- United States

- /

- Banks

- /

- NasdaqCM:FVCB

FVCBankcorp's (NASDAQ:FVCB three-year decrease in earnings delivers investors with a 21% loss

Many investors define successful investing as beating the market average over the long term. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term FVCBankcorp, Inc. (NASDAQ:FVCB) shareholders have had that experience, with the share price dropping 21% in three years, versus a market return of about 23%. On top of that, the share price is down 11% in the last week.

With the stock having lost 11% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for FVCBankcorp

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

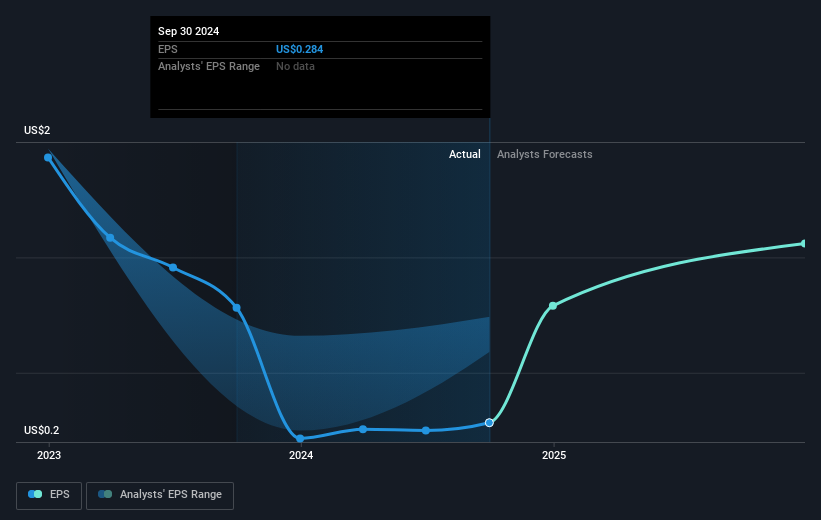

During the three years that the share price fell, FVCBankcorp's earnings per share (EPS) dropped by 38% each year. In comparison the 8% compound annual share price decline isn't as bad as the EPS drop-off. So the market may not be too worried about the EPS figure, at the moment -- or it may have previously priced some of the drop in.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

FVCBankcorp shareholders are down 12% for the year, but the market itself is up 26%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 2% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand FVCBankcorp better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for FVCBankcorp you should know about.

Of course FVCBankcorp may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:FVCB

FVCBankcorp

Operates as the bank holding company for FVCbank that provides various banking products and services for small and medium-sized businesses, professionals, non-profit organizations and associations, and investors in Virginia.

Flawless balance sheet and fair value.