- United States

- /

- Banks

- /

- NasdaqGS:HBAN

Huntington Bancshares (HBAN): Assessing Valuation After Recent Momentum Shift

Reviewed by Kshitija Bhandaru

Huntington Bancshares (HBAN) shares have shown mixed momentum this month, as investors weigh the company’s recent performance in light of shifting economic conditions. The stock’s total return remains positive over the past year, which reflects some underlying business strength.

See our latest analysis for Huntington Bancshares.

After rallying impressively over the past five years, with a 109.5% total shareholder return, Huntington Bancshares has cooled in recent months as share price momentum faded. The stock recently dipped 8% over the past month. While the shorter-term move reflects shifting sentiment, longer-term investors have still seen steady overall progress from the bank.

If Huntington’s recent pullback has you thinking about your portfolio, it could be the perfect moment to look beyond the usual names and discover fast growing stocks with high insider ownership

With shares now trading about 22% below analyst price targets and fundamentals still healthy, the real question is whether Huntington is offering hidden value or if the market has already factored in its future growth prospects.

Most Popular Narrative: 18% Undervalued

Compared to the last close of $16.21, the most widely followed narrative sees Huntington Bancshares’ fair value much higher, reflecting significant upside potential. The story driving this view is not just about current profits but focuses on bold growth strategies unfolding now.

Investments in digital banking and value-added payments platforms, alongside strong adoption among tech-savvy demographics, have already resulted in double-digit growth in payments and wealth management fees and are expected to continue boosting noninterest income and net margin over the long term.

Want to know why this target price is turning heads? The secret sauce could be found in rapid digital expansion and ambitious financial projections that set this bank apart from its peers. Ready to uncover the surprising assumptions shaping this bullish outlook?

Result: Fair Value of $19.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty around the broader economic outlook and integration challenges from new market expansions remain risks that could impact Huntington’s growth trajectory.

Find out about the key risks to this Huntington Bancshares narrative.

Another View: What Do Multiples Tell Us?

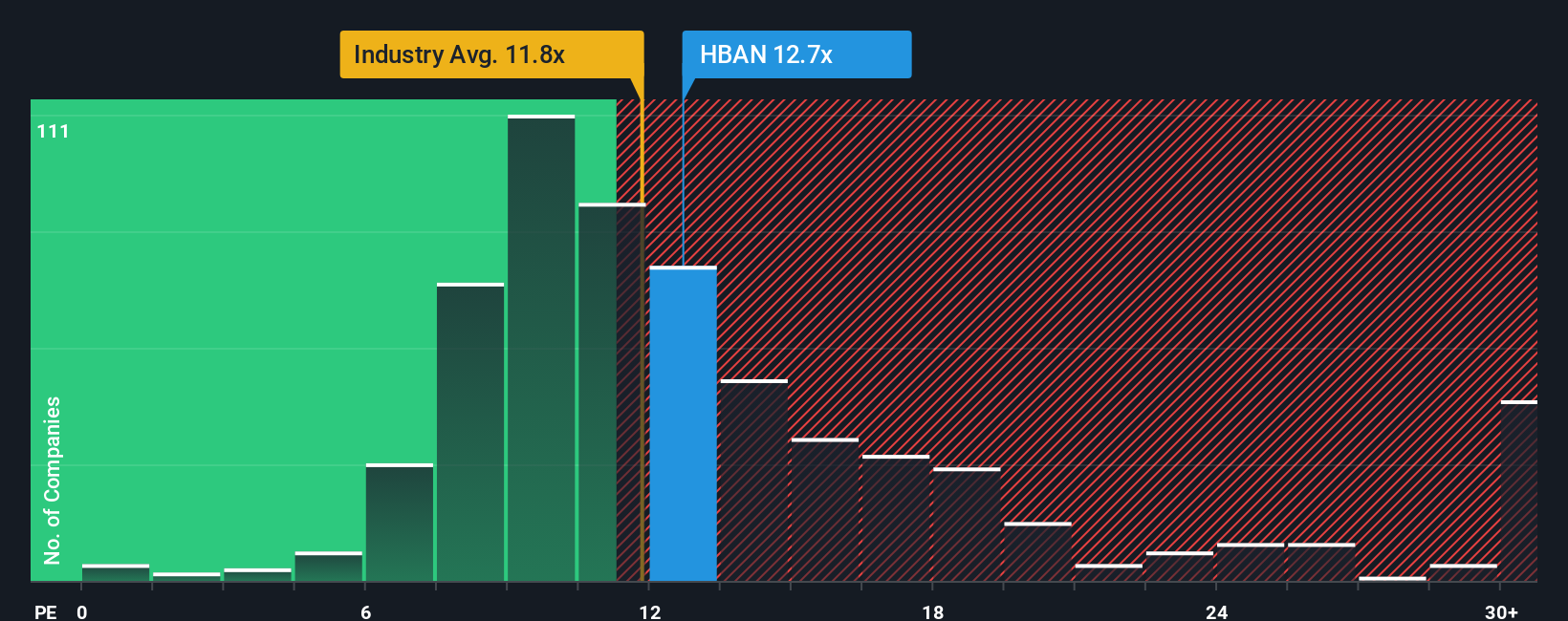

Looking at Huntington Bancshares through its price-to-earnings ratio, the story shifts. The shares trade at 12x earnings, slightly higher than the industry average of 11.7x, but below the fair ratio of 13.9x and nearly aligned with the peer average. This close-to-peers pricing suggests the market sees limited valuation risk. However, could a shift in sentiment send the stock in either direction?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Huntington Bancshares Narrative

If you see things differently or want to dig into the details yourself, it only takes a few minutes to shape your own perspective, so why not Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Huntington Bancshares.

Looking for More Investment Ideas?

Smart investors always keep tabs on new opportunities beyond the familiar. Give yourself every advantage—now is the time to act on compelling trends and tap into tomorrow’s leaders before the crowd catches on.

- Tap into income stability by reviewing these 18 dividend stocks with yields > 3% that provide reliable yields above 3%. This approach is ideal for building a resilient portfolio.

- Uncover growth potential by checking out these 24 AI penny stocks at the cutting edge of artificial intelligence, where innovation remains relentless.

- Seize early-mover opportunities with these 3571 penny stocks with strong financials boasting robust financials and surprising competitive advantages, often overlooked by mainstream investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huntington Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HBAN

Huntington Bancshares

Operates as the bank holding company for The Huntington National Bank that provides commercial, consumer, and mortgage banking services in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives