demand.

Based on this model, the fair value for Huntington Bancshares is estimated at $27.49 per share. With the intrinsic discount at 40.6%, the Excess Returns approach indicates the stock is meaningfully undervalued at its current price. This may present an opportunity for investors looking for quality at a reasonable price.

Result: UNDERVALUED

Our Excess Returns analysis suggests Huntington Bancshares is undervalued by 40.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Huntington Bancshares Price vs Earnings

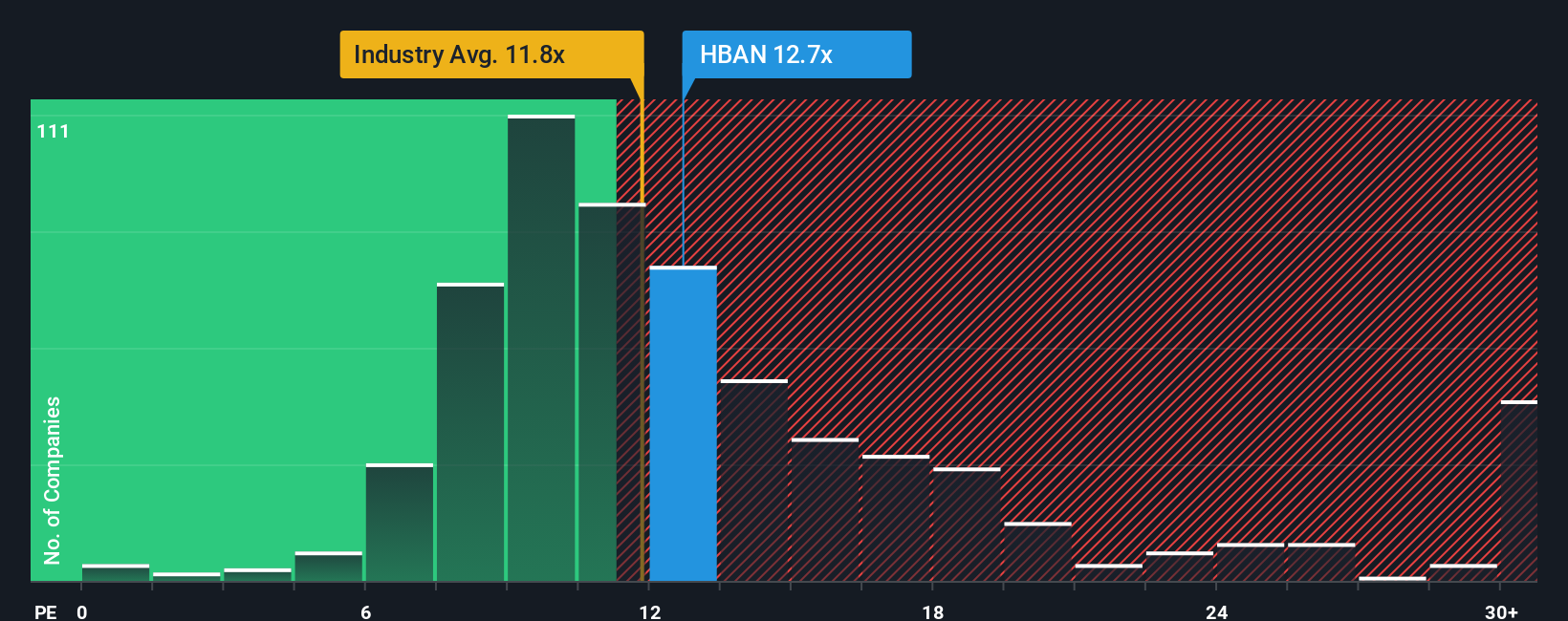

For companies like Huntington Bancshares that are consistently profitable, using the Price-to-Earnings (PE) ratio is a widely respected way of comparing value. The PE ratio is particularly useful because it shows how much investors are willing to pay for each dollar of earnings, making it especially relevant for banks and steady earners.

What counts as a “normal” or “fair” PE ratio can depend on many factors, including expectations for future growth and the level of risk in the business or industry. In general, companies with higher growth prospects or more stable earnings tend to justify higher PE ratios, while riskier or slower-growing firms command lower multiples.

Current data shows Huntington is trading at a PE ratio of 12x, compared to an average of 12.6x among its peers and an industry average of 11.7x. At first glance, this puts the stock right in line with its competitors. However, Simply Wall St’s proprietary Fair Ratio, which adjusts for Huntington’s earnings growth, profit margins, market capitalization, and business risks, comes in at 13.9x. This approach is more insightful than simply matching against peers or industry benchmarks because it tailors the multiple to the company’s unique risk and reward profile.

With Huntington’s actual PE ratio just under the Fair Ratio, the shares appear to be trading below where their fundamentals suggest they could be valued. This points to the stock being undervalued on this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Huntington Bancshares Narrative

Earlier, we mentioned that there is an even better way to understand a stock’s value, so let’s introduce you to Narratives. A Narrative is simply your story or perspective about a company. It connects the numbers you see (like your estimate of fair value, revenue, earnings, and margins) to the bigger picture of what the company is actually doing and where you think it is headed.

By creating a Narrative, you link Huntington Bancshares’ business story to a financial forecast and then to a fair value, turning raw data into actionable insight. Narratives are straightforward and accessible, and you can explore and build them easily on Simply Wall St’s Community page. Millions of investors use these features to compare their view against the market, making the approach both collaborative and intuitive.

With Narratives, you are empowered to decide when to buy or sell by matching your Fair Value from your Narrative to the actual market price. As new information like earnings or news emerges, Narratives are dynamically updated, so your investment decision-making framework always stays current.

For example, on Huntington Bancshares, one investor may focus on the company’s strategic expansion into Texas and digital banking growth, building a bullish Narrative that supports a higher fair value. Another investor may take a more cautious view of regulatory risks and slower profit margin growth, resulting in a lower valuation.

Do you think there's more to the story for Huntington Bancshares? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huntington Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HBAN

Huntington Bancshares

Operates as the bank holding company for The Huntington National Bank that provides commercial, consumer, and mortgage banking services in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives