- United States

- /

- Specialty Stores

- /

- NasdaqGS:REAL

RealReal (NASDAQ:REAL) hikes 17% this week, taking one-year gains to 455%

Active investing isn't easy, but for those that do it, the aim is to find the best companies to buy, and to profit handsomely. When an investor finds a multi-bagger (a stock that goes up over 200%), it makes a big difference to their portfolio. For example, the The RealReal, Inc. (NASDAQ:REAL) share price is up a whopping 455% in the last 1 year, a handsome return in a single year. On top of that, the share price is up 266% in about a quarter. On the other hand, longer term shareholders have had a tougher run, with the stock falling 11% in three years.

The past week has proven to be lucrative for RealReal investors, so let's see if fundamentals drove the company's one-year performance.

See our latest analysis for RealReal

Because RealReal made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

RealReal grew its revenue by 2.5% last year. That's not great considering the company is losing money. So the 455% gain in just twelve months is completely unexpected. We're happy that investors have made money, but we can't help questioning whether the rise is sustainable. This is an example of the huge profits some lucky shareholders occasionally make on growth stocks.

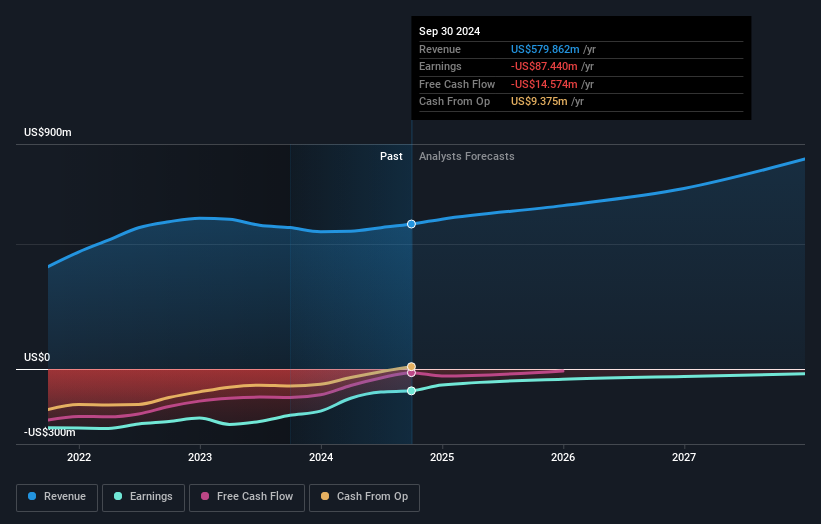

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. If you are thinking of buying or selling RealReal stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

It's good to see that RealReal has rewarded shareholders with a total shareholder return of 455% in the last twelve months. That certainly beats the loss of about 7% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that RealReal is showing 5 warning signs in our investment analysis , and 1 of those is concerning...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:REAL

RealReal

Operates an online marketplace for resale luxury goods worldwide.

Slight risk with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.