- United States

- /

- Banks

- /

- NasdaqCM:FXNC

First National (NASDAQ:FXNC) Has Announced That It Will Be Increasing Its Dividend To US$0.14

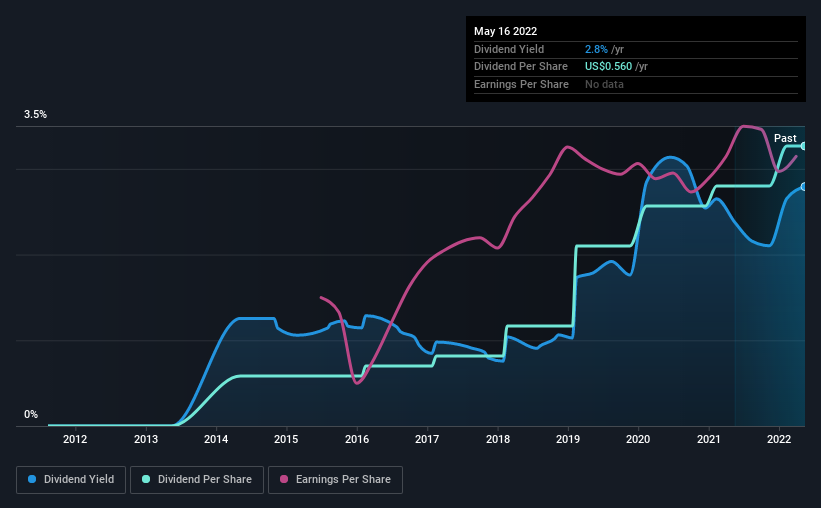

First National Corporation's (NASDAQ:FXNC) dividend will be increasing to US$0.14 on 10th of June. Based on the announced payment, the dividend yield for the company will be 2.6%, which is fairly typical for the industry.

Check out our latest analysis for First National

First National's Dividend Is Well Covered By Earnings

We aren't too impressed by dividend yields unless they can be sustained over time. However, First National's earnings easily cover the dividend. This means that most of its earnings are being retained to grow the business.

If the trend of the last few years continues, EPS will grow by 7.7% over the next 12 months. If the dividend continues on this path, the payout ratio could be 33% by next year, which we think can be pretty sustainable going forward.

First National Doesn't Have A Long Payment History

First National's dividend has been pretty stable for a little while now, but we will continue to be cautious until it has been demonstrated for a few more years. The dividend has gone from US$0.10 in 2014 to the most recent annual payment of US$0.56. This works out to be a compound annual growth rate (CAGR) of approximately 24% a year over that time. It is always nice to see strong dividend growth, but with such a short payment history we wouldn't be inclined to rely on it until a longer track record can be developed.

We Could See First National's Dividend Growing

The company's investors will be pleased to have been receiving dividend income for some time. First National has seen EPS rising for the last five years, at 7.7% per annum. With a decent amount of growth and a low payout ratio, we think this bodes well for First National's prospects of growing its dividend payments in the future.

We'd also point out that First National has issued stock equal to 28% of shares outstanding. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Our Thoughts On First National's Dividend

In summary, it's great to see that the company can raise the dividend and keep it in a sustainable range. The payout ratio looks good, but unfortunately the company's dividend track record isn't stellar. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 2 warning signs for First National that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:FXNC

First National

Operates as the bank holding company for First Bank that provides various commercial banking services to small and medium-sized businesses, individuals, estates, local governmental entities, and non-profit organizations in Virginia.

Flawless balance sheet with high growth potential and pays a dividend.