- United States

- /

- Diversified Financial

- /

- NasdaqGS:EEFT

Investors in Euronet Worldwide (NASDAQ:EEFT) have unfortunately lost 35% over the last five years

The main aim of stock picking is to find the market-beating stocks. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Euronet Worldwide, Inc. (NASDAQ:EEFT) shareholders for doubting their decision to hold, with the stock down 35% over a half decade.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for Euronet Worldwide

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

While the share price declined over five years, Euronet Worldwide actually managed to increase EPS by an average of 5.7% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or possibly, the market was previously very optimistic, so the stock has disappointed, despite improving EPS.

Because of the sharp contrast between the EPS growth rate and the share price growth, we're inclined to look to other metrics to understand the changing market sentiment around the stock.

Revenue is actually up 9.2% over the time period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

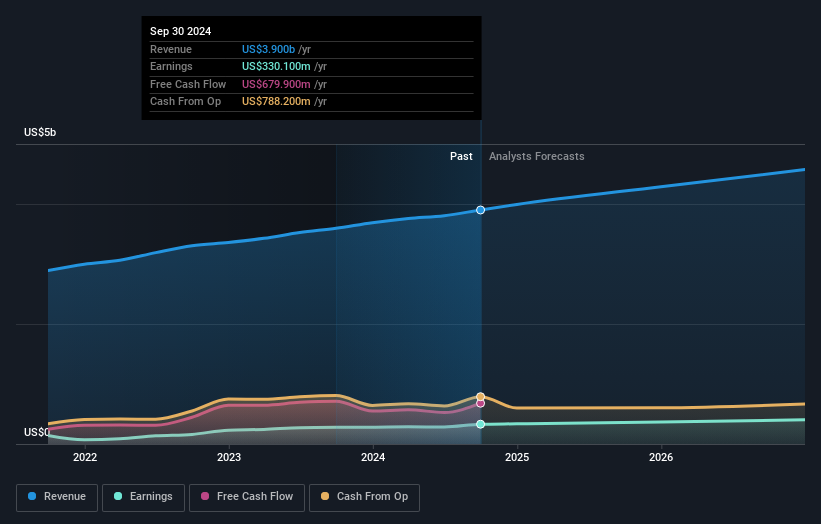

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Euronet Worldwide provided a TSR of 2.2% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 6% endured over half a decade. So this might be a sign the business has turned its fortunes around. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Euronet Worldwide is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Euronet Worldwide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:EEFT

Euronet Worldwide

Provides payment and transaction processing and distribution solutions to financial institutions, retailers, service providers, and individual consumers worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives