- United States

- /

- Banks

- /

- NasdaqCM:FXNC

Here's Why I Think First National (NASDAQ:FXNC) Is An Interesting Stock

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like First National (NASDAQ:FXNC). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for First National

How Quickly Is First National Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. First National managed to grow EPS by 8.7% per year, over three years. That's a good rate of growth, if it can be sustained.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that First National's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. First National reported flat revenue and EBIT margins over the last year. That's not a major concern but nor does it point to the long term growth we like to see.

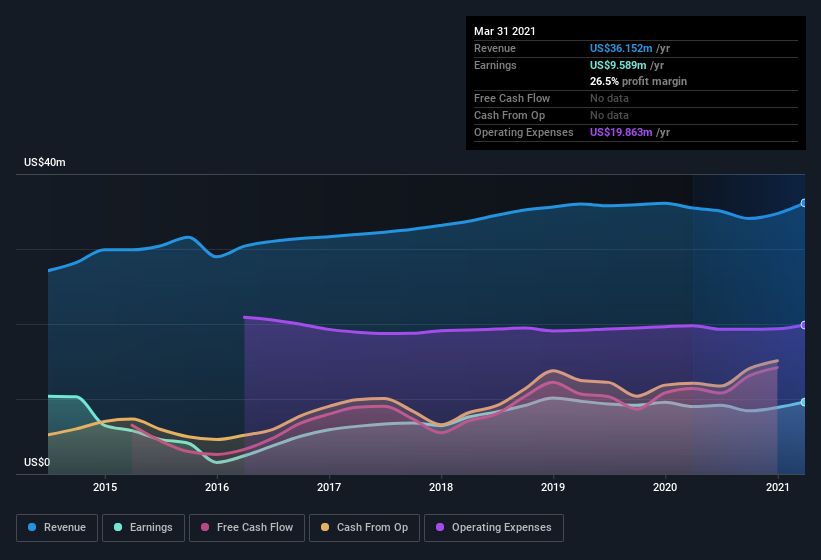

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since First National is no giant, with a market capitalization of US$89m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are First National Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Any way you look at it First National shareholders can gain quiet confidence from the fact that insiders shelled out US$786k to buy stock, over the last year. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. Zooming in, we can see that the biggest insider purchase was by Independent Vice Chairman Gerald Smith for US$152k worth of shares, at about US$18.54 per share.

Along with the insider buying, another encouraging sign for First National is that insiders, as a group, have a considerable shareholding. To be specific, they have US$16m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 18% of the company; visible skin in the game.

Should You Add First National To Your Watchlist?

One important encouraging feature of First National is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for my watchlist - and arguably a research priority. Still, you should learn about the 2 warning signs we've spotted with First National .

As a growth investor I do like to see insider buying. But First National isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade First National, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:FXNC

First National

Operates as the bank holding company for First Bank that provides various commercial banking services to small and medium-sized businesses, individuals, estates, local governmental entities, and non-profit organizations in Virginia.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives